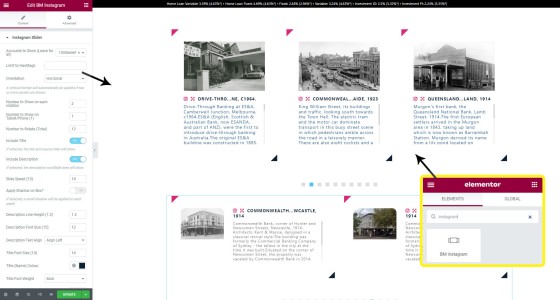

We've discriminately posted some screenshots of our updated mortgage broker website framework over the last few days, but I'm sharing this everywhere.We only built a website framework because your business relies on it (we had never inherited a suitable product previously). Leaning on a leading web presence assigns value to all programs, and it's (part of the reason) why those guys we work with do better than others.While there's thousands of updates applied to the latest website framework release, perhaps one of the more significant inclusions is password-protected modules for various areas of your operation (building on the soon-to-be deprecated legacy partner modules).Authenticated modules include the following:- Clients. Will eventually provide a full client dashboard. In the meantime, it'll be used for client resources.- Partners. Will replace our 'PartnerDashboard'. Necessary for a full, formalised, and attractive partner product. Our partner program is huge.- Education. A funnel tool for protected resources. Generally used pre-conversion- Yabber. We'll migrate some of our big-ticket tools direct to your website, such as email and SMS marketing, social media and document library. We'll also migrate some of our advertising tools. Big project.- Mentors. A module to support a full, compliant, and competency-based professional development program. The plan is for it to be used by new and existing brokers and support staff.We don't do a CRM - (that's what your agg platform is for... we build marketing tools) - so we use Microsoft Outlook contacts as a primary user source (we also integrate with a dozen other MS systems). The value of what I've just described isn't realised until you start using itA lot of brokers just 'have a website'. Bad decision. You need to operate a digital framework that'll support and grow your business, support *real* funnels, and actually attract and convert clients.Give me a call. 0400 777 300. .. #beliefmedia #linkedincompany #linkedin #marketing #marketingfunnel #yabber #website #elementor #finance #mortgagebrokers #mortgagebroker [title: Updated Authenticated User and Business Modules in Yabber]

This update is worthy of mention, not only because its a (noteworthy, albeit minor) website framework update, but because it's something anybody can do very easily (with good reason to do it).In the former website framework, all RBA articles were published as children of a post in the Resources module. The problem with this setup is that it required a user to log into Yabber, accept terms, and activate automation. The other problem? Only a few people jumped through the hoops and competes the task.We've created a standalone RBA archive, and all statements and other important news is now submitted to your website by default.The purpose of the archive? When emails are sent to your users (at any time, but particularly on RBA Tuesdays), we'll link to *our* website directly. This gives us leverage and provides an opportunity to convert. It opens up a pathway and gives us ownership of the funnel.The SEO canonical URL for each post is assigned back to the RBA source, but all other and necessary graph tags are applied.It's a cool feature that often attracts really good engagement (having a dedicated post type gives us additional stats that were previously difficult to resolve). If you're not a client, you can simply create your own archive manually. It's a little thing, but a lot of little things adds up to a big thing.

What does the consumer and business equipment pages look like in our mortgage broker website framework?Automotive, marine, aviation, and other types of finance is gateway lending that'll path the way for other types of finance, so like it or not, your website needs the information, and quite frankly, it'd be careless if it wasn't there. There's a little bit of overlap with the business module, but the pages are generally quite unique. There's a few quasi entry-landing product pages that includes jetskis, aircraft, commercial kitchens, motorcycles, and so on, and they're all necessary to satisfy the consumer-facing EEAT attributes (Expertise, Experience, Authoritativeness, and Trust), and they feed search engines with the same.Don't discount equipment. We now have equipment guys financing hundreds of vehicles a month. It's quick, easy, and a great service to provide. You'll write their home loan later on. These pages aren't promoted or linked predominantly. In fact, we only have a visible 'Auto' link in the header, and many brokers will remove it. I'm total, there's probably less than 15 equipment pages, but they're all tied together via the primary core FAQ module.

