The Lending API returns data of aggregated borrowing rates as reported to APRA by the banks. It should be noted that first and foremost that while the data itself is integral to some of our other tools, the APRA-based graphing features are somewhat pointless. However, the graphs are included in one of the 'information' sections of the website we provide our mortgage brokers because their inclusion lends itself to the expertise and authoritativeness that we want our brokers to demonstrate. A far more relevant and extremely high-converting interest rate feature is our powerful live bank product widget which returns specific bank products and rates to your website.

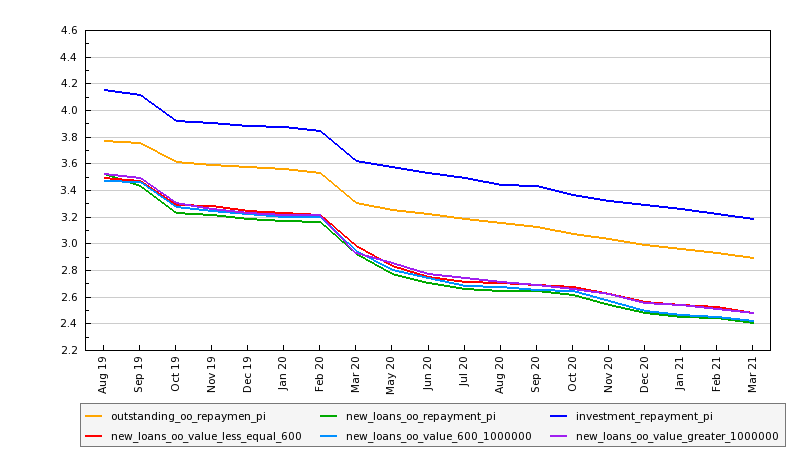

The graph returned with the shortcode of [bank_rates] returns the following:

For a consumer, the graph does show how quickly 'general' rates can rise and fall, and they support brokers' assertion that an 'affordability' safety buffer should be considered when borrowing.

Shortcode Attributes

Available shortcode attributes are as follows:

start

A numeric 6 or 8-figure

startdate, such as 202005. If astarttime is provided you should normally includedpointsor anenddate.

end

A numeric 6 or 8-figure

enddate, such as 202005. If aendtime is provided you should normally includedpointsor astartdate.

points

The number of data

pointsto return. Defaults to 48.

fields

The

fieldsreturned in the graph. Defaults tofields="outstanding_oo_repaymen_pi, new_loans_oo_repayment_pi, investment_repayment_pi, new_loans_oo_value_less_equal_600, new_loans_oo_value_600_1000000, new_loans_oo_value_greater_1000000"]. Options are detailed below.

Fields Definitions

The graphing is based on the fields supplied to the shortcode. If you choose to graph values other than the defaults you may choose from the following (the standard image graph returns up to 5 field values):

outstanding_oo_al_li

Lending rates; Housing credit; Outstanding; Owner-occupied; All loans; Large institutions.

outstanding_oo_al_ai

Lending rates; Housing credit; Outstanding; Owner-occupied; All loans; All institutions.

outstanding_oo_variable_li

Lending rates; Housing credit; Outstanding; Owner-occupied; Variable-rate; Large institutions.

outstanding_oo_variable_ai

Lending rates; Housing credit; Outstanding; Owner-occupied; Variable-rate; All institutions.

outstanding_oo_fixed_residual_fixed_lessequal_3years.

Lending rates; Housing credit; Outstanding; Owner-occupied; Fixed-rate, by residual fixed term; Less than or equal to 3 years.

outstanding_oo_fixed_residual_fixed_greater_3years

Lending rates; Housing credit; Outstanding; Owner-occupied; Fixed-rate, by residual fixed term; Greater than 3 years.

outstanding_oo_repayment_io

Lending rates; Housing credit; Outstanding; Owner-occupied; By repayment type; Interest-only.

outstanding_oo_repaymen_pi

Lending rates; Housing credit; Outstanding; Owner-occupied; By repayment type; Principal-and-interest.

new_loans_oo_al_li

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; All loans; Large institutions.

new_loans_oo_al_ai

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; All loans; All institutions.

new_loans_oo_variable_li

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; Variable-rate; Large institutions.

new_loans_oo_variable_ai

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; Variable-rate; All institutions.

new_loans_oo_fixed_residual_fixed_lessequal_3years

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; Fixed-rate, by residual fixed term; Less than or equal to 3 years.

new_loans_oo_fixed_residual_fixed_greater_3years

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; Fixed-rate, by residual fixed term; Greater than 3 years.

new_loans_oo_repayment_io

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By repayment type; Interest-only.

