The Commonwealth Bank of Australia was only two years old when the First World War broke out in 1914. Despite being in its infancy as an institution, the Bank readily took on the challenges and responsibilities of providing financial support to individuals and the nation as a whole during the war and its aftermath.

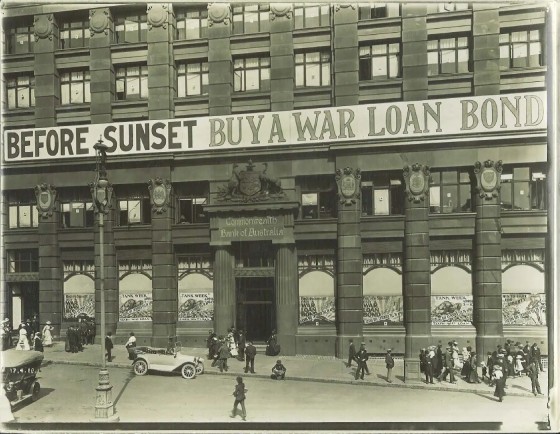

One of the areas in which the Bank was particularly involved was assisting in the organisation of Australia's war finances. Between 1915 and 1921 the Bank managed the raising of seven war loans and three peace loans from the public. These were used to cover Australia's war expenses including the repatriation of soldiers after the war. The Bank was also responsible for maintaining the stability of the currency. This included responding to the note shortage that occurred shortly after war broke out by issuing an emergency issue 1-pound note, commonly referred to as the 'Rainbow Note'.

In addition to these responsibilities, the Bank needed to be able to continue to provide banking facilities to Australians. This required the hiring of additional staff, predominantly female, to handle the increased workload and compensate for the absence of the staff who had enlisted.

The Bank also expanded its services in order to provide members of the armed forces with access to banking facilities. This included opening additional branches near to where the troops were quartered in England, expanding the range of services available at its branches, and making arrangements with overseas banks and the Defence Department to ensure that servicemen could access their money almost everywhere.