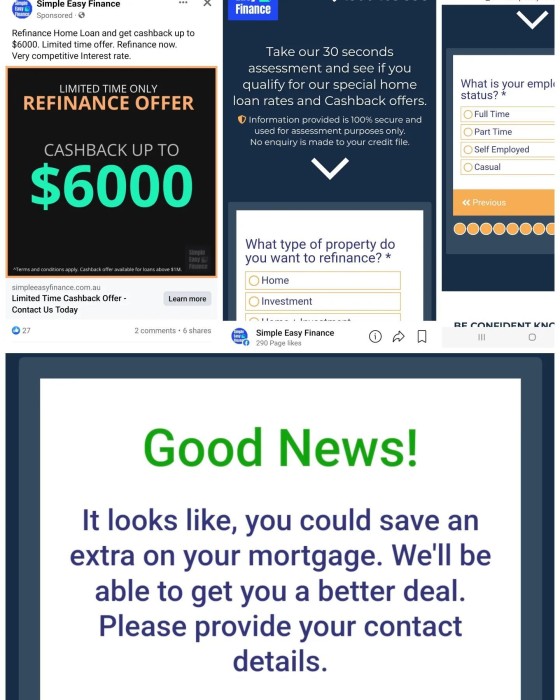

While the company has their own partially self-hosted system (despite the large number of plugins), at least they're not buying leads. However, they return a business-disqualifying quiz and then return a single 'we can help you' result regardless of what details are provided. The practice is one our solicitor described as clear 'baiting' (they were absolutely unable to improve my position based on the didn't details provided- I wouldn't have qualified for a Blockbuster card). To their credit they didn't return a fake 'qualified' rate.

Baiting is a practice in which a business advertises lower advantages for clients in order to attract customers when those conditions don't actually apply. Deliberately creating a false impression is against the law and results in both civil and criminal penalties. It's all detailed in Australian Consumer Law, s12DG, ASIC Act, s33, National Credit Act, s154, National Credit Code, and other pieces of legislation, and it's essential reading for anybody using social media, and absolutely required for anybody advertising their service via paid promotion (addition criteria obviously apply in the finance industry when compared to traditional retailers).

Unconscionable conduct, misleading representations, and 'bait' advertising is broadly defined and requires care to ensure your business is compliant. Be careful!

The experience is simply a subscription form. The time to set up this transactional feature was probably less than 5 minutes, but we're guessing it was sold as a 'solution'.

We released a new free plugin last week that introduces a superior turnkey experience in 1 minute and returns far better results. Similar to our free 1800Funnels product it is designed to eliminate pay-per-lead services from the industry.