What do the standard broker website PDP (Product Description Pages) look like? The attached screenshots are of the pages that make up the core 'evergreen' cornerstone content that every website requires, and each page is designed to funnel a user through to other resources or escalate. The purpose of tech page? A contact conversion.Attached is 20 images of which almost all are your standard 'product' pages. Each follows a high-performing modular format that satisfies those core conversion requirements (statement, offer, contact and appointment links/forms, FAQs, video, testimonials, and Insights). There's a ton of other info, but there are some core page attributes that are simply essential.There's just so much to each of these pages, and a full explanation will make its way onto our website within a few days. The level of customisation, the funnel pivot points, the conditional options, and the created pathways are all *far* superior to any competing product, and the pages are more effective than what you're using now.Some pages are not shown in the primary menu (pictured), but the menu can obviously be altered. There's also three industry pages - medico, legal, and essential services - and these pages supplement the alternate front-page (Switch) options we shared the other day (they're product pages and not information pages). Some pages aren't of much apparent use, but search engines require them for the purpose of EEAT, and you require them (for the same reason) as an organic funnel launch pad. The broker website has countless pages (97.6 million to be precise), but it is on these pages where your users will likely end up.So much to discuss, but we'll wait for our blog articles and FAQs.

What does the business section look like on our mortgage broker website framework?Not much has changed in the various updates and there's still around 12 basic pages. Unlike resi and associated lending, we have some information pages to supplement the FAQ module (pictured as truncated screenshots).Business lending is easy and essential, and it's a gateway into residential and commercial finance.There's a ton of business tools in the framework, such as address autocomplete, ABN lookup, and non compliant business forms.All pages obviously have calendar integrated forms, videos, testimonials, and our new 'Insight' blocks. It's not a big-ticket section, but it's an important one. When fishing for partners, this module makes a big difference. More information will be available on our website within a few days.

Why does the new website framework include (at least) 12 versions of the front page. This is a big question that will be introduced in our blog, but here's the short version.1. If you choose to position your website in some way, there's some options that you may choose from.2. The pages are just pages, so they can be linked to from anywhere for any reason.3. The pages integrate with our 'Switch' module. If the borrowing objective of a user is resolved, or we identity the primary user interest, we can force an alternate font page to be shown for that specific user. If relevance is is a key funnel commodity (and it is), then the Switch module is one of the most powerful tools in your digital toolkit. If a user submits a form for a specific purpose, or they arrive on an industry-specific landing page, this usually forces 'Switch' to action.

Pictured is three of the (15 or so) archive pages on the new website framework - the Finance Archive, Services Archive, and Resources Archive. These pages are difficult to find and are used more of an internal sitemap than any functional page.What the image will do is give you an indication of some of the evergreen cornerstone pages we've added. Pages that were previously 'bundled' in with others are now standalone, so development finance, commercial finance, debt consolidation, private funding, self-employed, and agriculture/farming all now have their own home. In total, there's around 17 finance types with some having child categories, such as equipment and business. Other siloed finance pages are introduced and another post will detail how and why they're used. A standalone medico page, for example - one that we've always used - is created as an 'alternate' front page, and it has had a serious facelift.If you're able to read the text on the 'Resources' archive, you'll see that we've introduced direct access to the Streets module (a gateway to around 20-million pages), the emergency search, and a few others. Some modules, such as Streets, property listings, and the comparison engine, will become effective with a rapid schedule of plugin updates. We expect to use a large number of modal tools to make use of these features. We've introduced an 'Insights' post type for case studies, and not unlike the FAQ module, we expect brokers to publish these in a segmented way so the most relevant case studies are shown. We've tied this into the Property module (with links to the Testimonial module) so you're able to use the feature for 'Recently Financed' widgets - a feature we've tested on one site with success. This funky feature is scheduled via a plugin update on the 3rd April.We have completely removed RBA statements from the Resources module, and these posts will now live in their own 'RBA archive' - a far cleaner way of displaying this type of content.A ton has changed.

With great power comes great responsibility. When the mortgage industry accounts for over 75% of all volume, one expects that industry to represent themselves with honesty and integrity. The biggest reason it *isn't* okay to use rates in your advertising is if you're using them to bait consumers into forming a false impression. In other words, you want to trick them.Comparison rates are kind of pointless but they exist for a reason, and their use is legislated. If you knowingly engage in advertising you know is illegal, you run the risk of losing your business.Attached images are just a sample - we have thousands You don't have to lie or deceive.The neglect irritates me.

