They don't ask a quiz. However:

RG 234

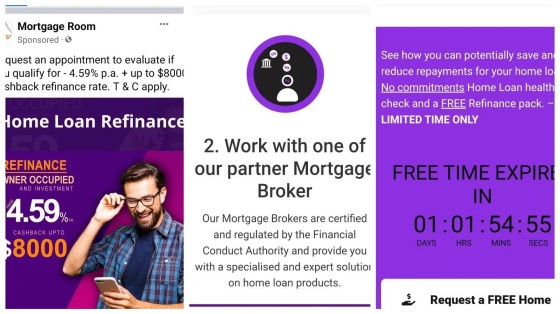

Warnings, disclaimers and qualifications should have sufficient prominence to effectively convey key information to a reasonable member of the audience on first viewing the advertisement. The 'qualification' provided on the landing page are not shown before the form, and the qualification is required as a disclaimer on the advert. If circumstances change (even recognising your non-compliance), merely withdrawing the advertisement may not alter the fact that certain expectations have been created, and the advertisement may have an effect that is misleading.

RG 234.37

An advertisement should not contain an open-ended promise about a benefit if it is likely that circumstances will change so that the promise will become misleading. It is important to remember that an advertisement may create a lasting impression in consumers' minds.

RG 234.47

The more that a qualification is required to balance the information contained in the headline claim (only a couple of lenders provide $8k cashback, and the benefit applies to around 1% of the popululation), the more prominently placed the qualification should be. The headline claim must not itself be misleading.

Further, a timer is provided for the advantage. Don't use timers - they're fake. And the advert makes reference to the Financial Conduct Authority (an organisation in the UK).

The fake website purports to be a broker website and the distinction isn't clear. Also no industry association, ACL details, or AFCA links (remember, they claim to provide a financial service - how is a complaint made?).

Just so much wrong with this shonky experience.

Stop the finspam. Do it right. Do it yourself. Pay cents on the dollar.