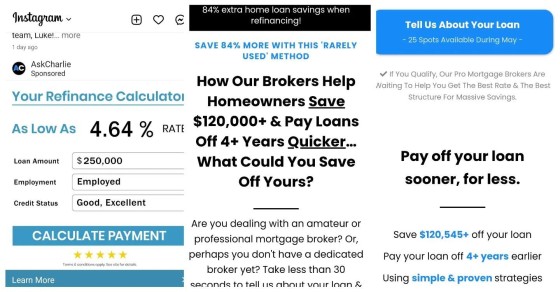

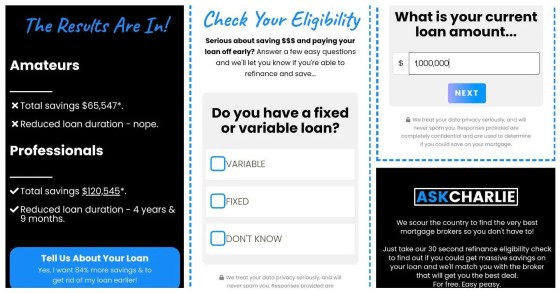

Limited panels shown, but enough info is presented to indicate I wouldn't qualify for a Blockbuster card (assuming the 'quiz' was served for a purpose other than charging more for leads). Property value was set at 250k.

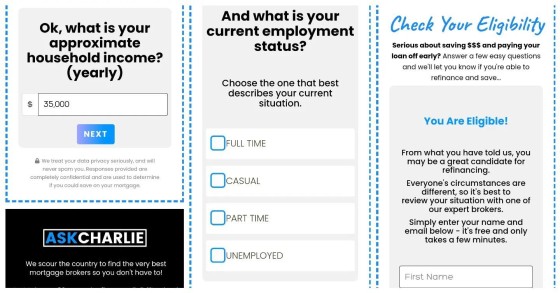

Same story. Quantitative statements. Missing conmparison data. Missing disclaimers. Invalid advice. The most concerning part of this experience - like so many offer dodgy leadgen crooks - is the message showing 'Checking Results' before returning a 'You Qualify' style of message. The practice is misleading, unethical, and illegal. The deception also qualifies as baiting.

Are brokers solely responsible for infractions? A leadgen company *is* liable for compliance when they pretend to be experts (simply by offering a broker-style website they are already operating illegally). While the primary responsibility for advertising material rests with the organisation placing the advertisement, the publisher may also have some responsibility for the content of an advertisement. However, it is a defence to a prosecution if the publisher received the advertisement for publication in the ordinary course of their publishing business and did not know, and had no reason to believe, that its publication would amount to an offence (this never applies in the mortgage market): s1044A, Corporations Act; s12GI(4), ASIC Act. What does this mean? It means the leadgen guy and the broker can *both* be fined (you'll also lose your Alana probably your trail etc.).

The experience is shared by others, such as Leadify, Mortgage Magnet, Swell, Karbn, Bizleads, NeedMoreLeada and a bunch of others illegal programs.

I genuinely don't understand how brokers can invite clear non-compliance into their operation, and how/why aggregation allows it.

Remember, our basic compliant solution is free. It'll install in a couple of minutes and return a 30X-50X ROI.