Spent some time shooting some video today with Andrew and one of Sydney's top property sales agents. We talked about all things construction and building contracts.There are still boneheads in the industry that'll tell you this isn't necessary.

Over the next 48 hours we're pushing over 60 new features and stylistic updates into our website framework. Some updates are minor while others are significant - the 'Headings' module sits on the 'minor' side.We'll share an update on our conditional and fully-integrated 'Buttons' module tomorrow. The 'Buttons' update is significant, and the feature is one you'll probably use regularly. Another noteworthy and reasonably major update we push tomorrow replaces the 'Education' section of your website with a password protected resource, and the RBA components of that section are migrated to their very own post type - stay tuned. There are a large number of ways in which to return various heading content blocks on your website, such as headings, titles, statements, and blocks - most of which are detailed in our website FAQ module. However, these assets are usually used in the design of certain pages - most notably landing pages - and they aren't always entirely suitable for top-to-bottom standard blog articles. For general linear pages and blog articles we have the 'Heading Shortcode' available to us, and the linked FAQ article describes how it is used.From a user-optimisation point-of-view, we've found that creatively applying some differentiation in headings makes the reading excursion more enjoyable, and it breaks up the boring monotone of your page. When the icon is used we've found that a higher number of users will scroll to the bottom of the page.Our should be noted that heading shortcodes have applied since 2016. This update simply integrated Yabber and provides more stylistic options.The module is heavily linked to the new 'Headings' module, and this feature is discussed (in brief) from within the shortcode article.https://www.beliefmedia.com.au/faq/headings-shortcode

UPDATE. We've reintroduced a program for those that have invested in poor advertising programs. If you come to us from lower-performing and non-compliant programs such as Broker Grow, Bizleads, and a few others, we'll increase your conversions by 300% or give you $25'000 (increased by 5k).The point of the exercise is to showcase and expose the nonsense programs floating around the market.This far we've seen improved results between 500% and 'immeasurable' (given so many 'systems' just didn't work, so we were comparing results against zero). Call me on 0400 777 300 for more details.Limited time. May be a wait period to start. Conditions apply (such as a video detailing results).

We've reintroduced a program for those that have invested in poor advertising programs. If you come to us from lower-performing and non-compliant programs such as Broker Grow, Bizleads, and a few others, we'll increase your conversions by 300% or give you $20'000.The point of the exercise is to showcase and expose the nonsense programs floating around the market.This far we've seen improved results between 500% and 'immeasurable' (given so many 'systems' just didn't work, so we were comparing results against zero). Call me on 0400 777 300 for more details.Limited time. May be a wait period to start. Conditions apply (such as a video detailing results).

I've spoken of the illegal 'Mortgage Magnet' operation in the past, so I won't repeat myself. The comments on this ad (taken at 10FEB2025, 12.23AM) shows the lack of comment oversight.Such a scam. Any ACL holder that doesn't police their downline advertising or lead source should be considered in breach of legislation.

We've provided further updates to the agile website footer and header menu modules.Built in Yabber, each menu item links to a page, modal, email, telephone, or login modal. The entire design is customisable, and each menu is assigned to a defined location.The menu update includes improved tracking, more advanced trigger handling (in Yabber), and a modified framework for scalability.Any change to either the header or footer menu takes seconds, and the menus may be applied to any footer template.The menu and footer menu module is obviously just one part of the broader menu and footer panels.It's just another reason your website will do better, and serve you better, than others.We'll have an FAQ published on our website later today

Let's talk about this first day campaign. It resulted in 56 distinct refinance leads at $1.53 per lead. Conversions are expected to be around 30% (slightly below our own average, but far higher than industry).Results aren't typical, so why did this campaign perform so well (when leads normally average $11)?(This ad was a company first after they introduced their first 25 partners). First, it started with our website. You don't win the funnel wars with mediocrity. It's a no-brainer. Second, the ad was content. Real content. Not talking heads or nonsense, but real edutainment.Copy was great, compelling, and had only one defined promise, but it highlighted the core points of positioning.The landing page was simple and continued with the ad conversation. It obviously included a form with conditional redirections. We didn't ask dumb 'disqualifying' questions (those dumb questions that disqualify brokers and alienate users). The funnel continued with further website integration. Third, automation was great, and the follow-up value was overwhelming. The conditional funnel logic was a work of genius :)Targeting was based on reviewing Census data. It wasn't copycat guesswork. It's what we call an abstracted audience (positioning based on data). It's the difference between 'advertising' and just throwing up some generic Facebook ads. Most do the latter. Typical lead cost is around $11-12, so today was exceptional, but also expected. It's just what happens when it's done properly.So, that's what a $35m+ day looks like. Some brokers won't do that in an entire year. And it cost ~$90.Meanwhile, some brokers buy leads, while others navigate the array of nonsense options floating around the market.

