We recently updated our mortgage broker website's 'Education' module to be more robust and scalable, and more importantly, we created the mechanism for the inclusion of one-click course material on your website. In order to test the back-end tech required to push courses of various kinds, we created a basic RBA page as a 'demo' of what a course might look like. In creating the page we pushed around 220 RBA Monetary Statements to the website, and we built a policy archive that will update when a new monetary media release is published.

IMPORTANT, FEATURE UPDATED: We've updated the RBA archive to assist brokers with the management of the module. The updated archive is detailed in an FAQ titled "How to Manage the RBA Statement Archive".

Note to Clients: The RBA archive is only enabled in the most recent version of the website framework. You're welcome to overwrite your website at any time to enable certain features... although this is easier when you haven't made significant changes. Comprehensive RBA information was previously provided to Platinum clients only, and we're in the process of migrating all former Platinum modules into the 'general' website experience.

The RBA topic wasn't ideal as a 'course', but it was a suitable resource for testing the methods we'll use on our end to manage more feature-rich education content. The reason that the RBA Policy statements weren't ideal as a course is because it isn't a course - it's just information. However, the 'Education' module - as the name implies - is more than courses - it's for content that provides users with a better understanding of 'anything'. In fact, the exact same method we're introducing on this page is employed to render 'Scamwatch' articles to your website (another resource that is now shipped by default).

We created a single page called 'RBA Monetary Policy Decision', sent all the policy statements as child pages to that primary 'course' page, and then build various features into the parent page that allowed flexibility in how our child pages are shown.

Pictured: The Education entry archive looks a little empty at this point. The 'Education' archive page only shows parent education pages. In this example, the RBA Page is highlighted. Selecting the page returns the primary 'course' entry page.

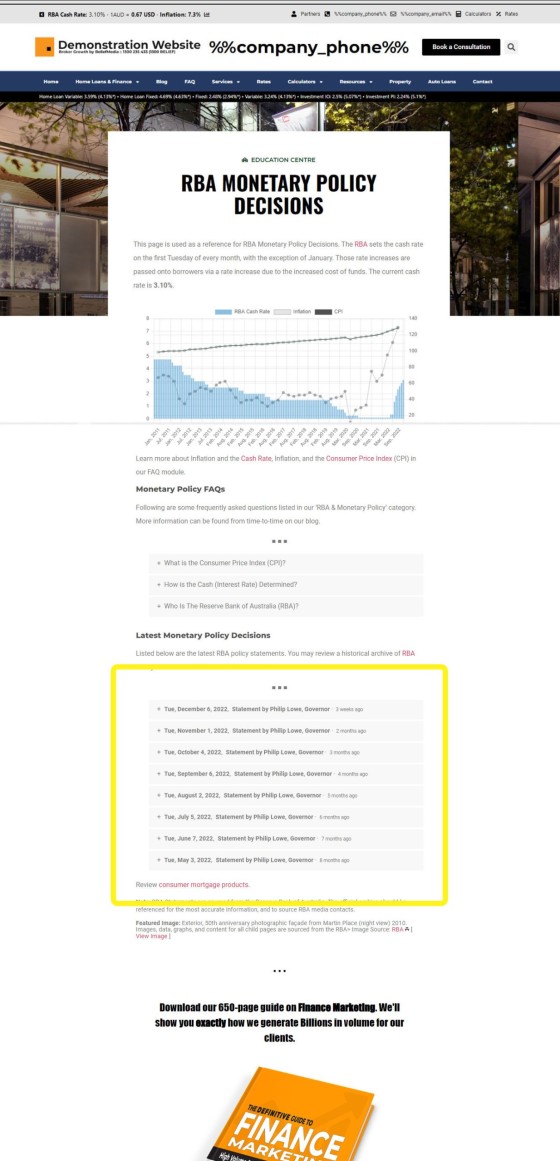

Pictured: The individual RBA page includes a few FAQs on monetary policy and an accordion that includes the most recent policy statements (highlighted). Each of the policies links to a standalone page with the statement in full.

As a standalone feature, the hundreds of monetary policy statements provide your website with an extremely valuable resource. As such, we've created an RBA archive that shows paginated statements in a format similar to your blog.

Pictured: The RBA Policy Archive lists all monetary policy statements in a paginated blog-style format. Each post links to a standalone policy page. Not all material listed in the education module will include a standalone archive - this is generally limited to third-party automated content, and each archive has to be specifically created.

To be clear, as each statement is published to the RBA website, the same monetary statement will be sent to your website (various subscription options will be made available via the 'Managed' module in Yabber).

A Note on SEO

The information detailed on this page introduce obvious benefits to your website from a user experience perspective, but search engines won't necessary share the same opinion. The SEO value of each page in this archive is assigned back to the source RBA website (via a canonical URL and appropriate in-page markup), so the content exists primarily to engage audiences that originate from sources other than Search.

Conclusion

One of the primary objectives of a marketing funnel of any kind is to qualify you, and this objective is one that comes from your demonstrated expertise and authoritativeness... and this can only be achieved with a library of content that stands out from the ocean of digital mediocrity that is seemingly a staple of the mortgage industry. It's content on the periphery - such as the RBA statements and archive - that shapes your website into something more than a bas sales-pitch and turns it into a machine capable of creating real engagement.

How often have you linked to the off-site RBA Policy Statement? Liking to the RBA is a common and required action, but it does take our user away from the resources we want them to consume, so this feature enables a more holistic and integrated experience. That said, each RBA Policy page links directly to the original RBA statement via a link at the bottom of each page in order to comply with licencing.

Note: Every page on your website is a potential organic entry point, so every page on your website needs to provide a top-of-funnel subscription/offer. A simple panel (subscription and offer) is assigned to the education page via the standard form assignments panel, and the single form shown under each RBA Policy Statement is achieve in the same way. A single video may optionally be assigned to show at the top of each policy page.

Clients should note that the new framework is required to support the feature, but there are provisions to create the library yourself.