The term "Mortgage Calculators" is the second most queried term on search engines after "Mortgage Brokers", and the query is often accompanied by a location qualifier (lending itself to local SEO). What does this mean? It means that if you don't have mortgage calculators on your broker website you're potentially ignoring millions of search appearances every year, and hundreds (or even thousands) of website visitors every day. It's for this reason we're completely rebuilding all our older loan calculators to be more robust and usable, and as a first for the industry, we're making the interactions with the calculator fully trackable.

We looked at all the calculators made available to the mortgage market and determined that they all looked like plugins, they were all rather generic, they lacked essential features, and they were grossly over-priced. It was only a few years ago one could buy a calculator for around $15 outright and it'd perform necessary functions; fast forward to the modern-day world of cloud hosting and the subscription-based model and it's become somewhat standard to pay a large monthly premium for just calculators (and we've seen subscriptions for over $100 per month). We wanted to inject some common-sense, sanity, and affordability into the market so we've packaged the calculators into our mortgage broker website by default, and made it part of either a Yabber subscription  , or a standalone subscription that includes all our product, graphing, and other financial tools on the periphery.

, or a standalone subscription that includes all our product, graphing, and other financial tools on the periphery.

Since calculators are one of the most searched home loan terms in any search engines it stands to reason that you'll include calculators everywhere- not just on dedicated calculator pages (an example of this is our LMI Calculator which we include on around ten FAQ pages in our default high-performing mortgage broker website). To permit ease of use we're building all our calculators into our Elementor drag-and-drop plugin, or they can alternatively be used with WordPress shortcode. Any page-view or click objectively diminishes conversions and engagement, so we're trying to build a framework where calculators are rendered whenever and wherever they're required, or whenever they serve a page-based objective.

We've essentially scrapped all our older calculators and we're progressively replacing them with a brand new suite of high-performing tools. We had one clear objective: make the calculators appear as though they're part of your website rather than a plugin that you've simply embedded from elsewhere. Further, given that calculator interactions are imperative to an understanding of a client, and the data potentially provides information that shapes an understanding of their borrowing objectives - and thus determines the marketing funnel course - we record interactions on many of our calculators so the calculators themselves are triggers for other website actions.

Calculators are a powerful tool and the data sourced from their user is imperative to an understanding of our clients, so for the very first time, we're introducing products to the industry where the interaction with a tool can actually shape their funnel journey.

The Repayment Calculator

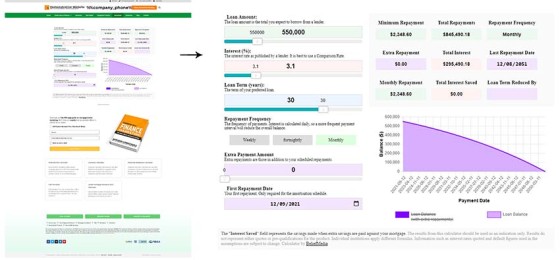

The first of about 20 calculators is our basic repayment calculator. We approached the development of this calculator after surveying a few hundred real-world mortgage clients and asked them what they were looking for. An overwhelming 68% said that the calculators they previously used didn't provide enough information. In response to this we created two versions: a repayment calculator, and an advanced repayment calculator, with the latter including 15 accompanying graphs (yes, 15 graphs - normally suitable for demonstrations by a broker, or for seriously inquisitive borrowers).

Pictured: The standard repayment calculator as shown on the front page of the Calculator archive. Standard repayment conditions apply, such as payment frequency, loan term, and extra repayments. Extra repayments adds another chart element to the graph.

The pictured calculator, or any other calculator, can be dropped into any page with our Elementor website plugin, or rendered with standard WordPress shortcode.

Each calculator includes a standard disclaimer - an important compliance requirement when showing such tools.

Calculators in the Funnel

Because mortgage calculators are used to guide your clients into appropriate decision making they're also an essential component of your marketing funnel; that is, some of your follow-up email campaigns should direct a user to various calculator tools to support the education your email program provides, and the interaction with a calculator often feeds us with a better understanding of client objectives. Certainly, on our end, we're able to accurately assess exactly how many website users engaged with our calculators, where they're from, who they were, and what values were used - this data-driven understanding of how our marketing assets are used are the basis of an integrated and full-stack marketing experience. It's this need for data that has also seen us develop some calculators a little differently to those that you may be familiar, with many built into your page without a reliance on iframes or JavaScript.

Using a calculator should have the capacity to course-correct a funnel by way of a new email follow-up subscription, or using another calculator might be sufficient reason to schedule an automated text message. In other cases, if our BeNet AI engine is able to determine a user will need a guarantor we should be able to schedule a CRM task, or perhaps send them an email with guarantor information (prompting a phone call). There's really no end to the potential benefits delivered by a system that is integrated, and with a funnel crafted in such a way that it actually does what it is supposed to do - shape a user journey and convert traffic into clients.

Calculators and Bank Product Data

The next phase of our calculator implementation is to build JavaScript-free calculators that integrate directly into your page and return results with live bank product data (via your panel of lenders). The first stage of this program will see us roll out the comparison engine directly into mortgage broker websites, with a following version introducing a higher-level feature used to match calculators directly with real-time comparative data.

Complimentary Calculators

We've had a program running for a while that seeks to introduce brokers to finance calculators and tools that aren't typically made available to them. In fact, we've intentionally shared complimentary tools that aren't part of any standard calculator product suite availed to the industry.

We started the journey by providing a number of basic inline calculators to the industry that they likely don't already use or have access to, such as our LMI calculator, LMI postcode risk calculator, and Guarantor liability calculator. Other non-calculator tools we've provided introduce features not typically made available on mortgage broker websites, such as RBA graphs (and cash-rate data), a BSB Number Search Engines, and stylistic bank boxes.

We're providing one website plugin per month to the industry for the next 12 months; the next scheduled tool is an easy-to-use and fully trackable stamp duty calculator.

This program was used to introduce calculators to brokers that could be used inline on any page.

Calculators are a WIP

Since our calculators are being rebuilt from scratch, they're not all available right now, but we expect to have the full suite available by December.

The calculators on our broker website are managed via their own post type (or archive) because they're a resource that'll continue to grow. As we deploy new calculators and tools they're simply added to that archive.

Conclusion

We're reinventing mortgage broker calculators. Knowing that mortgage calculators are a heavily trafficked resource on your website, and understanding that the mortgage calculators feed us with information to better understand client circumstances, we're applying back-end solutions to capitalise on this understanding in order to provide an even more immersive and powerful funnel experience.

Full custom calculators and other tools are available on request.