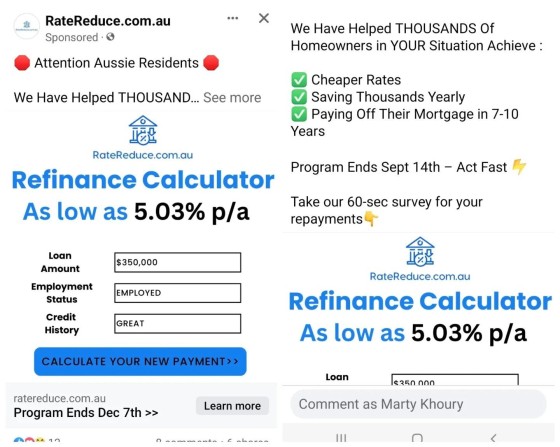

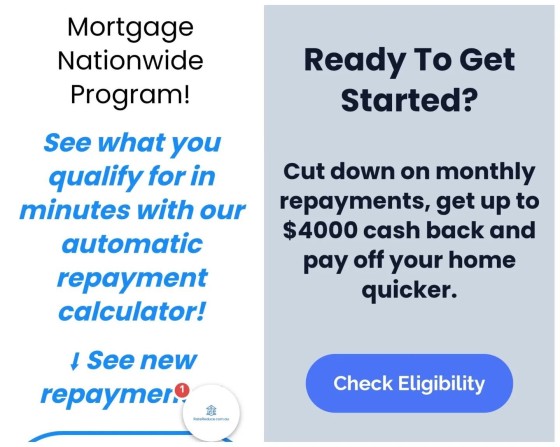

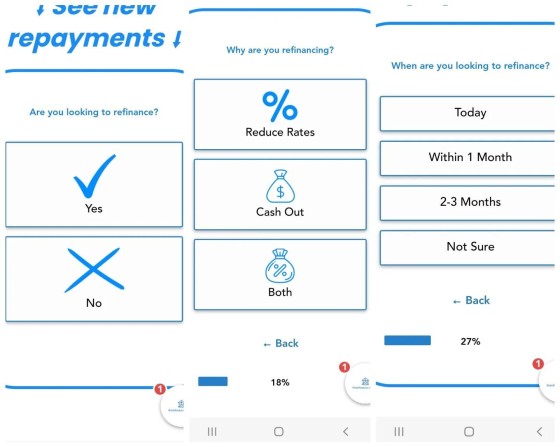

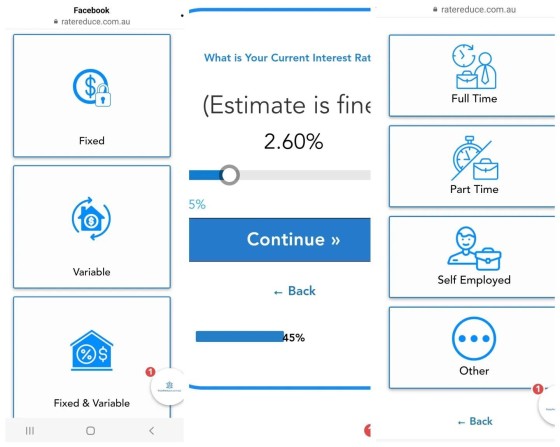

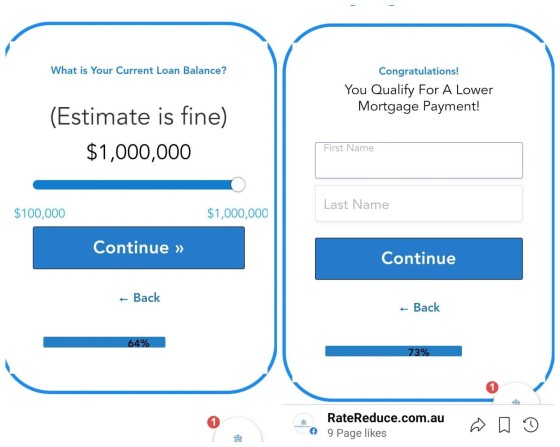

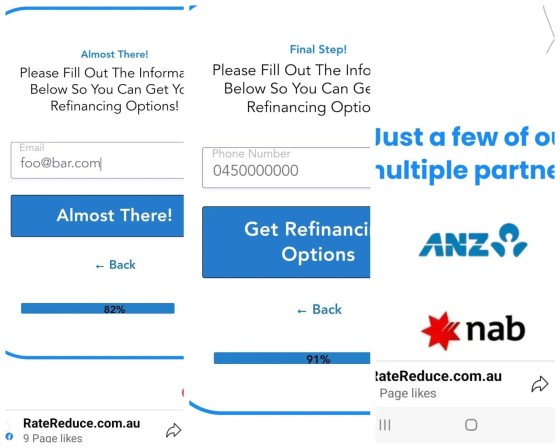

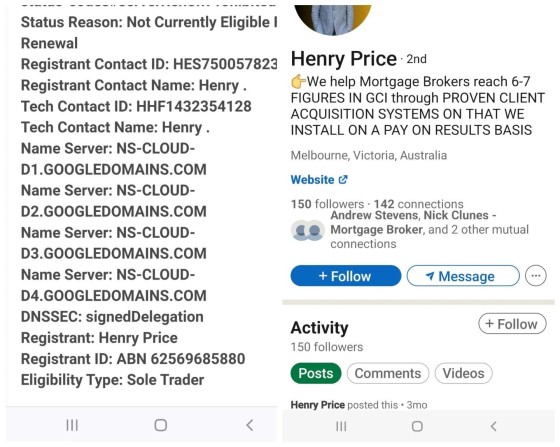

If a broker published this ad directly they'd be expelled from the industry in a second... so why and how a broker can hide behind a false veil knowing that this fake advertising is taking place is simply disgusting. I won't even bother pointing out the 22 violations as they're quite clear.

1. Borrowers deserve better. Best Interest Duty isn't a gimmick, and it's not selectively applied. Laws are in place to protect consumers from this baiting style of false advertising.

2. Brokers themselves should know better, and they should never ever enter into an agreement without knowing exactly what sort of material/messaging is used to represent their operation.

3. Those brokers that engage with these services have successfully contributed towards the loss of industry reputation. Brokers were once a respected breed - they now share a trust rating with used-car sales people. Leadgen charlatans and crooked experiences like the one pictured are partly responsible.

4. Aggregators need to pick up their act. We've just finished a documentary called "Finscam" targeting one aggregator specifically, and this agg 'chose us' for very good reason. We'd provide details if the footage we took wasn't evidence in an ongoing investigation.

5. We introduced Facebook advertising to the finance industy. Since then, the cost of a conversion has increased by around 100X. The best clients are clever enough to develop a blindness to the FB BS.

You'll need to watch our feeds tomorrow afternoon as we'll be showing you in real-time how we help our brokers achieve more volume in a month than most will see in a year. For the first time ever we'll be showing you our closely guarded and very genuine secrets.

Stop the finspam. Don't buy leads.