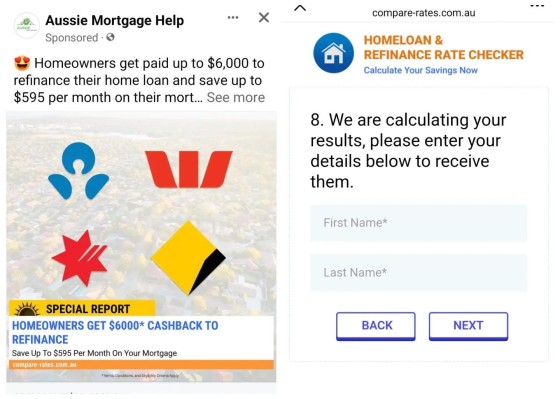

Quantitative statements have to be qualified, and this includes information on cashbacks. We know everybody does it... but that doesn't make it right. The statement that says "Save up to $595 on Your Mortgage" is one that drags the experience deeper into a realm of undisputed non-compliance.

The form asked a bunch of questions with the last screen saying 'Calculating Results' despite not providing them with enough information to calculate anything. It's BS.

Just a few points:

RG 234

Warnings, disclaimers and qualifications should have sufficient prominence to effectively convey key information to a reasonable member of the audience on first viewing the advertisement.

RG 234.37

An advertisement should not contain an open-ended promise about a benefit if it is likely that circumstances will change so that the promise will become misleading. It is important to remember that an advertisement may create a lasting impression in consumers' minds.

RG 234.47 The more that a qualification is required to balance the information contained in the headline claim, the more prominently placed the qualification should be. The headline claim must not itself be misleading.

RG 234.51

If a qualification is required, it must be published at the same time as the original message. Subsequent qualifying disclosures will not be effective as the misleading impression will already have been created.

Bottom line. Any promise, statement, claim, or headine, needs to include appropriate disclaimers, especially when qualifying criteria applies (and it always does). Want to know what works in this style of Ad? Honesty. Attract your ideal audience with enough information to support your claim, and get them engaged.

This baiting is illegal. Brokers don't need to trick or deceive consumers into providing details - your service is already awesome.