Marketing is meant to be simple, and it is. Using our systems, and applying around 7-minutes of effort, you may manufacture marketing campaigns that are infinitely superior to the charlatans selling 50 leads for $8000... and you'll pay cents on the dollar for far more effective and compliant results. Packed with hundred of features, an FAQ architecture, integrated calendars on every page, a full-featured and broker-specific modal system, a video framework, advanced conditional systems, lender data everywhere, and triggers and marketing options on every page, BM's SEO-optimised website is extremely powerful, simple to use, and it is designed to convert.

This article will introduce many of the changes introduced to the most recent iteration of our extremely powerful mortgage broker website. The framework is delivered with over 200 standard pages, and makes over 100'000 pages available when considering those pages rendered by way of lender product pages, BSB pages, school search results, childcare search results, and so on, with the search features on the periphery designed to turn your website into a resource that attracts, engages, and converts traffic.

Some time back we wrote an article on our mortgage broker website, but with all the features we've introduced, even that article is now rather outdated. That said, it's still a reasonable reference for introducing yourself to general website features.

The Origin Story

When we first manufactured a broker website framework for the finance industry, it was done so because every experience we'd every inherited was awful -truly awful. None of the websites we were asked to work with were designed to convert (and none of them ever did, despite their claims), and not a single one of them included the consumer-facing and finance-specific features that we'd consider absolutely essential in order to provide an engaging funnel experience. We looked at what various digital companies were selling, and we evaluated the crappy bottom-of-the-barrel lead generation options that businesses were misled into believing were a good idea, and we quickly made the decision that we'd push a framework with our core digital service that would be fully integrated with brokers' broader digital efforts, and fully integrated with their paid funnel promotions... and it remains the only example in the industry... and it's priced lower than virtually all alternatives. Since introducing the full-stack framework, we've worked tirelessly to ensure that the experience that we deliver clients is the single most powerful marketing experience of its type available to mortgage brokers. The degree of success, of course, is predicated on the fact that certain marketing features are actually used - you can have the greatest website in the world, but it won't return any results if nobody knows it exists.

A large number of brokers come to us for just a website, and since the website itself was previously designed around supporting promoted campaigns, it wasn't as effective as it could be. Packed with conditional features, a converting architecture, and built to seamlessly integrate with highly effective turnkey campaigns, our digital product has always provided a more effective experience than every competing product in the market, and it has always had the potential to deliver an exceptional experience, except it didn't include everything we wanted it to include in order to completely round out the organic experience (something that was always built into our former Platinum product). The new framework changes this.

We've recently updated the website framework with multiple features, and provisioned for the inclusion of other features in the very near future. As we'll come to explain, it's only now that we've developed the website into the scalable resource we always wanted it to be. While there's a clear and undiluted focus on those elements required in order to quickly create and promote paid promotion, there's more of a heavy emphasis on the internal (and standalone) website pathways that are required to amplify conversion potential.

We're Not a Web Design Company: Despite the fact we've given WordPress-related talks all over the world, built over 1000 of our own website application, thousands of client websites, and provided financial websites to the industry for over 25 years, we are a Marketing Fintech company first and foremost. Your website is the conduit that connects your digital and other audiences to your business so it has to be good, and as a marketing company that develops financial software we were obligated to create a digital experience that manufactures opportunities. Further, we were obligated to introduce a product that has the capacity to end the ubiquitous and business-debilitating nature of leadgen scams services.

Framework Update

This section will be of interest to current clients because incoming brokers won't appreciate the changes. There's far too many changes to list, so we'll touch on the more visible functionality. In general, the revised marketing framework includes around 50 additional pages, more lender and partner options, and tighter integration with various Yabber modules.

The most significant update is the provisioned support for property listings and the rate comparison engine. The former is a tool to support your partners (despite the fact it's more feature-rich than the tool property professionals are using themselves), and the comparison engine is as you would expect - a featured mortgage comparison service. However, neither of these services are live just yet... but the pages and necessary framework changes were introduced to support the modules. We've got a few hoops to jump through, so when we flick the switch in Yabber, and assuming you're using the tools, the website services will become active on your website immediately.

Comparison Website: For the last few years we've provided our former Platinum clients with a standalone comparison website designed to capitalise on that portion of the market that gravitates towards the online experience. It's expected that we'll simply make that standalone site available to all clients. The integrated comparison engine in your existing website, however, will be made available to all website users, and unlike other services on the market, we have the capacity to return resolved and geographically relevant property suggestions with product results.

