Some time back we introduced lender widgets, product archive pages, and associated product data to our mortgage broker website. Their inclusion on your website, and when used as part of a subscription funnel of any kind, will have a tremendous impact on engagement and conversions. This article introduces a significant update to the Lender module widgets.

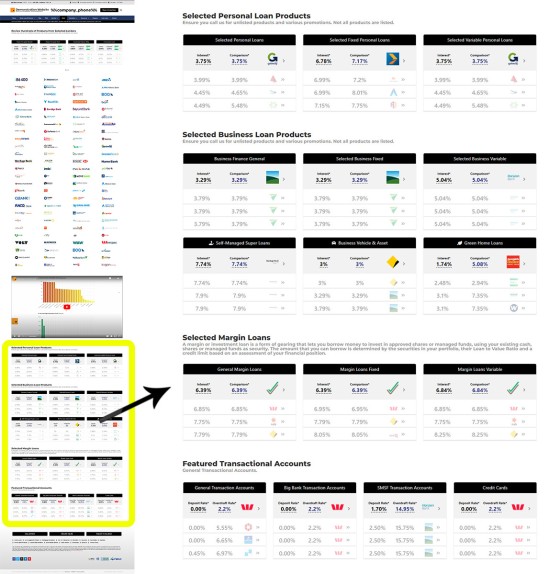

The widget data now supports business finance, equipment finance, auto finance, personal loan finance, and transactional data. The data was previously made available via our now-retired Platinum product, but it has since undergone a facelift and is now part of our standard marketing product. Product data is further segregated by borrowing attributes, such as Green Loans, SMSF Loans, Leasing, Car Finance, and so on. Additional widgets were introduced to Elementor to support the new features, and this article will introduce the new functionality.

Note to Clients: Clients should note that the V3 website framework is required for the default inclusion of this data on your website (unless you have a managed service you will have to add them yourself). Further, version 0.8.4.2 of the BeliefMedia (Yabber) plugin, and 0.8 of the BeliefMedia Elementor plugin, is required before the functionality we're about to describe is made available on your website. Update via Yabber if required. It's highly likely we've already performed these updates on your behalf.

We say over and over that in order for your efforts to be rewarded with a conversion, your website and campaigns must be designed to capitalise on the single funnel commodity that is more likely to improve results than any other: the attention of your user. Nothing captures the attention of your user with more authority than relevant and targeted education, and providing access to thousands of products made available via your accredited lenders is one of the core attributes of your customer journey that'll capture attention, assign appropriate expertise and authoritativeness to you and your experience, and start to illicit the required trust from your user. When your website is promoted in an appropriate way, you will see almost all conversion pathways move through the lender archives in one way or another... with some users reviewing dozens of pages before they make contact with you. Inclusion of ubiquitous lender data objectively works, and it's for this reason we're starting to assign more time intro developing additional products to take advantage of the various lender tools.

Your Website: If you don't promote your website, you don't assign efforts into your SEO or content creation program, or you don't have any promoted campaigns, then any marketing assets you might own, including your website, will no effect. Any tool you own will only return results when it is used.

The inclusion of additional product types objectively improves your website experience, and the experience that you provide your funnel participants has a direct impact on the quality and quantify of consumer that migrates into your opportunity pipeline.

New Widget Types

Before we introduce the new widget tools, it's important to refresh ourselves on the standard mortgage product widgets. Your mortgage broker website is delivered with hundreds of widgets with selected products positioned on virtually every page, and they showcase lender products based on attributes defined in Elementor or Yabber. This website has a menu item called 'Bank Data' that provides an 'abbreviated' version of the tool as made available in the broker framework, but it's suitable for a general understanding. At the time of writing we're just about to made a new demo website available at BrokerGrowth  , so it's worth checking out that link to gain a better appreciation of what your website might look like (it includes all widget types as they might appear on your own website).

, so it's worth checking out that link to gain a better appreciation of what your website might look like (it includes all widget types as they might appear on your own website).

