Some time back we introduced the Lender Archive that is a default component of the mortgage broker website framework we provide clients. Supported by around a dozen different rate widgets of various kinds, the archive is provided in three tiers: lenders, lender parent products, and lender product pages, with the latter providing a comprehensive understanding of the conditions, terms, criteria, rates, and so on that apply to each product. They're an essential mid-funnel mechanism for manufacturing the pathways that'll invariably convert, and they support part of the nested experience provided in your funnel communication. This article introduces the lender modals that we've recently introduced for inclusion on these pages.

Accredited Lenders: Every widget or archive will only show those lender for which you're accredited. Each website or widget inherits its own profile or lenders that you defined in Yabber.

First, we're not suggesting that you be a rate-driven broker. However, in order to be value-focused you'll need to supply the information relating to the products you have on your panel - it's expected of you, and it objectively increases your conversions. Sometimes you'll attract on rate and convert on structure; one can't assume that because a customer is rate-focused it means that they're a rate-chaser - it simply means that the customer doesn't don't know what part rate plays in their borrowing. With every client that touches your business you'll be required to supply the education necessary to understand why structure is important.

Lender Modals

A few weeks ago we introduced our revised Conditional Modals module. The modals are served on the basis of resolved interest, geography (FHB), specific page, or via link. It's an extremely comprehensive module supported by triggers, statistics, and conditional features. The problem - as is the perennial problem that faces any digital strategist - is introducing absolute relevance to the modals since they're perceived as a nuisance by just about everybody. If you do serve a modal it must be relevant, and it should respond to the known behaviour of the user on your website and provide a relevant high-value pathway (high value for the client and for you). To a certain extent we've mitigated this juxtaposition with our standard modals by resolving interest, and it seems to work extremely well. However, when a user is on our lender archive or information pages they're potentially telling us something about themselves or, at the very least, they're expressing an interest in a known product or product type - we need to know about this.

Modals on bank archive pages now take this potential conversion opportunity into consideration and serve a specific modal for a single lender, or a defined group of lenders. The method of discriminate modal delivery isn't conditional, per-se, but it is focused on relevance, and anything that captures the attention of your user is more likely to yield results than anything generic.

Creating & Assigning Lender Modals

The individual modals assigned to lenders are created  in an identical manner to standard modals. The assignment of these modals, or resolving which modal to show on which page, however, is a little different. We reached out a short time ago to our clients and it seemed that brokers didn't want to create modals for each lender on their panel, but rather create modals for a group, such as big banks, second tier lenders, those that consider higher-risk lending, and so on. While you may assign a single entry and exit modal for each lender, the default assignment panel provides for a group of lenders that may be connected to a single entry and exit modal. Whether you assign one lender or twenty lenders to any single modal is up to you. The method of assigning lender modals will be further developed based on feedback from clients.

in an identical manner to standard modals. The assignment of these modals, or resolving which modal to show on which page, however, is a little different. We reached out a short time ago to our clients and it seemed that brokers didn't want to create modals for each lender on their panel, but rather create modals for a group, such as big banks, second tier lenders, those that consider higher-risk lending, and so on. While you may assign a single entry and exit modal for each lender, the default assignment panel provides for a group of lenders that may be connected to a single entry and exit modal. Whether you assign one lender or twenty lenders to any single modal is up to you. The method of assigning lender modals will be further developed based on feedback from clients.