Property Widgets: While assigned to their own page, the forthcoming property listings may optionally be placed anywhere by way of widgets that aren't entirely different to the widgets used to serve mortgage data, and the creation method using Elementor (or Yabber) is the same.

Generally speaking, we've updated the FAQs, introduced around 50 additional pages, included widgets for finance other than mortgages, introduced video features, and made provisions to include property feeds (via an interface similar to our Lender Widgets), a comparison engine, and various other archives. Additional cornerstone pages were added, with some being for consumer-information, but others for niche markets and SEO authority, such as marine, aircraft, motorcycle, and aircraft finance (none that are linked to directly). There's a ton of hidden 'internal' pages, and many are akin to 'Easter Eggs' in that are linked in strange places (for example, the header of this website, when viewed on a PC, will show current inflation, exchange rate, and cash rate; click on the graph icon and it'll take you to one of these more obscure pages).

The auto finance page was one that was always problematic, and in the previous framework we generally left that page fairly naked until direction was given to us by the client. Every Platinum client we have ever had would filter this category of lead directly to a third-party provider that would manage the deal, but very few standard clients utilised this external pipeline. In light of the 1000+ auto leads our system processes every month (quite a large number), we've introduced a new auto finance page (with relevant rate widgets), and we've created standalone pages for business (auto) finance and equipment finance (with a number of other pages on the periphery).

Pictured: A large number of pages are now made available for equipment finance. We include pages for auto finance, caravan finance, motorcycle finance, aircraft finance, and marine finance. On the business end, many of these options are tailored for the business consumer. A page is also manufactured for general business equipment finance, and this page link to various business resources. Some of these pages are 'hidden' in that they're not primary navigation elements, but exist for those cases where they're required, and they continue to be ingested by search engines. So, while the former auto finance page was rather empty, we now have around 9 pages dedicated to equipment finance and financing options.

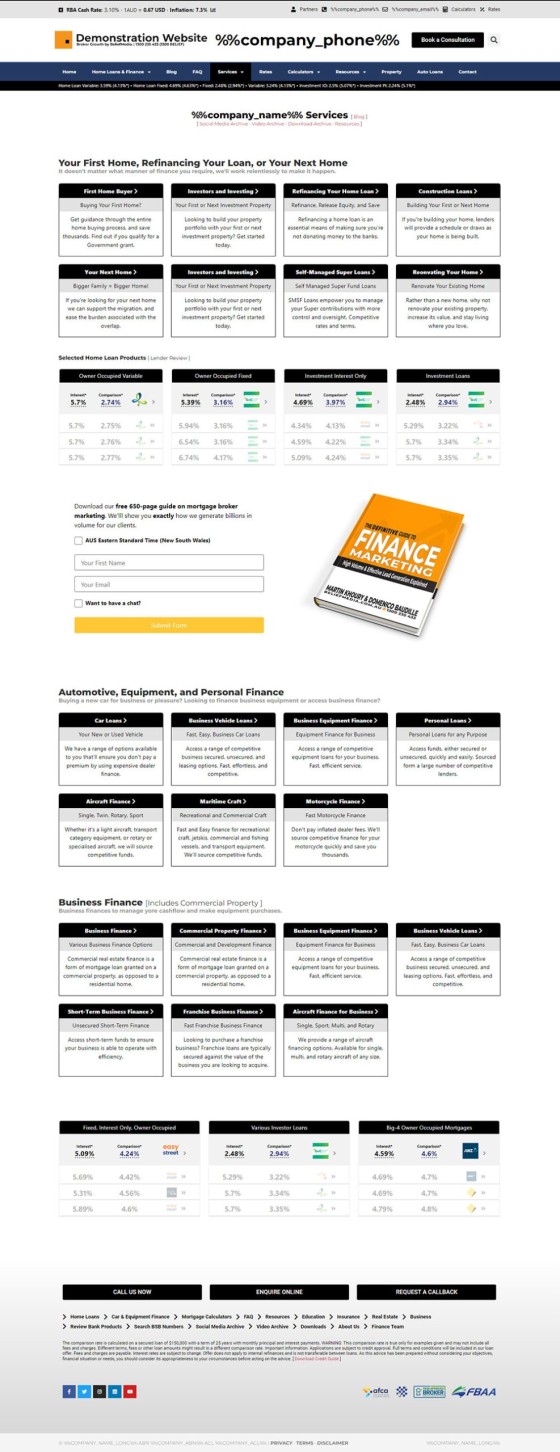

The navigation we've introduced is intuitive and provides easy access to the appropriate resources. In fact, the 'Services' page (pictured below) includes what is essentially a visual sitemap and renders details on the bigger-ticket and more obscure service.