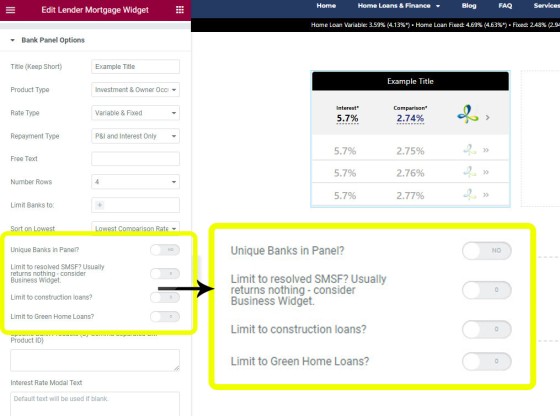

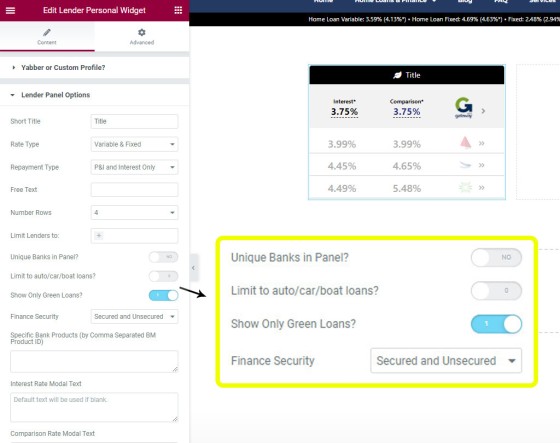

Pictured: A screenshot of four example product widgets. The manner in which each widget is created takes seconds, and the style applied is globally updated via Yabber. The widgets are created by dragging and dropping a block onto a page before defining the attributes that apply to the returned products. Data is always up-to-date and refreshed daily. Optional shortcode may be used to return the widget onto any page but the preferred method is via Elementor.

The most significant change with the standard lender widget is the inclusion of filtering based on product type, such as SMSF Products, Construction Loans, and Green Loans. When SMSF products are returned a small icon is shown before the widget title.

Pictured: The highlighted area shows changes to the standard Widget data. You may see options for additional product types over coming data, such as bridging and other siloed loan types.

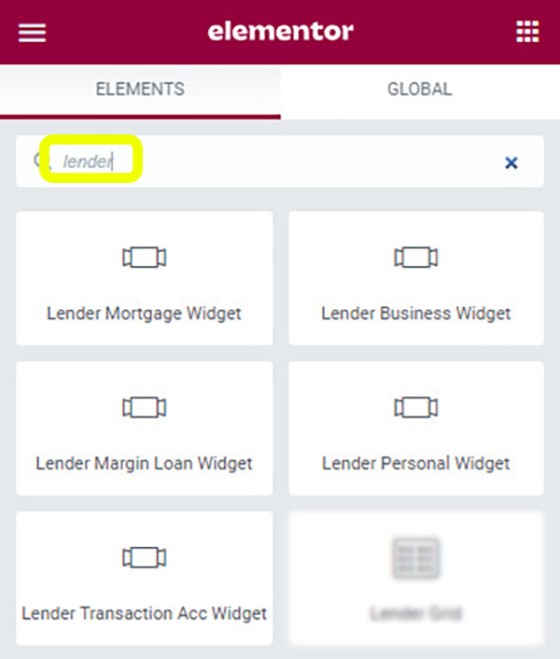

When searching 'lender' in the Elementor menu, you will notice the addition of four new widget options in addition to the standard mortgage widget: Lender Business Widget, Lender Margin Loan Widget, Lender Personal Widget, and Lender Transaction Acc Widget. Each widget has their own set of borrowing attributes to define, and each includes its own filtering options. Note that it's highly likely we'll add additional widgets in the future.

Pictured: The Lender Widgets in Elementor. Other widgets will be added if they're required. This is obviously the only example of Lender Widgets in the industry.

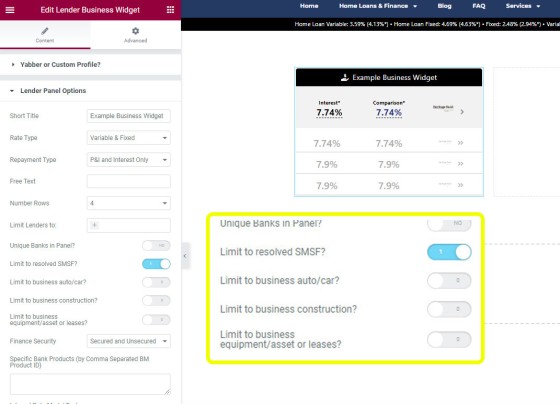

An example business widget, when dragged into Elementor, is shown below.