This might be obvious to many of you, but it's one of those toilet-tactics that'll add an easy 50m to your operation with minimal effort (1m a week is worst-case). There's only a handful of brokers I work with that do what I'm about to describe and they're all seeing great results. Banks have big advertising budgets, and their ads get lots of engagement. Follow all lenders, and then contact those that have commented directly if they've expressed interest of any kind. It's surprisingly effective. You're exposed to a 'buy now' market, and you're not paying for it. It just works. Once you have somebody on staff, have them perform the function for just 20 minutes twice a day. If you're one of our clients, talk to us about how we aggregate comments and then send AI messages. When a user comments on your own ads, ensure you hide that comment to limit exposure.There's obvious ethical issues with what I've described, but one could argue that you have a vocational responsibility to offer help when you see somebody that needs it. Contacting those that comment on other brokers ads is where it starts to get dodgy.

The Re-Mortgage brand run by 'Mortgage Magnet' is one of the most dishonest leadgen services in the industry. They engage in false advertising, predatory practices, fraud, and they disregard about every piece of legislation designed to protect consumers. They're an example of 'Worst Interest Duty'.We've critiqued Mortgage Magnet numerous times in the past (in fact, in the last week I've spoken to a broker that lost his business on the back of buying leads from these charlatans), and we're not going to critique them again. The point of sharing this recent screenshot is just to share the comments. They're usually deleted pretty quick, but in this case we get to see a few before they're removed.

Domenico is leaving for Rome tomorrow on a very short-notice gig to support one of our entertainers. As a result, we'll have to pause website upgrades until late next week.

Every now and again we attract a client with a very specific set of challenges. This is one of them. Meet 'Milly'.

With the need to carry more broker bums on weekends, we've invested in a few extra seats. It's called the 'Broker Mobile', or 'Bro Mobile' for short.

I'm in Wagga, Junee, Temora, Albury, and other nearby areas visiting brokers for the next few days. Call me on 0400 777 300. M.

The reason I occasionally carry on about the (lack of a) comparison rate in advertising isn't just because it's illegal, or because it highlights a bigger picture issue with broad business compliance. The reason the bread-and-butter requirement grinds my gears is because the rate is used to deceive consumers. There's a word for *knowingly* and deliberately deceiving a consumer: fraud. I wish those people with a voice would start using it and put an end to the ubiquitous nonsense.Of course, the comparison rate is one issue of about 30 that are routinely ignored. Your service is amazing, and you don't need to lie in your advertising. You absolutely don't need to intentionally introduce deception or lies in order to attract business.

For the last few years we've made attemps to call out illegal, non-compliant, unethical, or offensive financial advertising. Originating mainly from pay-per-lead services, the plethora of deceptive finspam has left a permanent stain on the industry's underpants.We were fortunate to be asked to provide advice and guidance to various groups over the last year, and it's great to see Facebook implement many of the changes we've suggested. What they've introduced is a good start. It's not a fix, but it's another layer of protection for consumer.After we authored our final recommendation, we asked 72 lenders to endorse our prposals, and we were thrilled to receive 72 responses. Of the 41 aggregators we asked, none chose to endorse what was essentially a manifesto for ethical advertising.As far as Facebook is concerned, anybody running ads will have to validate themselves and their licencing. We've completed this with all our active clients, so this post is for everybody else.From Facebook:To help prevent fraud and impersonation in financial products or services advertising, and in some cases to comply with regulatory authorities, Meta may ask you to verify information about yourself or your organization in order to publish ads that promote financial products or services. These requirements are intended to promote consumer safety. Before running eligible financial services ads, advertisers will need to verify information about the ad beneficiary and payer, including their Australia Financial Services License information (unless otherwise exempt). Generally, the beneficiary is the individual or organization benefiting from the ad, whereas the payer is the individual or organization paying for the ad.Eligible financial services ads will need to contain a Paid for By disclaimer, featuring the name of the individual or organization paying for and/or benefitting from the ad. The clickable disclaimer leads to a separate info sheet. https://en-gb.facebook.com/business/help/719892839342050.. #beliefmedia #linkedincompany #linkedin #advertising #facebookmarketing #facebookadvertising #marketing [title: FB Verification Required For Financial Advertising]