Pictured: The new Services menu shows a dropdown that links to secondary services, such as auto finance, equipment finance, business finance, personal finance, aircraft finance, and of course, home loans. The top-level services item links to the page as shown. This page is fully customisable, and should be altered to better reflect your brand. Each of the boxes is called a 'BM Box'. Designed to be consistent with the style of the lender and otter widgets, the BM Box is available as a drag-and-drop Elementor widget or shortcode, and the style may be altered in Elementor or globally via Yabber.

Pictured: Compared to the previous framework, navigation is simplified and includes more elements that were previously only available through a manufactured pathway. More options were added to the footer navigation panel for archive and primary pages. Those familiar with the former framework will appreciate the 'Insurance' page was removed from the primary menu by default (required 'somewhere' to satisfy Best Interests obligations) and it was relegated to the footer. We'll typically arrange these menu items during our setup process. The very top banner includes the current inflation rate, interest rate, and currency conversion, and these resources link to various nested pages. We previously hid a page that graphs Bitcoin pricing, an we were reluctant to include it, and even more reluctant to link to the resource based on the spammy nature of the service. However, we may update this with the next plugin update based on early feedback.

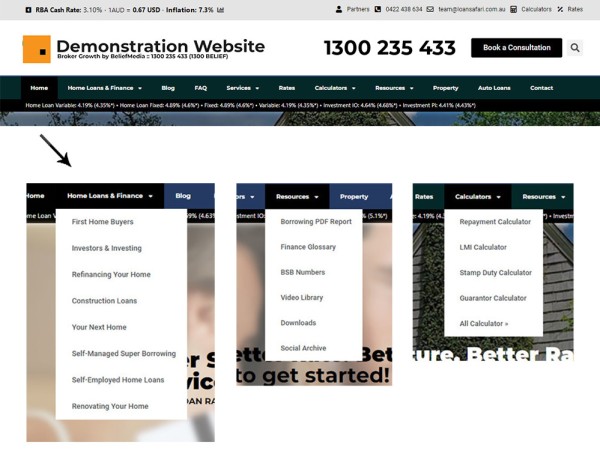

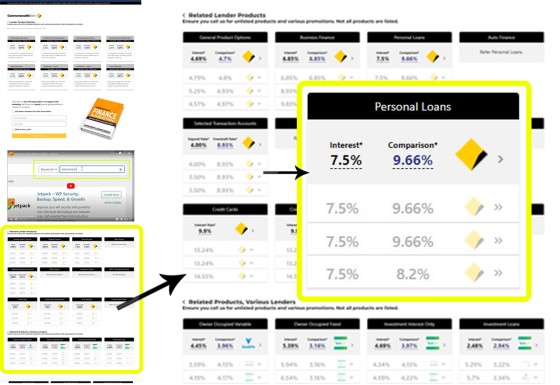

The new framework supports an entire new collection of product widgets that includes Personal Loans, Business Finance, Transaction Accounts, and Margin Loans. These widgets are obviously assigned to the appropriate pages, and they're included in all tiers of archive and product pages.

Pictured: A screenshot of four example product widgets. The manner in which each widget is created takes seconds, and the style applied is globally updated via Yabber. The widgets are created by dragging and dropping a block onto a page before defining the attributes that apply to the returned products. Data is always up-to-date and refreshed daily. Optional shortcode may be used to return the widget onto any page but the preferred method is via Elementor.

Pictured: An example of personal loan widgets on the Personal Loans service page. Widgets are shown on virtually every page of every type. Widgets are normally shown in rows of four, and occasionally three panels.

Pictured: The Lender Archive Page, in this case a page that shows all products made available by the Commonwealth Bank. Note that a number of 'secondary' widget types are listed at the bottom of the page - all associated with the lender.

