Again, I feel the need to remind brokers that their service is awesome, and lying, fake advertising, and deception, isn't necessary to garnish the attention of your audience. The law was written for very good reason, and protecting consumers from financial predators is important. Despite the contempt leadgen charlatans have for the law, it turns out that Legislation isn't a work of fiction, and misleading financial clients will cost you your licencing and career.

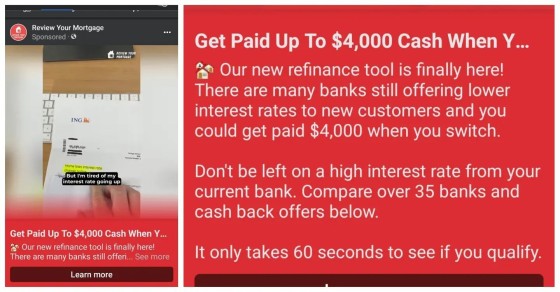

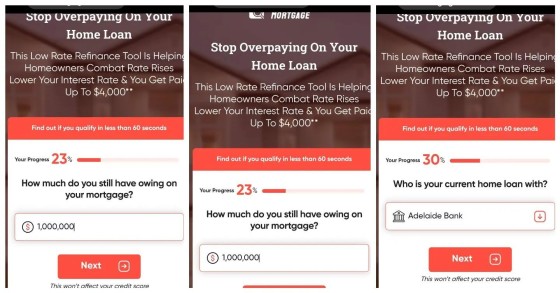

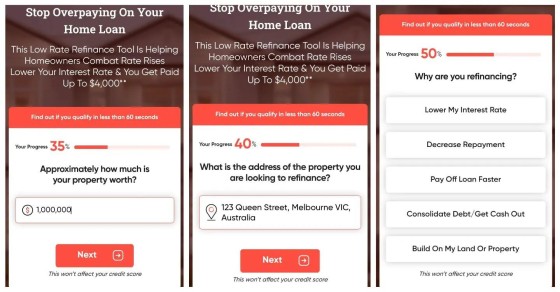

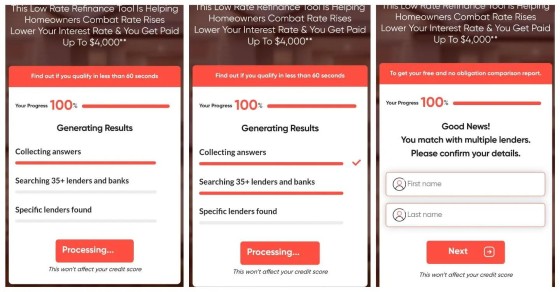

I was somewhat optimistic by the copy that introduced us to the 'new' refinancing tool, but it's nothing of the sort (although they wouldn't let me enter a property value lower than the loan amount - a small but negligible feature given the weight of other breaches). Other issues apply, such as the fake testimonial, which of course adds a funky new dimension to the illegality.

Pro tip: Fake brokers don't get reviews for a fake service (this implies you provided a financial service - opens up a can of stinky worms). And don't show an image that is clearly Stock.

On a positive note, I match with various lenders on the basis of my $1000 yearly income, despite not knowing anything about my circumstances. Bonus - I'll hold them to their promise. All those fancy bars gave me the very real impression that they were actually checking my results against a comparison engine.

Our AI flagged this ad, but we were obviously already aware, and we've picked up clients that had purchased their 'leads'. One broker told is he converted at "just over 1%", but I think he's exaggerating. Seriously, at 1% you'd enjoy comparable success trying to convert corpses in a funeral home.

Stop the finspam. Don't buy leads.