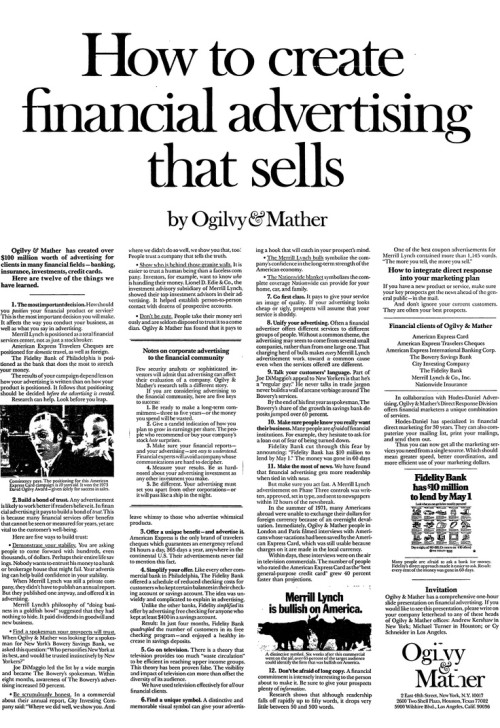

"How to create financial advertising that sells" was a 1974 advertisement from New York based advertising agency Ogilvy & Mather.

The ad was one of a number of Ogilvy's long-form advertisements that were used as a means of demonstrating their expertise and providing industry-specific social proof. The long-form advertising was a technique widely avoided by many in the in fear that they were giving too much away.

The company call-to-action is placed as an unobtrusive snippet of text towards the end of the advertisement inviting interested persons to a one-hour slide presentation.

The advertisement is printed in full without omission. A full copy of the original 1974 ad is printed towards the end of this article.

■ ■ ■

Advert Reproduction

Ogilvy & Mather has created over $100 million worth of advertising for clients in many financial fields – banking, insurance, investments, credit cards.

Here are twelve of the things we have learned.

1. The most important decision

How should you position your financial product or service? This is the most important decision you will make. It affects the way you conduct your business, as well as what you say in advertising.

Merrill Lynch is positioned as a total financial services center, not as just as stockbroker.

American Express Travelers Cheques are position for domestic travel, as well as foreign.

The fidelity Bank of Philadelphia is positioned as the bank that does the most to stretch your money.

The results of your campaign depend less on how your advertising in written than on how your product is positioned. It follows that positioning should be decided before the advertising is created.

Research can help. Look before you leap.

Consistency pays. The position for this American Express campaign is 10 years old. It won the 1973 David Ogilvy award – given solely for success in sales.

2. Build a bond of trust

Any advertisement is likely to work better if readers believe in it. In financial advertising is pays to build a bond of trust. This is because many financial services offer benefits that cannot be seen or measured for years, yet are vital to the customer’s well-being.

Here are five ways to build trust:

- Demonstrate your stability. You are asking people to come forward with hundreds, even thousands of dollars. Perhaps their entire life savings. Nobody wants to entrust his money to a bank or brokerage house that might fail. Your advertising can help build confidence in your stability.

When Merrill Lynch was s still a private company, they didn’t have to publish an annual report. But the published on anyway, and offered it in advertising.

Merrill Lynch ‘s philosophy of “doing business in a goldfish bowl” suggested that they had nothing to hide. It paid dividends in good will and new business.

- Find a spokesman your prospects will trust. When Ogilvy & Mather was looking for a spokesman for New York’s Bowery Savings Bank, we asked this question: “Who personifies New York at its best, and would be trusted instinctively by New Yorkers?”

Joe DiMaggio led the list by a wide margin and became The Bowery’s spokesman. Within eight months, awareness of The Bowery’s advertising increased 50 percent.

- Be scrupulously honesty. In a commercial about their annual report, City Investing Company said: “Where we did well, we show you. And where we didn’t do so well, we show you that, too. People trust a company that tells the truth.

- Show who is behind those granite walls. It is easier to trust a human being than a faceless company. Investors, for example, want to know who is handling their money. Lionel D. Edie & Co., the investment advisory subsidiary of Merrill Lynch, showed their top investment advisors in their advertising. It helped establish person-to-person contact with dozens of prospective accounts.

- Don’t be cute. People take their money seriously and are seldom disposed to trust it to a comedian. Ogilvy & Mather has found that it pays to leave whimsy to those who advertise whimsical products.

3. Offer a unique benefit – and advertise it.

American Express is the only brand of travelers cheques which guarantees an emergency refund 24 hours a day, 365 days a year, anywhere in the continental U.S. Their advertisements never fail to mention this fact.

