There are dozens of ways in which you may render lender data on your mortgage broker website, and this data includes page-level archives that'll return information in an indiscriminate manner to support your funnel and educate your clients. These archives are supported by various panels and widgets that are used to showcase data of a certain type or from certain lenders. Supplementing existing features, and in preparation for version 4 of our website framework, we've introduced a suite of new archive pages that render the lowest rate from all accredited lenders on a specific page. The pages were built into the framework because we could... and necessarily because we should. In the light of operational experience, and on the back of millions of pages views, we can definitely claim that providing lender data in various formats objectively improves page views and conversions, so it stands to reason that providing additional resources will further cement broker expertise and authoritativeness and ultimately converts more website funnel traffic. This article introduces the new lender archive pages in brief.

Like it or not, borrowers want access to research material and lender data, and rightly or wrongly, over 93% of all mortgage clients consider the rate to be the single most important borrowing attribute. Even if borrower priorities aren't entirely aligned with what will ultimately serve their best interests, the website pathways and conversion-peaks that the information provides will facilitate initial contact, and it's in your early discussions with a client where you'll educate them on their wayward ways and provide the education necessary to make a more informed decisions.

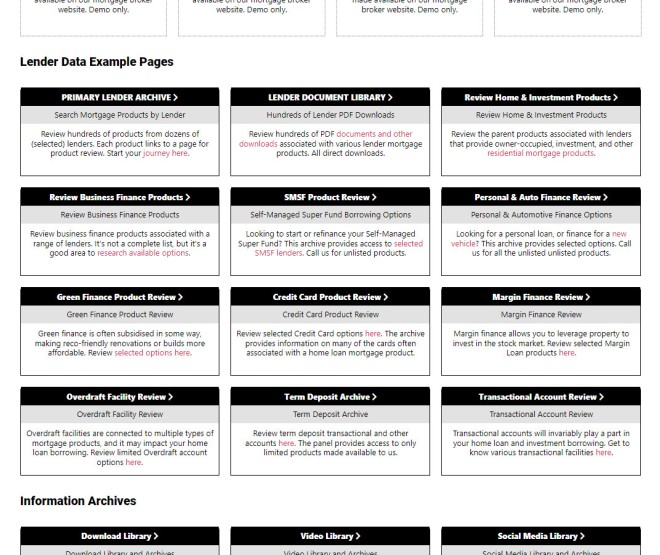

On all website's we now deliver we've created a small menu in the Resources section that links to the nine primary archive pages, including the standard Lender Archive and Document Archive. The new archive pages are shown in the image below.

Pictured: The nine menu items are shown as BM Boxes. Each links to a dedicated archive showing the lowest product of each type that is associated with each accredited lender. Each panel links to a page showing the LVR and other criteria that relating to the selected product. The BM Navigation Box (or optional BM Navigation Panel) may be styled in any manner that tickles your pickle.

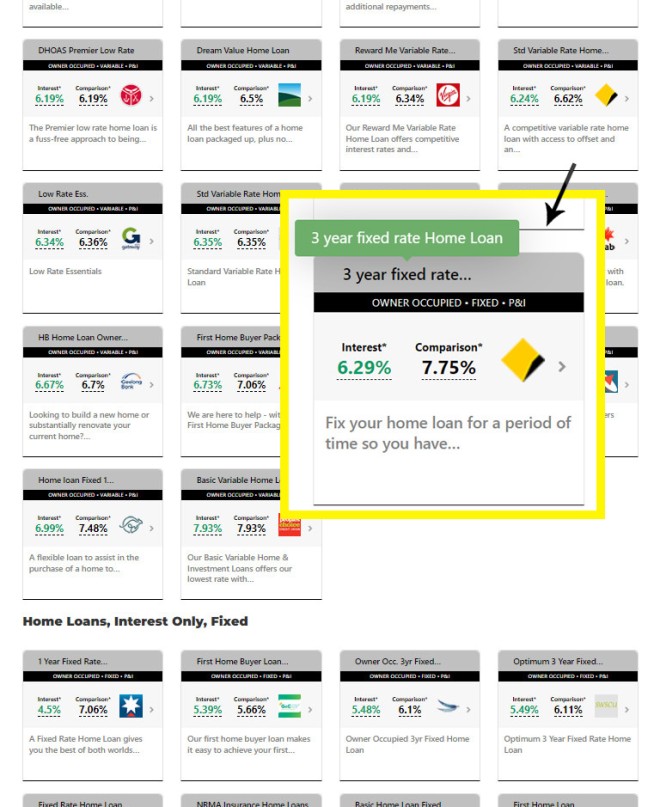

Demo: We've listed the archive pages on this website via our own Resources page. Each archive will generally render as pictured below.

Pictured: A small extract from the Home Loan and Investment Archive. The Home Loan and Investment archive can be particularly long. The idea is to provide authoritative proof of your product claims and expertise - it's not to guide clients into any particular product. Note that each of the lenders in the screenshot is different, with each panel linking to the applicable product page. Archives are cached for up to 48 hours before replaced with new data.

In total, there are ten archive pages that returns content of the following types:

- Review Home & Investment Products

- Review Business Finance Products

- SMSF Product Review

- Personal & Auto Finance Review

- Green Finance Product Review

- Credit Card Product Review

- Margin Finance Review

- Overdraft Facility Review

- Term Deposit Archive

- Transactional Account Review

These archive support the default primary lender navigation archive and document archive. Remember, the ten archives listed above - unlike the two primary archives - are more of a navigation sitemap than any kind of usable resource, and they'll be used in the funnel to reinforce concepts rather than define them.

When the comparison engine is released to the entire client base, each widget (both in archives and elsewhere) will carry an 'Apply Now' link.

Lender API

Your client API Key provides full and complete access to the Lender and Comparison API, and this includes an endpoint that'll serve the data used to render the archives as described. The applicable API documentation should be consulted for those that are interested.

Current Clients

The broker website framework evolves constantly with new features added routinely. The archives we've just described aren't available on older products, but they can be included if needed. To update yourself, create the applicable pages, create a title (which you can copy for styling from another page), and then simply include a shortcode on each page that follows the following format: [bm_lender_product_archive id="business"] (this returns the page archive content). It's the id that is altered on each page, and these values may be found in Yabber. If this all sounds a little complicated, you should make contact with us.

Conclusion

As mentioned earlier, the pages are created because we can include the data... and not necessarily because we should, but that doesn't mean that the feature won't improve on website engagement - because it does.

When introducing the new archives via a post on LinkedIn, it was met with a response from a good broker stating that he'd "... prefer to have a discussion with the client first", and while this is true, one has to appreciate that this conversation is delivered on the back of persuasive digital that serves to reinforce your expertise and authoritativeness in the market, and it contributes to wards the trust necessary to create the conversation conversation.

Advertising and promoting on the basis of rates is often a race to the bottom, and we're all more than familiar with rate-shoppers... so the archive data (along with all other lender data assets) are used to create the early conduit that'll funnel a potential mortgage client into a discussion. Our marketing messaging should speak the language of the consumer, and rates are a language that the consumer understands. So, the lender data is an information-magnet that funnels through to contact, and the client discussion is then used to provide more appropriate guidance. The comment on LinkedIn mentioned earlier was a little like suggesting the roast chicken comes before the chook, and it's a failed understanding that's shared by the entire industry.

We needn't have to remind you that having a great website, social, or digital presence doesn't necessary return conversions without traffic! The idea is that the traffic you do have will convert in greater numbers if you inject the necessary features into your digital experience. Assigning funds to your marketing budget without supporting digital is a wasteful endeavour.