I tend to waffle on about the lack of a comparison rate in advertising, and It's not because I think the comparison is overly important, and it's not simply because it's against the law. It's because I see it as a deliberate means to deceive consumers. Failure to abide by such an entry-level and seriously basic obligation - particularly when consumer-facing communication is intentionally crafted to trick customers - is a symptom of something much uglier. Brokers have evolved into the primary channel for obtaining a home loan, and this places a bigger-picture burden on the entire industry to hold itself to the highest of standards, and our honesty, integrity, and ethical behaviour is measured in binary terms - either we're honest or we're not, and when over 80% of all consumer advertising manufactured by brokers is manipulative or dishonest in some way, this ubiquitous malfeasance inevitably shapes consumer opinion and invariably impacts the credibility of those honest brokers that have higher standards.Sadly, the everyday infractions aren't limited to advertising. Most of the time, it's because brokers simply aren't provided with the necessary guidance.We've created a package for aggregators and ACL holders that deals with a number of compliance issues, and we've prepared a presentation suitable for PD days. If you'd like more information, please make contact with us.

About This Stock and Bond Business, by Louis H. Engel. The ad is so good that I'm sharing it 76 years after it was first written. Most copy we see nowadays is forgotten within seconds. There's so much to learn from this amazing ad and copy. Ogilvy was famous for his story telling, saying over and over that "the more you tell the more you sell", but the unfiltered, raw, informative, compelling, educational, and entertaining copy that was central to the early examples of long form has slowly devolved into long 'squeze-type' 'copy that says virtually nothing, provides no answers, and exists solely for the purpose of escalating 'manufactured' intent with little regard to the broader 'Lantern' attributes that are central to BM's own advertising models (Experience, Expertise, Authoritativeness, and Trust).We often draw upon a Simpson's line "you don't make friends with salad" to articulate the nature of the digital handshake at the top of funnel, and this ad tends to support this ideology. Content engages, while hyped sales copy does not. "About This Stock and Bond Business" was one of Louis H. Engel's most innovative advertisements. Considered one of the the one hundred most influential ads in North American history, the ad appeared in the fall of 1948, approximately two years after he had joined Merrill Lynch.The ad consisted of six thousand words of very small print squeezed onto a full-size newspaper page (the full-page broadsheet advertisement was the original landing page). The copy was informational and educational, and textbook dry in tone. There were no explicit references to the firm's own brokerage services in the entire text, but at the bottom right of the page was a small calling card (call-to-action) that identified Merrill Lynch as the sponsor and invited readers to request free reprints of the advert in pamphlet form.Once tested, responses exceeded three million, and those returns translated into millions of prospective customers.Use long form to tell a story - not to sell. The former achieves the latter. Full write-up in our FB group.

There are a few big-ticket compliance SNAFUs in this ad (the exclusion of the comparison being the most obvious), but usage of the Coat of Arms in a black and white ad designed to emulate a Government document is the focus of this rant.The use of the mark is regulated under federal law, and its use in any advertising is prohibited unless specific permission is granted (and it never is, particular when used in consumer-facing finance advertising, and certainly not on ad that is natively non-compliant or deceptive).Let's look at some of the laws relating to usage of the Coat of Arms.1. Crimes Act 1914 (Cth). Section 73: Prohibits the unauthorized use of the Australian Coat of Arms in a way that suggests a connection to the Australian Government.2. Trade Marks Act 1995 (Cth). Section 39: States that the Australian Coat of Arms is a protected symbol and cannot be used in trade or commerce without authorisation. Use in advertising is considered a form of trade or commerce.3. Intellectual Property Laws Amendment Act 2015 (Cth). This amendment strengthens protections for official government symbols, including the Australian Coat of Arms.4. Copyright Act 1968 (Cth). The Australian Coat of Arms is not covered by copyright but is protected under laws governing national symbols. Misuse could still lead to enforcement under this act in conjunction with other legislation.5. Australian Government Branding Guidelines. These guidelines clarify appropriate uses of the Australian Coat of Arms and explicitly prohibit its use for commercial purposes, including advertising.6. Consumer Law. Implying a government endorsement or affiliation is misleading and a breach of Australian Consumer Law (Schedule 2 of the Competition and Consumer Act 2010, Section 18).7. Other consumer/financial legislation deals with trickery, deception, false representation, false endorsements or associations, and consumer perception.Be careful.