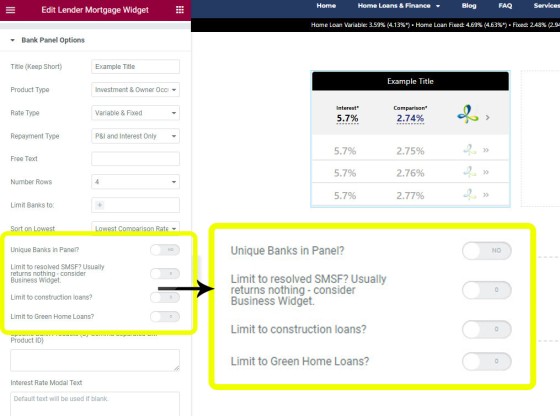

Pictured: The highlighted area shows changes to the standard Widget data. You will see options for additional product types with additional filtering options, such as bridging and other siloed loan types.

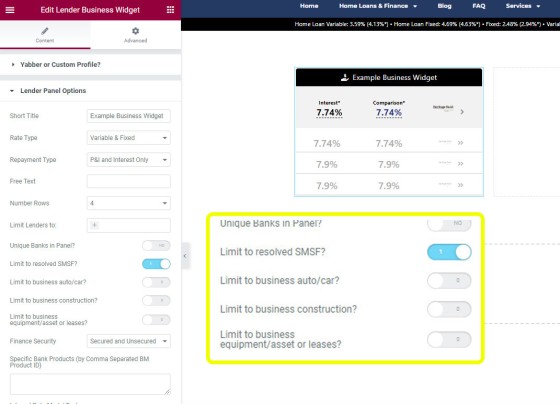

Pictured: Example business widget. In this example we're filtering on SMSF products, and as such, a small icon appears next to the title, although it's expected that the title will properly reflect the returned products. Business finance may be filtered on SMSF products, auto finance, business construction, and equipment/asset/lease finance.

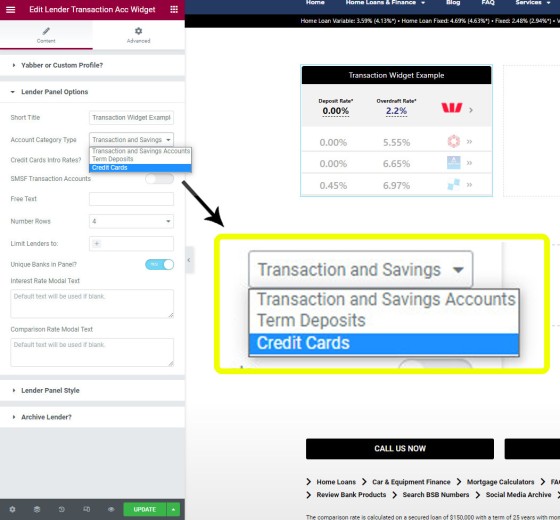

Pictured: Transaction account widget is pictured. The transaction account widget requires that you select 'Transaction and Savings Accounts', 'Term Deposits', or 'Credit Cards'. Limited options apply. This particular product-set isn't something that you'll include everywhere, but it'll be shown o the lender archive page and, perhaps, other select locations.

Shown above is a number of images sourced from our article on the updated Elementor website lender widgets. Four new widgets were included in total. Each widget (including the updated mortgage widget) provides filtering on product type, or attributes assigned to a particular product, such as dedicated vehicle finance, green loans, and so on. The always up-to-date product widgets provide for a deeper education-focused journey. For those using an older framework, the widgets are available in the latest plugin updates, but you'll have to place and define the widgets yourself.

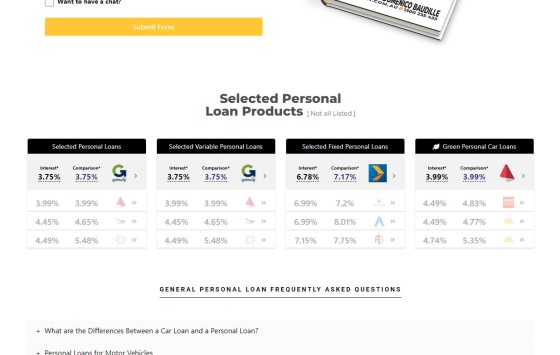

Lowest Rate of Type: Not unlike mortgage interest rates, various panels provide for placeholders that'll return the lowest rate of a specific type  (such as an 'Unsecured Business Loan', or Personal Loan Rates

(such as an 'Unsecured Business Loan', or Personal Loan Rates  ). This enables up-to-date usage of rate data anywhere on your website. This 'find-and-replace' feature was always available with mortgage data by way of the Mortgage Ribbon shortcode, and we've introduced a range of new placeholders that are supported by the same shortcode to return the lowest rate for other finance types (ordered on interest or comparison rate).

