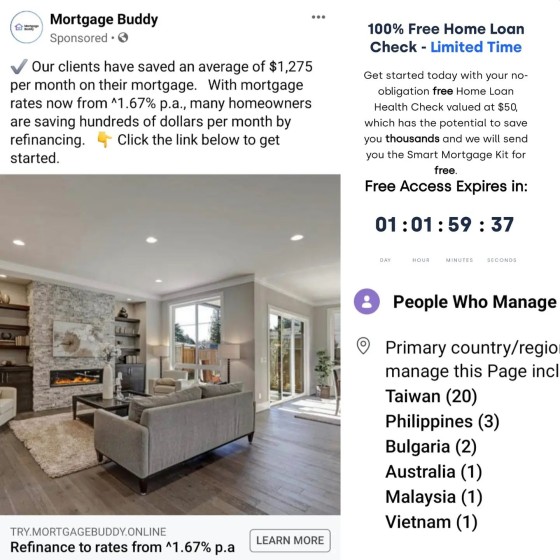

Other than the standard compliance issues associated with rates, comparison rates, quantitative statements etc., this group has an atrocious and misleading 'funnel' experience (for example, they provide a fake countdown for free help to a 'free' service - just disguising).

As you may know, we subscribe to just about everything to see if we receive a callback (we're always leaning on the unqualified side when we jump through those ridiculous quiz questions, so we've never received a call back from this mob). With each subscription we use a new email that isn't able to be traced back to us. The result: all of those distinct emails are now a part of various property, bitcoin, and other ridiculous mailing lists. In other words, Mortgage Buddy are double-dipping on your data and selling it to others (the dodgy offshore business isn't obligated to subscribe to Australian privacy principles, or adhere to even the most basic expectations of the Privacy Act).

Any broker that subscribes to this service is inviting clear non-compliance into their operation, and they're leaving themselves liable for prosecution.

Why won't ASIC (or even aggregation groups) step up and put an end to this crap? We really need better industry education.