Pictured: Example business widget. In this example we're filtering on SMSF products, and as such, a small icon appears next to the title, although it's expected that the title will properly reflect the returned products. Business finance may be filtered on SMSF products, auto finance, business construction, and equipment/asset/lease finance.

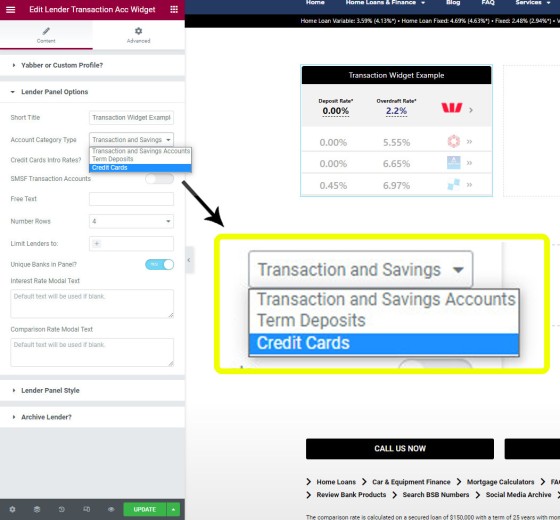

Personal products may be filtered on car/auto/boat finance or green loans, Margin Loans are filtered on standard attributes but include an option for secured and unsecured loans, and transactional accounts are returned based on selecting transactional and savings accounts, term deposits, or credit cards. The values returned for transactional accounts varies; for example, credit cards are returned with interest payable on credit and overdraft. Every product links to a product page where all product attributes are returned to a user.

Pictured: Transaction account widget is pictured. The transaction account widget requires that you select 'Transaction and Savings Accounts', 'Term Deposits', or 'Credit Cards'. Limited options apply. This particular product-set isn't something that you'll include everywhere, but it'll be shown o the lender archive page and, perhaps, other select locations.

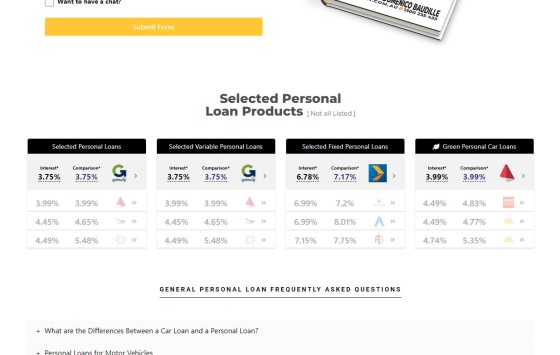

Pictured: The personal loan widget. In this particular example we're showing Green products (often a little deceptive when listed alongside featured products). Not unlike some other options, the personal loan widget provides filtering on a number of attributes, including secured and unsecured loans.

Margin Loans: The margin loan widget includes rather limited options. What is a Margin Loan? A margin or investment loan is a form of gearing that lets you borrow money to invest in approved shares or managed funds, using your existing cash, shares or managed funds as security. The amount that you can borrow is determined by the securities in your portfolio, their Loan to Value Ratio and a credit limit based on an assessment of your financial position.

Pictured: An example of personal loan widgets on the Personal Loans service page. Widgets are shown on virtually every page of every type. Widgets are normally shown in rows of four, and occasionally three panels.

The time to create each individual widget is around 10 seconds - it's extremely easy to do.

Business, Personal, Equipment, Transactional, and Margin Archives

A variety of assorted products is now returned on the standard archive page, and products of each type is now returned on the lender-specific archive page. However, we also have reserved pages (that aren't live just yet) that include all products of all different types. These pages will list all products in a sortable accordion-style format, and we expect to push the feature in early January. The new website framework includes the necessary code so it'll be a plugin update that makes the features available (either way, they're not of immediate value).

