It's expected that brokers know their legislation, but for those looking for a cheat sheet, ASIC's Regulatory Guide 234 gives your reason to know the law... and no excuse not to know it. There are really only a handful of big-ticket advertising rules.

In terms of MH's ad, the following obvious points need to be made. It's not an exhausting list of the infractions. The ad itself was contained in a FB form, so no silly quiz was shown.

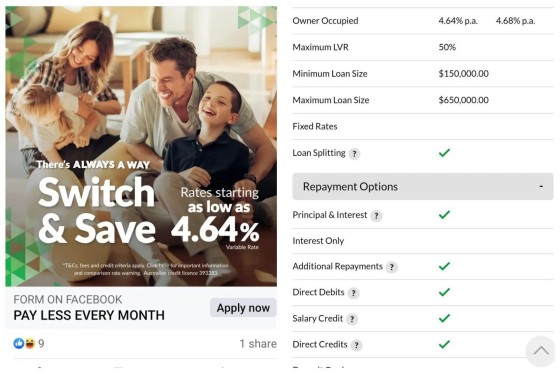

First, the rate of 4.64% has a comparison rate of 4.68% (not shown in ad). The rate applies to an LVR of 50% and limited to 650k - clear exclusionary product attributes.

RG 234.47

The more that a qualification is required to balance the information contained in the headline claim, the more prominently placed the qualification should be. The headline claim must not itself be misleading.

RG 234.51

If a qualification is required, it must be published at the same time as the original message. Subsequent qualifying disclosures will not be effective as the misleading impression will already have been created.

RG 234.67

An advertised comparison rate must be identified as a comparison rate and the comparison rate must not be less prominent in an advertisement than any interest rate (s164, National Credit Code). One example provided: a comparison rate is smaller in size or faded in colour when compared to the interest rate.

RG 234.69

A comparison rate in an advertisement must be accompanied by a warning about the accuracy of the comparison rate and that the comparison rate is accurate only for the example given in the advertisement (s163, National Credit Code; reg 99, National Credit Regulations).

Your objective in advertising should be to educate and inform. Don't try and navigate legal obligations... even if you are tickling a fine line that keeps you legal.