). This enables up-to-date usage of rate data anywhere on your website. This 'find-and-replace' feature was always available with mortgage data by way of the Mortgage Ribbon shortcode, and we've introduced a range of new placeholders that are supported by the same shortcode to return the lowest rate for other finance types (ordered on interest or comparison rate).

Standalone Website Package

In light of the woeful and objectively disgraceful and costly experience currently provided by aggregators such as AFG and Finsure, we've introduced a website package that will return far more conversions than you're using now, and it;s priced lower than the setup costs for your current website. Of course, unlike typical aggregator websites, our experience is a fully-owned and completely scalable solution where you have complete control over content (we had one broker using an aggregator-supplied website that waited 12-months for a line of text to be altered). Of course, various marketing features are integrated to support paid promotion - something you just can't do with aggregator products.

Stop Buying Leads From Lead Generation Companies

Until we pulled the Funnels product last week for a major update, the completely free website plugin was availed to the industry for nearly three years, with those using it indicating that it has consistently returned an ROI at least 40X higher than results sourced via the plethora of something-ify leadgen crowd. I personally don't understand how a single leadgen company continues to operate in our space when we've had a free 10-second turnkey solution available for years.

Pay Per Lead Services: The deployment of our digital system is so easy to use that we ran an 'Industry Challenge' for a number of years. My daughter would have 20-minutes to create a campaign, and the 'other' mob would have 2-hours. If we didn't multiply their ROI by at least 10X we'd donate 10k to charity, and the opposite would apply. We started the challenge when my eldest daughter was 5, and she's now a couple weeks shy of turning 9. We dropped the challenge because it became clear that nobody would willingly lose to a little girl (and they always would). We would never, ever 'sell' leads because it's unethical and contrary to the best interests of a business - simple as that. Instead, we're a few days away from launching a product that is a true lead-generation company killer, in that the product is sold with management of the first 50 leads... and we're priced lower than the charlatans that continue to sell garbage leads to the industry. Information on our Lead Package is forthcoming.

If you're buying leads, we'd argue that you're a processing company for a leadgen company, and the leads delivered to you are usually (and almost always) attracted via unethical, non-compliant, and illegal means. Want a solution that's priced lower than packs of third-party leads, is delivered with 50 leads attracted via your own website experience, and lasts forever? Read about our new lead marketing package.

The only way to grow and scale your business effectively is to take ownership of the assets required to attract, nurture, and convert leads - with or without paid promotion.

A Note to Clients

Updating old installations with the newer framework were provided as a general service, and almost impossible to perform when you had introduced significant changes to presentation. The process is now one we complete quite quickly, but you'll have to email Domenico in order to have it scheduled. The update is one that we'd consider essential - it's a no-brainer. Most internal pages take on a similar shape (because we know the format works), and internal pathways have been updated to provide a more engaging experience.

Our 'problem' is that the product we deliver you becomes a fixed asset. If you're not a managed client you won't see any significant core updates if they're introduced (although you'll always get plugin updates), so when you take delivery of your product it becomes a fixed and forked resource. This is both the advantage and the Achilles heel in that you can give your experience life and let it take on its own unique shape, but it also negates our ability to effectively push significant Core updates in the future (such as new pages). Unfortunately, this is the reality we'll learn to live with... but it's also the reality that is normal for every other website product on the planet.

Core updates aside, we've updated our article system to address an issue where a handful of clients didn't receive our articles, so with that fix we've introduced an enhanced facility that'll allow us to push other page types, such as FAQs, education pages, and other types of content (in addition to articles), directly to your website.

The teams page has been updated to support profile options to better match the needs of your business. Profiles are still created in Yabber, but they're rendered in the legacy 'archive' format (suitable for franchises or highly staffed organisations), or with a more customisable styled block, or with an Elementor widget. Yabber has been updated to support the new methodology.

While advanced and generally only used only by our higher-performing clients, the conditional modules have undergone some significant changes. If used correctly, the understanding you'll have of your digital traffic when conditional systems are used is unrivalled, and the application of this understanding takes shape via additional conditional content blocks. We don't factor in the conditional features into our cost because so few use the module, and if we did in fact charge for the functionality it'd make the product cost-prohibitive.

