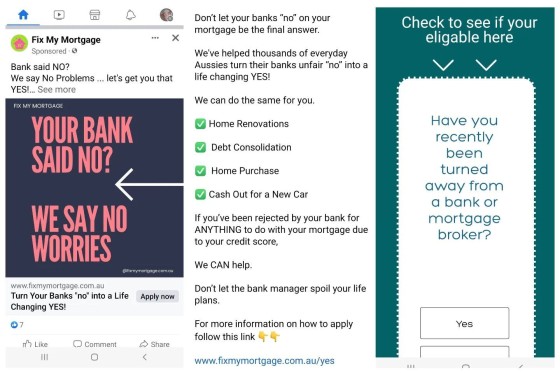

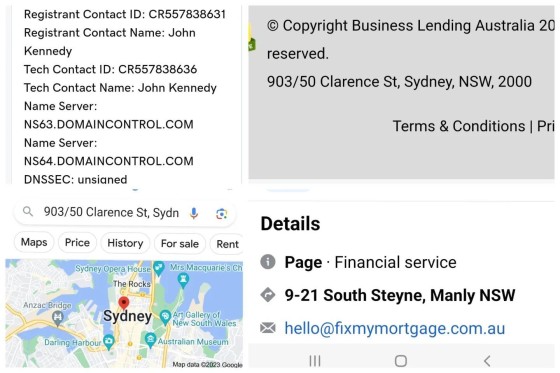

Branded as 'Fix My Mortgage', the fake brand supplements other experiences such as 'Re-Mortgage'.

We're all entitled to make mistakes, but deliberately deceiving brokers (and, more importantly, lying to consumers) is malfeasance at a level that certainly requires regulatory intervention.

We once commented on one of John's ads (and called multiple times) re our 'Industry Challenge'; we gave him the opportunity to compete against my daughter (now 9, we made the offer when she was 6). If she didn't multiply his results by 30X we'd donate 10k to charity (he'd have 2-hours and my daughter would have 20-minutes). He declined.

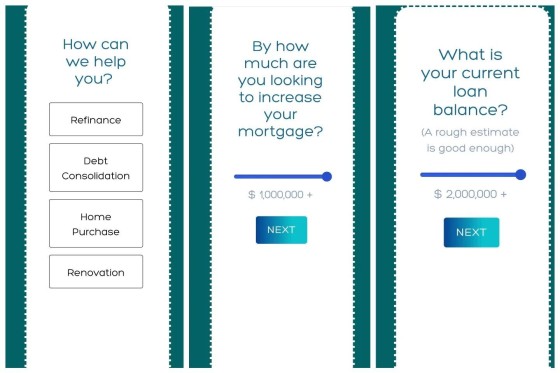

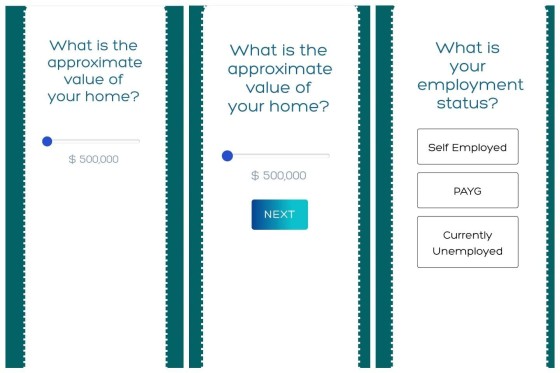

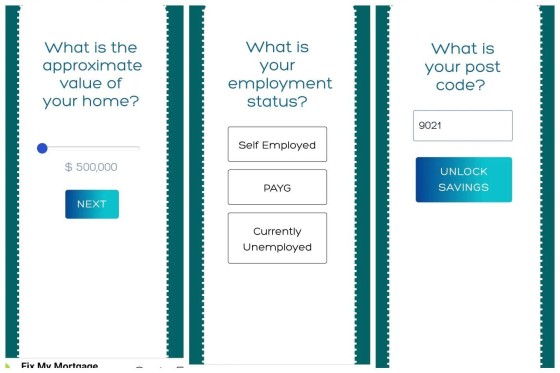

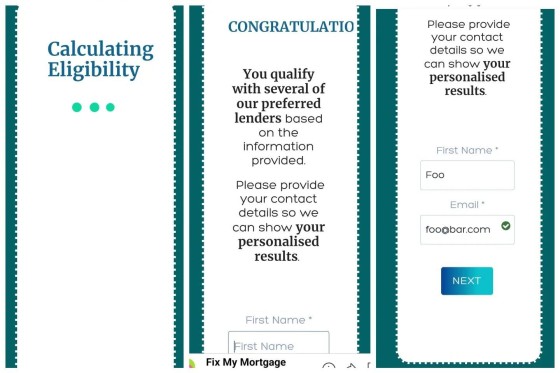

The ad is very poor (and confusing). The typical fake advertising, fake qualification, and fake quiz applies. The list of infractions.is long.

There's a lot wrong with this ad and subscription, but to lean on BID (as pictured) in order to assign credibility to the Deception Funnel is unethical at best. How dare anybody introduce a deliberately deceptive experience and then use BID - something most of us respect - in order to soften the need for a phone number. You don't have to lie!

We could go on.

Brokers provide an amazing product that we all need. You don't have to lie! It's experiences such as this one that has contributed towards the broad distrust of finance advertising and mortgage brokers in general. Meanwhile, ACL holders and aggregators do nothing (I'm going to call out one agg in particular very shortly - I'm compiling a list of all their most egregious beaches).

FYI, my wife provided her details for a low-quality loan. She never got a call.

The fake website associated with the experience obviously has problems. There's an invalid physical address, no valid privacy links, disclaimer, etc. It's an abomination.

Don't buy leads. Stop the finspam.