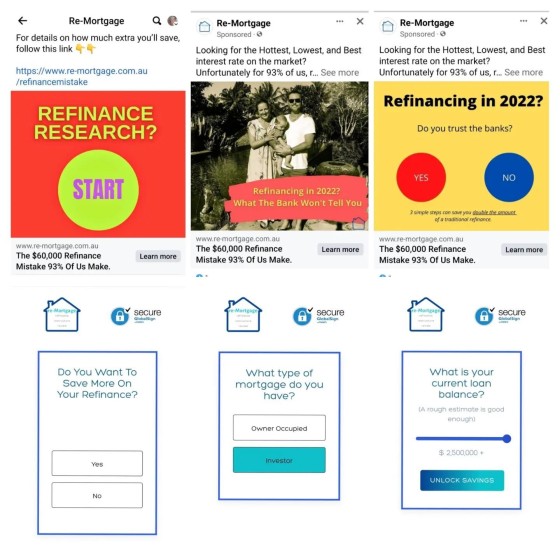

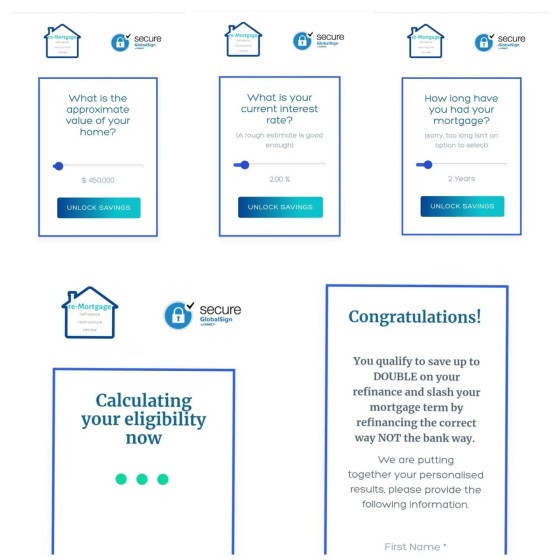

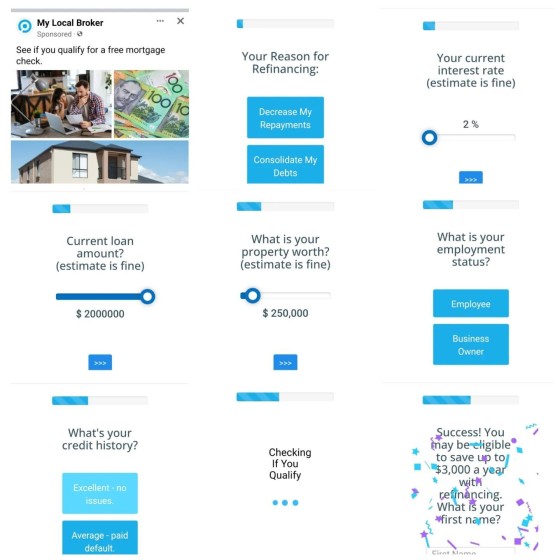

Their lacklustre and deliberately deceptive subscription funnels are so similar we've simply grouped them together. The former group is probably one of the lowest performing leadgen charlatans in the country (and seriously, probably the entire Oceanic region), while the latter group (MLB) are a little sub-aggregator that might not even be entirely aware that their marketing representation has exposed them to potential fines and litigation.

We've previously shared the legislation detailing why this style of baiting is unethical, contrary to BID, and blatantly illegal. Violating numerous pieces of legislating -, including the Privacy Act, 1988 - the subscription experience asks questions that have no impact on the outcome. The 'quiz' shown by both companies will lie about 'Checking Results' at the cessation, and both *knowingly* create a false impression and understanding in the minds of the consumer that they 'qualify' for some sort of benefit (the generic 'qualification' message is shown regardless of the data supplied by the user). In other words, both groups deliberately lie in order to steal data from the client.

I had my wife subscribe to both experiences, and I had her make a 'typo' that'd exclude her from any loan, or even a Blockbuster membership. Neither group followed up on her enquiry in any way. Despicable.

I'll comment on the woefully bad ad copy another day.

This week we'll be releasing our 'Comparison API' for free to those that are signatories to our 'Finance Marketing Code of Conduct'.

In terms of the deplorable 'subsciption funnel' provided by Mortgage Magnet, our free plugin provides returns results that we've measured to be at least 50X more effective.

If interested, we're running a live FB Marketing webinar on Wednesday. Those that attend will get the new version of the free plugin.

Stop the finspam.