I've referenced ASIC's RG234, although the guide points to the relevant legislation.

RG178.23

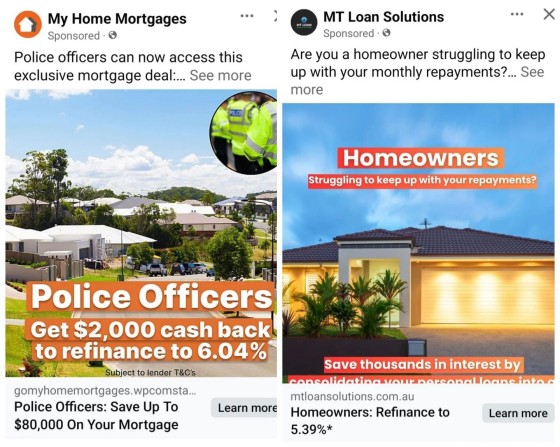

"An advertised comparison rate must be identified as a comparison rate and the comparison rate must not be less prominent in an advertisement than any interest rate or the amount of any repayment stated in the advertisement: s164, National Credit Code.

We [ASIC] consider that the following examples would result in the comparison rate being less prominent than the advertised interest rate:

(a) a comparison rate is smaller in size or faded in colour when compared to the interest rate; or

(b) an interest rate is published online and a consumer is required to click through or additionally do something (such as move their cursor over the interest rate) to view the comparison rate; or

(c) the displayed comparison rate is not in close proximity to the displayed interest rate."

RG178 5

"Information in advertisements should be current (changes should be made in a week - is this rate current?)

RG178/RG234.156

"It is not necessary to show that consumers have actually been misled - the law prohibits conduct that is *likely* to mislead.

Consumers cannot be expected to study or revisit an advertisement - the most important consideration is the overall impression created by the advertisement when viewed for the first time.

Silence can be misleading or deceptive when it is reasonable for a consumer to expect disclosure of important information - silence on important details can render a statement misleading, even though it is factually correct."

It's not hard to be compliant.