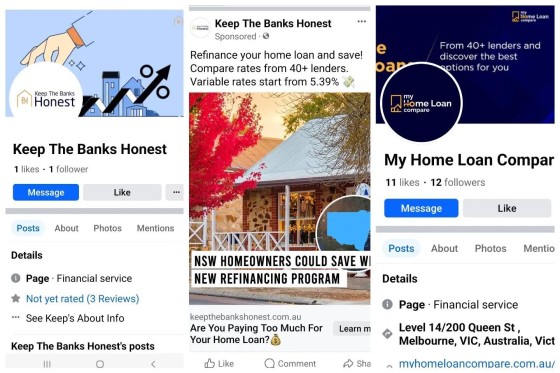

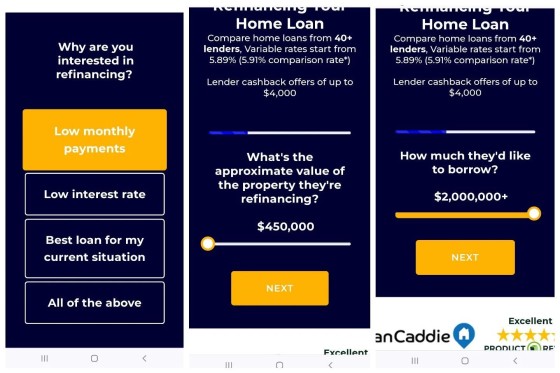

There's generally no harm in promoting on rate (since it's considered by almost all borrowers to be the single most important product attribute), but when you advertising 5.39 (illegally without a comparison rate), you had better make sure responding brokers have access to that product. We had people respond and not a single broker had access to the product.

Even today you can access 5.2/5.39CR with a 60% LVR, and one lender will offer 4.9/4.9CR on the basis of a leveraged full-rate commercial loan, so, there are some low rates available... but barely any aggs have the lenders on their panel (you'll generally need an ACL to access the best deals). If you do show these rates you don't need to lie about the qualification criteria.

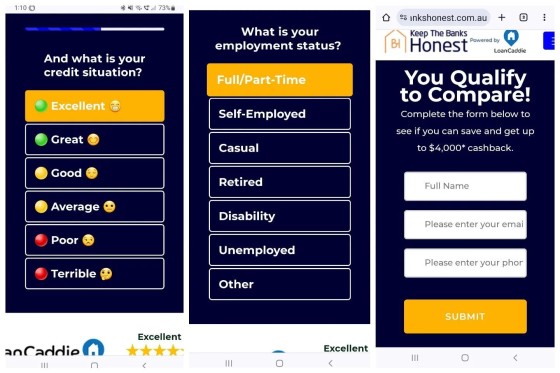

Questions are the same as always and you end up 'qualifying to compare' - a bizarre way of saying nothing. Details provided obviously wouldn't provide us with anything. It's just a dumb thing to say.

FYI, any leadgen charlatan that sells you leads on the basis of 'data points' is kidding themselves and lying to you. It's the standard nowadays - beware.

Don't buy leads. . #beliefmedia #linkedincompany #linkedin #finance #mortgagebrokers #mortgagebroker [title: Shad of the Day, 12th December 2023] #financemarketing [album: Shad of the Day, 12th December 2023] #facebookmarketing #facebookadvertising #advertising