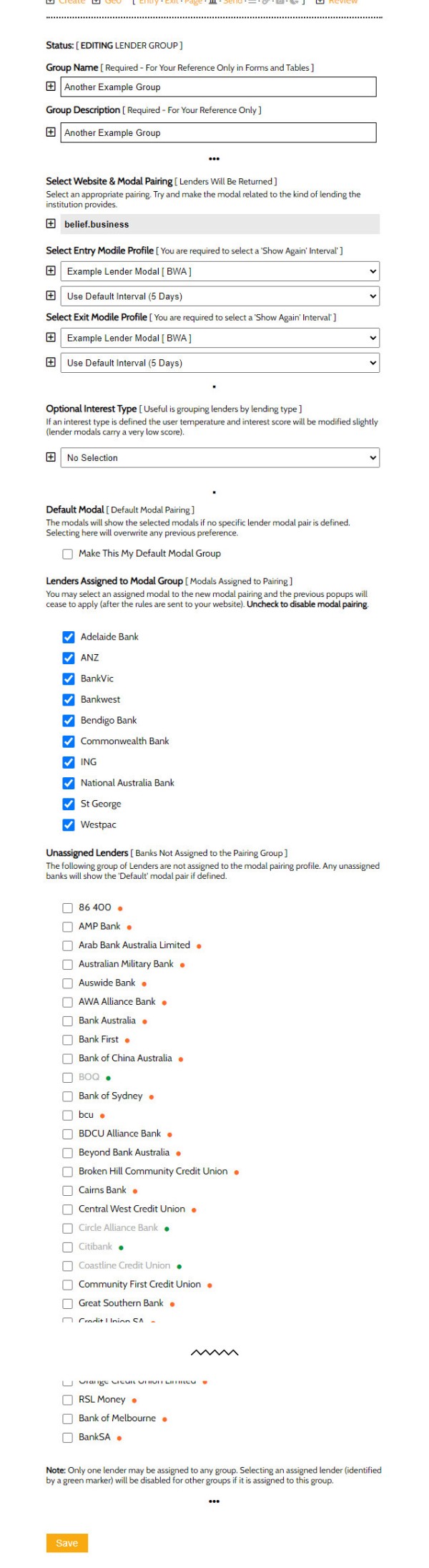

Pictured: Assigning modals to a group of lenders. The list of lenders was truncated in a serious way for readability. Shown in edit mode with lenders assigned to the specific modal pairing at the top of the image, you simply select the entry and exit modal for the specific group of lenders and save. Those lenders in the lower panel shown in grey and with a green dot are already assigned to a modal group, but may be overwritten simply by selection. The modals with a red marker are yet to be assigned to any group. If a default modal paring is shown then the selected entry and exit modal will show when no specific lender was assigned.

It's a seriously simple system to use. As stated, you may assign each and every lender on your panel with a specific modal, and in the ideal time-free world this would be ideal, and would inevitably improve upon conversions, but the expected usage is that a group of lenders offering similar products might be grouped together (you could even assign every single lender on your panel to the same entry and exit modal). You may use various placeholders to show the lowest available (comparison or interest) rate made available via your panel (remembering that if you show the rate you're obligated by law to show a comparison rate at an equal size and in a tone that doesn't diminish its importance). You may also use the location ("State") placeholder, and the various in-modal shortcodes apply as they always have done.

Modals may be reviewed and edited via the standard Modal Review panel.

