The Compare-1 clowns violate a number of laws, but it appears that brokers, ACL holder, and aggregators, just don't care.

Brokers don't have to bait and lie in order to attract business. You're operating a printing press for yourself and your clients - you don't need to employ trickery (call us for an introduction to ethical leadgen for a fraction of the cost).

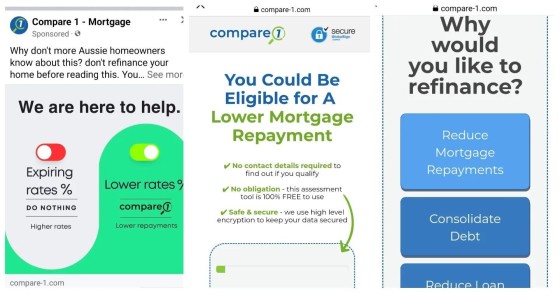

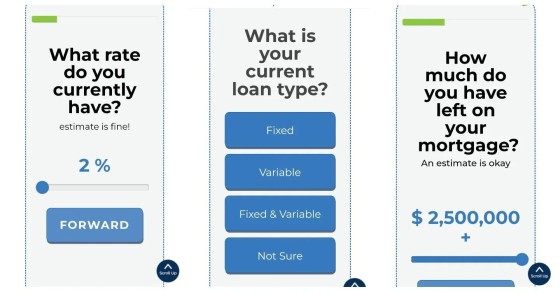

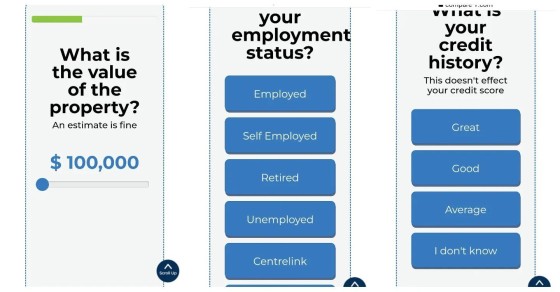

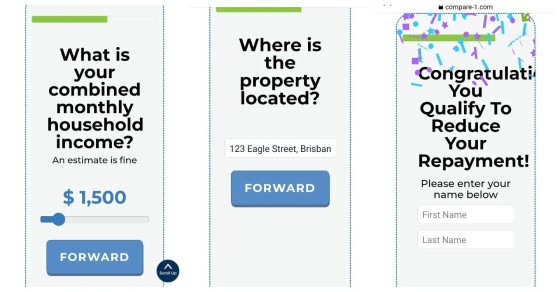

Don't claim that 'no personal details are required to find out if you qualify' when the results will indiscriminately return a 'You Qualify' message, and don't say 'Click here to see if you qualify' when you're doing nothing of the sort (the 'Q' word is one that should be used only sparingly). This style of fake advertising will bite you on the bum when somebody relies on your flawed advice.

As for the fake 'website', the finance reviews are fake (they've used a photograph of a Dutch scientist for one review and a European 'adult actress' for another). Fake reviews open up a whole new can of worms (typical of leadgen).

Fake messaging, intentional deception, fake infornation, baiting, and false advertising are defining characteristics of this disguisting group. How dare they expose brokers to this level of non-compliance, and how dare they introduce illegal practices to businesses that are silly enough to pay them for a service. Customers deserve better.

Best Interest Duty is an overarching obligation that doesn't start when you feel like it.