4. Simplify your offer

Like every other commercial bank in Philadelphia, The Fidelity Bank offered a schedule of reducing checking costs for customers who kept certain balances in their checking account or savings account. The idea was unwieldy and complicated to explain in advertising.

Unlike other banks, Fidelity simplified its offer by advertising free checking for anyone who kept at least $400 in a savings account.

Result: In just four months, Fidelity Bank quadrupled the number of customers in its free checking program – and enjoyed a healthy increase in savings deposits.

5. Go on television

There is a theory that television provides too much “waste circulation” to be efficient in reaching upper income groups. This theory has been proven false. The visibility and impact of television can more than offset the diversity of its audience.

We have used television effectively for all our financial clients.

6. Find a unique symbol

A distinctive and memorable visual symbol can give your advertisement a hook that will catch in your prospect’s mind.

- The Merrill Lynch bulls symbolises the company’s confidence in the long-term strength of the American economy.

- The Nationwide blanket symbolises the complete coverage Nationwide can provide for your home, car, and family.

7. Go first class

It pays to give your services and image of quality. If your advertising looks cheap of ugly, prospects will assume that your service is shoddy.

8. Unify your advertising

Often a financial advertiser offers different services to different groups of people. Without a common theme, the advertising may seem to come from several small companies, rather than from a large one. That charging her of bulls makes every Merrill Lynch advertisement work toward a common cause even when the services offered are different.

9. Talk your customers’ language

Part of Joe DiMaggio’s appeal to New Yorkers is that he’s a “regular guy”. He never talks in trade jargon never builds a wall of arcane verbiage around The Bowery’s services.

By the end of his first years as spokesman, The Bowery’s share of the growth in savings bank deposits jumped 60 percent.

10. Make sure people know you really want their business

Many people are afraid of financial institutions. For example, they hesitate to ask for a loan out of fear of being turned down.

Fidelity Bank cut through this fear by announcing: “Fidelity Bank has $10 million to lend by May 1.” The money was gone in 60 days.

11. Make the most of news

We have found that financial advertising gets more readership when ties in with news.

But make sure you act fast. A Merrill Lynch advertisement on Phase Three controls was written, approved, set in type, and sent to newspapers within 12 hours of the newsbreak.

In the summer of 1971, many Americans abroad were unable to exchange their dollars for foreign currency because of an overnight devaluation. Immediately, Ogilvy & Mather people in London and Paris filmed interviews with Americans whose vacations had been saved by the American Express Card, which was still usable because charges on it are made in the local currency.

Within days, these interviews were on the air in television commercials. The number of people who rated the American Express Card as the “best general-purpose credit card” grew 40 percent faster than projections.

A distinctive symbol. Six weeks after this commercial went on the air, over 65% percent of the target audience could identify the firm that was bullish on America.

12. Don’t be afraid of long copy

A financial commitment is intensely interesting to the person about to make it. Be sure to give your prospects plenty of information.

Research shows that although readership falls off rapidly up to fifty words, it drops very little between 50 and 500 works.

One of the best coupon advertisements for Merrill Lynch contained more than 1,145 words. “The more you tell, the more you sell.”

How to integrate direct response into your marketing plan

If you have a new product or service, make sure your key prospects get the news ahead of the general public – in the mail.

And don’t ignore your current customers. They are often your best prospects.

Financial clients of Ogilvy & Mather

- American Express Card.

- American Express Travelers Cheques.

- American Express International Banking Corp.

- The Bowery Savings Bank.

- City Investment Company.

- The Fidelity Bank.

- Merrill Lynch & Co., Inc.

- Nationwide Insurance.

In collaboration with Hodes-Daniel Advertising, Ogilvy & Mather’s Direct Response Division offers financial marketers a unique combination of services.

Hodes-Daniel has specialised in financial direct marketing for 30 years. They can also computerise your mailing list, print your mailings, and sent them out.

Thus you can now get all the marketing services you need from a single source. While should mean greater speed, better coordination, and more efficient use of your marketing dollars.

Many people are afraid to ask a bank for money. Fidelity’s direct approach made it easier to ask. Result: every cent of the money was gone in 60 days.

Invitation

Ogilvy & Mather has a comprehensive on-hour slide presentation on financial advertising. If you would like to see this presentation, please write on your company letterhead to any of these heads of Ogilvy & Mather offices: Andrew Kershaw in New York; Michael Turner in Houston; or Cy Schneider in Los Angeles.

Ogilvy & Mather

2 East 48th Street, New York, N.Y. 10017

2600 Two Shell Plaza, Houston, Texas 77002

5900 Whilshire Blvd., Los Angeles, Calif. 90036

■ ■ ■

Notes on corporate advertising to the financial community (Ogilvy)

Few security analysts or sophisticated investors will admit that advertising can affect their evaluation of a company. Ogilvy & Mather’s research tells a different story.