Lender Modal Triggers

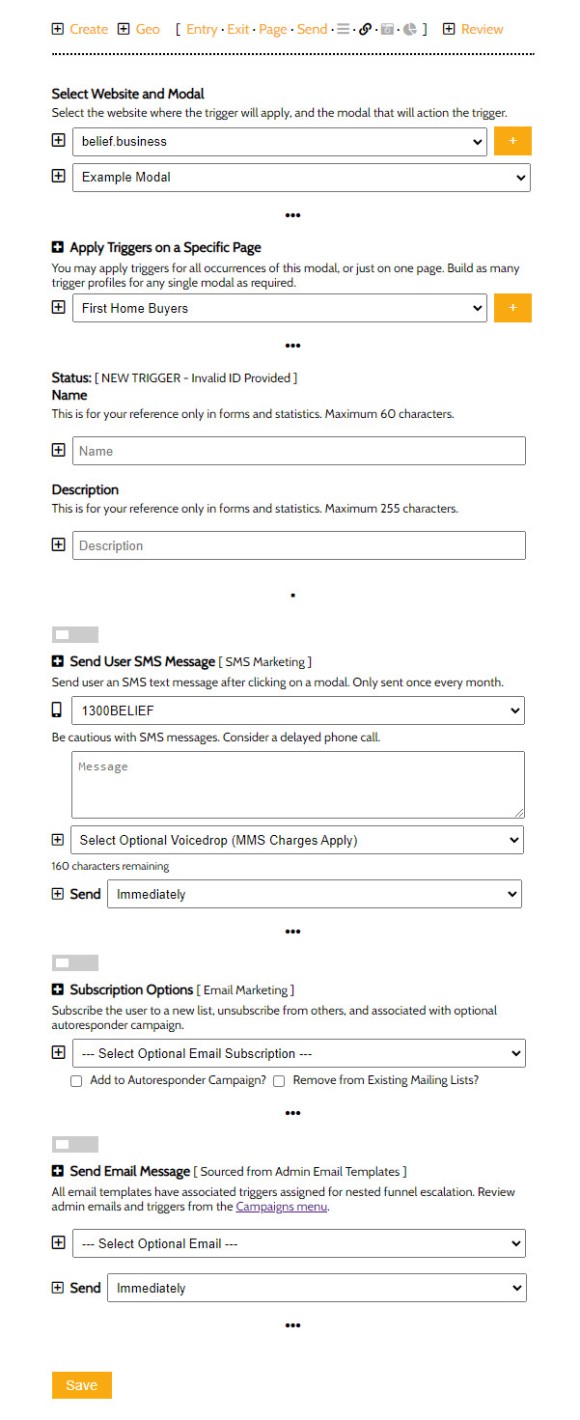

The modal trigger system works on the basis of the modal that is served to the user, so the lender modal triggers are created in exactly the same way as standard modals.

Pictured: The trigger system - an essential component of a marketing funnel of any kind - works in the same way as standard modals. Basic options apply via the Minimal Trigger Panel.

Creating a Lender Modal Link

You won't always want to use the lender modal as an entry or exit modal, and there may be cases where you'll simply want to link to the most up-to-date modal crafted specifically for a lender. In such cases you may link with the shortcode of [link lender="cba"]your-text[/link], where link is the three-letter bank abbreviation .

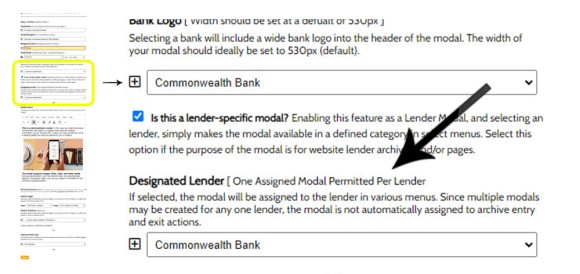

Pictured: We've added an option to the modal creation panel that allows you to assign a single lender to any modal. This is separate to the automated lender logo because you may want to assign a modal to a lender without the image). This assignment makes it available via a shortcode link, and it also makes the modal available in alternate menus when required.

There are actually two other modals associated with two lenders; the entry and exit modal associated with the group that the lender is assigned. We can also link to the assigned entry or exit modal via link with the shortcode attribute of type="entry" (or "exit"). This may sound confusing but it's quite easy to use, and quite frankly, won't be one of your commonly used shortcode features. The standard method of linking to a modal should usually apply, and the described method is probably more relevant when you have a specific modal assigned to each and every lender on your panel.

Lender Archive Link: We've also introduced an easier-to-remember link to the Lender Archive. The shortcode of [link bank="cba"]your-text[/link] return as link as follows, and it simply directs a user to the primary archive page for each lender. From the archive page a user will be able to navigate their way into the relevant product pages. The term 'bank' was used only because 'lender' was taken!

The [link] shortcode is part of a framework that provides unified and easy-to-remember linking navigation.

Conclusion

A modal isn't just a modal (we said the same thing about links and PDFs). What we've described on this page tends to highlight the serious impact that an integrated system can have on your marketing funnel - not just in the data that's returned, but the actions taken to shape the funnel participant's journey.

A full record of each individual modal is recorded in Yabber, and the forced display or click is returned in tabular format and in statistical graphs. Each modal served optionally contributes towards our understanding of a specific user based on the interest assigned during modal creation.

In a scheduled article we introduce the framework surrounding a higher-performance funnel that you can introduce into your own operation, and we discuss how modals are used to improve upon organic and paid conversions.

If the modal system we've described seems new to you it's because it's the only finance-specific and only conditional modal experience in the industry (and it's a minuscule part of what makes our digital product superior).