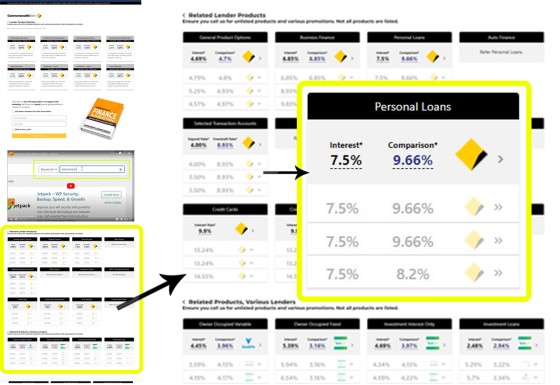

Pictured: The Lender Archive Page, in this case a page that shows all products made available by the Commonwealth Bank. Note that a number of 'secondary' widget types are listed at the bottom of the page - all associated with the lender.

Pictured: The Lender Archive Page. Note that a number of 'secondary' widget types are listed at the bottom of the page, while the lender icons will take you to a page that details the products associated with that specific lender. Standalone pages exist for siloed product types, such as business loans, personal finance, SMSF products, and Margin Loans. Note the video; the inclusion of videos on lender pages, archives, and every other page of your website, is detailed in an article that describes the method for assigning videos everywhere.

Pictured: Each widget product links to a full-featured product page. Data includes LVR/LMI and rate criteria, balances, features, eligibility, fees and charges, limitations and restrictions, and associated PDF documents. The PDF documents are optionally listed as embedded (downloadable) files. The resource is designed to be consumer-facing and easily understood, and it provides an amazing funnel-focused customer journey. Each product page includes a subscription form and lender-specific (or grouped) video. The entire lender product system creates a webbed interconnected archive.

If you're a client, you'll find the 'hidden' pages in the 'BM Lenders' menu from WP's administration dashboard. The pages are live but just not shown. As the plugin is updated to include the features the products will immediately show. It'll be your choice to link to these resources should you choose to promote these services. The widgets, however, are shown on all the applicable pages. Your Personal Loans page, for example, will show personal loan widgets, and your Business Finance page will show SMSF, auto, equipment, and other product widgets.

Lender Archive Video

As mentioned, video will have a positive impact on the user experience, and we make the assignment of videos to lenders, or groups of lenders, very easy via a module in Yabber. The video below, while already a little outdated, provides an overview of how this is accomplished.

While it's a difficult task to create videos for every page of your website, assigning them is easy, and in the case of lender archives, you may generally start with a single video and simply assign it everywhere.

Mortgage Comparison Engine

The updates as we've just described are part of the preparation for pushing a full comparison-style module to all brokers. We've held off for a little while because of a preference to deliver the feature with an integrated application form, but if we don't have the latter completed soon we'll make the service available and simply link to the appointment page.

The mortgage comparison engine is predicated on highly refined product filtering, and this requires us to evaluate virtually every product of every type in order to search for free text that doesn't conform to Open standards. Once we're happy, and once our legal team gives us the nod, we'll release the product to the standard website (again, the page itself is live within the BM Lenders admin menu, but it currently shows 'Coming Soon' text). We are being very careful not to make the same mistakes as others - including SalesTrekker - by returning results that aren't consistent with the provided client data.

Conclusion

Strangely, we've had brokers ask that various product widgets be removed from various pages despite the fact they objectively improve your organic visibility and conversions. In some cases, the broker simply didn't want to deal with business or personal finance (fair enough), but in a few cases there was the concern that a client will use your website as an education tool (a marketing objective), but then go direct to a lender.

I see both arguments as flawed. In terms of any product you don't want to manage yourself, you should seek to introduce automation or partners to manage those areas of your business. A car loan today matures into a home loan next year, and an investment property the year after. Look after your clients and everything is a gateway into something else. In terms of 'hiding' information from clients because you're concerned you will be bypassed, the notion is absurd, albeit one we understand. The information and education you provide is a funnel gateway and provides thousands of potential organic top-of-funnel opportunities. Live bank and product data is like throwing gasoline into a fire.

Our marketing service is one that supports holistic digital management, and this just happens to include the industry's most powerful website. Our full feature set is extensive and includes hundreds of marketing modules.