If you care considering advertising to the financial community, here are five keys to success.

- Be ready to make a long-term commitment – three to five years – or the money you spend will be wasted.

- Give a candid indication of how you plan to grow in earnings per share. The people who recommend or buy your company’s stock hate surprises.

- Make sure your financial reports – and your advertising – are easy to understand. Financial experts will avoid a company whose communications are hard to decipher.

- Measure your results. Be as hard-nosed about your advertising investments as any other investment your make.

- Be different. Your advertising must set you apart from other corporations – of it will pass like a ship in the night.

Advert Reproduction

following is the original 1974 advert reproduction. If you would like a copy of this reproduction you may download it here  (it's the same copy of this article we provide to our clients with six other documents on day 18).

(it's the same copy of this article we provide to our clients with six other documents on day 18).

Conclusion

"How should you position your financial product or service? This is the most important decision you will make. It affects the way you conduct your business, as well as what you say in advertising." This principle applies today as it did when it was authored. We work with the financial industry that is generally perceived as a personality-deprived sea of suits and ties - how does one stand out in an industry that by its very nature is boring? We'll often tell brokers that "creative is called creative for a reason" - yet so many are investing into stock advertising. The plethora of identical ads, lead generation harvesting websites, and lack of any creative effort yields ordinary results by accident - not on or by purpose.

Of interest is Ogilvy’s line "the more you tell, the more you sell" (top right). While Dr Charles Edwards might have said it first, Ogilvy made it famous. There’s no question that long-copy sells if you’re selling the right product. There are occasions (the finance market is one of them) where short-form well and truly outperforms the long-form alternative. In essence, if you’re detailing the virtues of your offer, the long-form does work. However, long versus short copy is beyond the scope of this article (discussed briefly on our introduction to lead magnets).

Everything about this advert is vintage except for the core principles that have withstood the test of time and still form the foundation for financial advertising. When Ogilvy and Mather printed the article they essentially took ownership of the principles discussed despite being commonly used by others at the time. However, they took the long-form approach when others were printing small ads that weren’t nearly as readable or compelling.

The principles aren’t entirely different to many that we introduce and work with, such as positioning your brand (Unique Selling Point), having a company spokesperson (or celebrity financier), honesty, and so on.

What’s fascinating about this advert is that the end result would be a campaign costing in the hundreds of thousands without coming close to the success (and far higher ROI) one would enjoy today for a mere fraction of a fraction of the cost.

The notion that the company is proud that they might have an advert pressed “within 12 hours of a newsbreak” was a remarkable achievement in 1974 – but would be considered a missed opportunity by today’s standard. Social media, blogging, and the immediacy of advert creation and targeted delivery means you should have your message sent to a relevant audience within just minutes. The same can be said of having video interviews shown on television within days of being shot.

“Going on television” by todays’ standards simply means creating video. And the “wasted circulation” Ogilvy speaks of is largely avoided because of highly refined targeting options – we can reach who we determine is our ideal audience... then retarget them appropriately based on relevance.

The call to action should put our current opportunity into perspective. A letter - written to a department head on a company letterhead - was sent via snail-mail so one might eventually receive an invitation to a one-hour slide presentation. And this was a true static slide presentation – not some fancy PowerPoint. We can have a lead registered to a webinar and watching with interactive features in less than a minute. While we might see this immediacy as an opportunity – and it most certainly is – we’re also appealing to a more sophisticated and discerning audience that will often associate advertising with spam (the vintage process added a certain value, importance, and exclusivity to the exchange). Our modern mission is to create compelling copy that rises above those other ads that a user might scroll past and demonstrate clear and unique value. Additionally, the way social targeting works is that we’re often competing alongside our competition – we must stand out. Still, even with modern day consumer hesitation and reluctance to engage with digital advertising, it’s still far more effective than anything printed in 1974. The same core principles as described in Ogilvy’s advertisement applied in modern day yields exceptional results.

We'll be publishing a large number of vintage Ogilvy advertisements under the post tag of Ogilvy  although it's always worth researching the modern day application of the concepts via our Finance

although it's always worth researching the modern day application of the concepts via our Finance  tag. If you've ever engaged in any kind of advertising it'd be prudent to read about everything David Ogilvy has ever written.

tag. If you've ever engaged in any kind of advertising it'd be prudent to read about everything David Ogilvy has ever written.

David Ogilvy died in July 1999 so he lived to see the birth of the Internet, but never saw the development of Internet speed and infrastructure necessary to fully appreciate the impact it would have upon the industry he helped create.