"How to create financial advertising that sells" was a 1974 advertisement from New York based advertising agency Ogilvy & Mather. It's a master-class in copy.[More information and a full transcript of this advert can be found in our FB group]The 'financial advertising' advert was one of a number of Ogilvy's long-form advertisements that were used as a means of demonstrating their expertise and providing industry-specific social proof. The long-form advertising was a technique widely avoided by many in the fear that they were "giving too much away" (a ridiculous proposition when measured against our current understanding), but the technique was a defining feature of Ogilvy's ads while others were trying to be cute.Of interest is Ogilvy's line "the more you tell, the more you sell" (top right). While Dr Charles Edwards might have said it first, Ogilvy made it famous. There's no question that long-copy sells if you're selling the right product in the right way (sadly, something brokers just do not do).When Ogilvy and Mather printed the article they essentially took ownership of the principles discussed despite the fact they were commonly applied by others at the time (their points of diff were shared by others, but Ogilvy were the ones talking about them). Ogilvy took the long-form approach when others were printing small ads that weren't nearly as readable or compelling.If you write long form, tell a story. Stories master.

The relevance of the screenshot is because it was taken when our broker attracted 50 leads - the typical number of 'leads' delivered by leadgen charlatans at a cost of around 8k.Leads delivered by leadgen crooks convert under 3%, and usually closer to zero. You would literally enjoy more success if you parked your ass at a bus stop and talked to strangers. Let's say that our broker invested 8k into their *own* marketing using the above campaign (about 4X what most brokers will spend). That's 1221 leads.Funnel branded leads convert between 18% and 30%, with refinance campaigns usually coverting up to 28%.Let's say we converted just 25% of our 1221 leads with commissions at $3500. That's roughly 305 deals.The net result: $1,068,375.The guy that purchased 50 leads probably closed one deal and wasted a lot of time chasing ghosts. The reality? FB is slow initially with conversions around 20%. Even if you converted half of what we've detailed above you're still looking at $535k. Screw the pooch completely and you'll only walk away with $267k. On the flip side, you can always do better. Facebook advertising is not just interruption marketing - you're also competing with others using the same words... and most homeowners already have a broker (so it's literally relationship destroying marketing).We often say Facebook advertising is like hanging out at a Caltex service station expecting to meet classy girls. It doesn't happen.Around 90% of our time is spent helping brokers build their network. This month our partner program alone will return 560m. Our brokers will still advertise on Facebook, but it'll be for the same reason McDonald’s sells cookies.Not a single one of our current clients running FB ads is paying more than $70 for a conversion into a settlement. Not one.Invested in the 'Broker Grow'? - nothing to do with our awesome 'Broker Growth' program. Migrate across to our product, and if we don't improve your conversions by 300% overnight we'll give you 10k.

Commbank to charge $3 for cash withdrawals. Appaling.

Shad of the Day, 15th November 2024. More of the same nonsense with *multiple* compliance issues. This gem comes to us from 'Finance Group AU' (aka 'Finance Scanner' among other fake brokerage brands), and it's operated by a typical leadgen crowd called Biz Focused. If you're ever in need of some finance humour you simply need to sit yourself down and check them out... unless you're buying their leads, in which case you'll probably want a Bex and a sulky nap.I get tired of the Shad because it's the same recycled nonsense, but in this case it's worth mentioning because of the lengths these clowns go to in order to hide their involvement with the service (no mention on the website, no domain info etc). It makes me wonder if they're hiding from regulators, or perhaps they're creating distance so brokers don't connect the dots and identify the dodgyness (reminds me of the story of a guy that married a beautiful girl, only to learn on their wedding night that he had in fact married a feminine man). Either way, the pictured experience probably delivers leads to brokers at around $130, but if you did it yourself (a solid 10-minutes worth of work for something so simple), higher quality leads would be delivered for less than $10. We work in a crazy industry.Don't buy leads. The industry deserves better. Our customers deserve better.Stop the finspam.