new_loans_oo_repayment_pi

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By repayment type; Principal-and-interest.

new_loans_oo_lvr_commitment_less_81_percent

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By loan-to-valuation ratio at commitment; Less than 81%.

new_loans_oo_lvr_commitment_greater_equal_81_percent

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By loan-to-valuation ratio at commitment; Greater than or equal to 81%.

new_loans_oo_value_less_equal_600

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By value at commitment; Less than or equal to $600,000.

new_loans_oo_value_600_1000000

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By value at commitment; $600,000 - $1,000,000.

new_loans_oo_value_greater_1000000

Lending rates; Housing credit; New loans funded in the month; Owner-occupied; By value at commitment; Greater than $1,000,000.

investment_all_li

Lending rates; Housing credit; Outstanding; Investment; All loans; Large institutions.

investment_all_ai

Lending rates; Housing credit; Outstanding; Investment; All loans; All institutions.

investment_variable_li

Lending rates; Housing credit; Outstanding; Investment; Variable-rate; Large institutions.

investment_variable_ai

Lending rates; Housing credit; Outstanding; Investment; Variable-rate; All institutions.

investment_fixed_residual_fixed_lessequal_3years

Lending rates; Housing credit; Outstanding; Investment; Fixed-rate, by residual fixed term; Less than or equal to 3 years.

investment_fixed_residual_fixed_greater_3years

Lending rates; Housing credit; Outstanding; Investment; Fixed-rate, by residual fixed term; Greater than 3 years.

investment_repayment_io

Lending rates; Housing credit; Outstanding; Investment; By repayment type; Interest-only.

investment_repayment_pi

Lending rates; Housing credit; Outstanding; Investment; By repayment type; Principal-and-interest.

investment_new_all_li

Lending rates; Housing credit; New loans funded in the month; Investment; All loans; Large institutions.

investment_new_all_ai

Lending rates; Housing credit; New loans funded in the month; Investment; All loans; All institutions.

investment_new_variable_li

Lending rates; Housing credit; New loans funded in the month; Investment; Variable-rate; Large institutions.

investment_new_variable_ai

Lending rates; Housing credit; New loans funded in the month; Investment; Variable-rate; All institutions.

investment_new_fixed_residual_fixed_lessequal_3years

Lending rates; Housing credit; New loans funded in the month; Investment; Fixed, by residual fixed term; Less than or equal to 3 years.

investment_new_fixed_residual_fixed_greater_3years

Lending rates; Housing credit; New loans funded in the month; Investment; Fixed, by residual fixed term; Greater than 3 years.

investment_new_repayment_io

Lending rates; Housing credit; New loans funded in the month; Investment; By repayment type; Interest-only.

investment_new_repayment_pi

Lending rates; Housing credit; New loans funded in the month; Investment; By repayment type; Principal-and-interest.

investment_new_lvr_commitment_less_81_percent

Lending rates; Housing credit; New loans funded in the month; Investment; By loan-to-valuation ratio at commitment; Less than 81%.

investment_new_lvr_commitment_greater_equal_81_percent

Lending rates; Housing credit; New loans funded in the month; Investment; By loan-to-valuation ratio at commitment; Greater than or equal to 81%.

investment_new_value_less_equal_600

Lending rates; Housing credit; New loans funded in the month; Investment; By value at commitment; Less than or equal to $600,000.

investment_new_value_600_1000000

Lending rates; Housing credit; New loans funded in the month; Investment; By value at commitment; $600,000 - $1,000,000.

investment_new_value_greater_1000000

Lending rates; Housing credit; New loans funded in the month; Investment; By value at commitment; Greater than $1,000,000.

Conclusion

the RESTful API returns a large amount of data in a paginated format. Various parameters will aggregate data or return calculated values; the details are documented in Yabber  . All data is sourced from the RBA via APRA and updated on schedule.

. All data is sourced from the RBA via APRA and updated on schedule.

As mentioned, the graph is one of those that provides lesser consumer-facing value than some of the others we provide, but it does make a nice addition to our broker website. The Product API and associated Rate Widget panel is a far more usable rate-based resource.

The value that we derive from the data (primarily) is based on the information it provides our BeNet AI-engine. Aggregated with other data sources it contributes towards a bigger picture understanding of audience or business trends that feeds into our Facebook platform to optimise campaign assignments.

The image graph is just one format that we return to client websites. Alternate shortcode may be used with our website graphing plugin to return interactive and more dynamic charts. The API (as documented on Yabber  ) returns data in any number of formats compatible with popular graphing applications.

) returns data in any number of formats compatible with popular graphing applications.