The new framework contains all the markup necessary to generate 'every page' video, such as those above posts and FAQs or in cornerstone content. If you don't upgrade you will have to add these video 'placeholders' yourself.

We've drip-fed a large number of features into the system over the last 6 months or so, such as the revised Glossary and Calculator modules. All these and other modules are obviously now supported by default.

Many clients will remember the discussion we had on introducing stock market quotes to your website. It's always been an optional plugin, but the question was whether we migrated the feature to Core. In the end, we've created a few pages that will serve these pages, although we're yet to come to a decision on how they'll be used. While a small point, with the introduction of the Margin Widgets, and given our emphasis on Partner Programs, it appears a prudent inclusion... but there simply has to be a point where your website potentially impacts on general perception. It's likely we'll trial the feature further and measure interactions/conversions in order to assess general suitability.

Keep It Simple: It's important that you don't modify certain Key Pages in any significant way. Assets were positioned in such a way based on assessing thousands of conversions, so making any major modification potentially impacts your conversions. As always, avoid pastel colours, particularly in the header, and try and keep to a simple thematic style (all colours are updated via Elementor's global settings).

More Than a Website

The number of business owners that say that their website doesn't return any leads is staggering. Your website doesn't return any business because it's not an engaging asset designed to convert business. If you don't have an amazing website experience with conversion facilities built in everywhere it simply will not return the business every website should be designed to return. Rather than try and articulate our unique methods and underlying ideology here, you should reference our blog with around 500 posts detailing exactly how to improve your results.

Our product is more than a website. Powered by Yabber, our digital marketing and social media system, Yabber includes around 500 modules that include email campaign management, managed article and social tools, social media tools and scheduling, SMS features, and more. Again, the blog should be referenced to understanding the type of support Yabber provides. However, as detailed above, if you don't want these tools we now provide a product that serves just the website experience.

In the last couple of years, and in light of a more widespread adoption of tools such as our partner website plugin, we've seen some businesses attract triple-digit partners per month. As more and more spammy non-compliance introduces itself to platforms such as Facebook, paid promotion (for many) has become less and less effective. Various relationship programs, with digital supporting your other efforts, will still return ridiculously effective results. Ignore anybody that tells you otherwise, or has the balls to discourage the type of marketing efforts upon which the industry is built - they're lying to you.

The Cost and Delivery Time

You should contact us for pricing as we'll be running a short-lived special for the new 'website-only' package. Another promotion will apply for the Lead Package (the first time we've introduced something we don't want anybody to buy). No offence to Finsure, AFG, and others, but we've priced the product lower than just their setup fee to ensure that their brokers have more affordable and workable options available to them.

Delivery time is generally between 5 and 7 days, but this depends almost entirely on the time it takes to set up your Microsoft and Telstra application (the former is a limiting requirement and can take 36 hours). The average deliver over the last 6-months is about 4 days.

Once your product is delivered, we schedule three one-on-one sessions where we customise your website, set up various article and social systems, and generally discuss how promoted campaigns will work.

Conclusion

Some of our clients see triple-digit leads every single month while others will see very few... and a quick review of Yabber reveals that a couple have seen zero. A website itself doesn't magically reveal itself to your audience. Appropriate use of automation, social media, paid promotion, and ongoing content creation, is all required before you see any success. Despite the fact the website itself is highly optimised for Search Engine Optimisation, your efforts will be totally unrewarded unless you craft your own experience and content. When a user does land on your website, however, it's at this point where your digital experience will elevate your expertise and authoritativeness above that of your competitors. Certainly, if you're engaging with paid promotion on Facebook, YouTube, or elsewhere, your website funnel features will come alive and provide the dynamic experience that no others provide, and it'll work at setting you and your services apart.

The difference between the results our clients enjoy, and those returned via others in the marketplace, are diametrically opposed. We believe that the difference between what we provide, and the nonsense industry products that brokers will often use, is far enough apart that their service makes ours look like marketing anti-gravity magic.

Server Updates: Give the high demands applied by way of our BeNet AI, and the large amount of processing we use to manage your resources, we're currently in the process of migrating to new servers. While website disruption isn't expected, your DNS will have to be updated to reflect the move, and there will be modules within Yabber that are unavailable for parts of December. The migration is expected to be completed later this month.