The featured rate is just *one more* method of returning lender data to your website. Like it or not (and most brokers don't), the information you share in your consumer-facing marketing material should reference rates because that's what your clients want to see. We're often biased towards a rateless world because of the expectation that the data often implies options (despite warnings and links to LVR criteria) and because our underlying and core 'structure-first' messaging trends to dominate. However, the rate should be used as an information magnet to filter a client into a discussion where the compelling nature of your expertise should be enough to course-correct any malformed understanding. We're compelled to speak in a language that our consumer understands, and in a world driven by rate-related information and news headlines, the rate is a shared language that the consumer understands (in fact, over 93% of consumers form their early understanding based on rate), so using interest rate information will objectively improve conversions. Rates aren't your primary message, but they support your broader expertise.

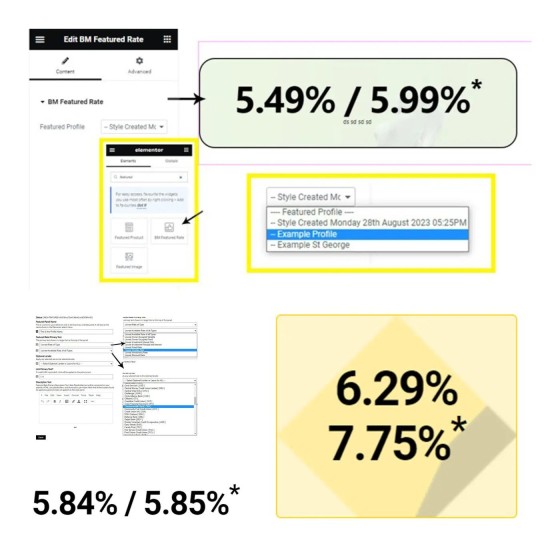

The tool joins 16 other rate blocks and tools.

https://www.beliefmedia.com.au/website-interest-rates