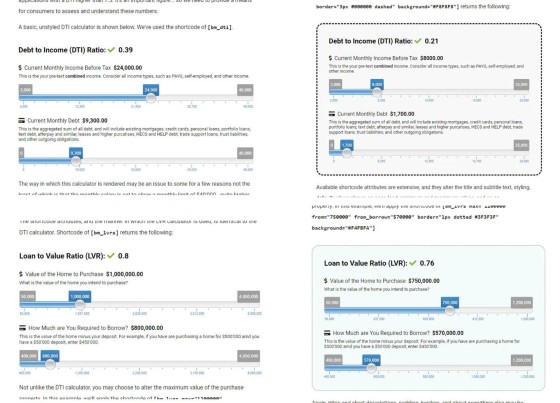

We've just added a new DTI calculator, and created an additional LVR calculator. It's a small update, but an important new feature.

A debt-to-income ratio (DTI) is a personal finance measure that compares your debt against your aggregated income. Lenders will usually use a DTI as a means to measure and manage their risk. Those borrowers with a lower DTI, or a lower ratio of debt measured against monthly income, are generally considered lower risk, while those with a high DTI are considered a higher risk.

APRA define the DTI as "the ratio of the credit limit of all debts held by the borrower, to the borrowers' gross income", and they define 'debt' as buy-now-pay-later digital services, other mortgage lending, personal loans, credit-cards, consumer finance, margin lending, Higher Education Loan Program (HELP) or Higher Education Contribution Scheme (HECS) debt, and any other debts held by the borrower (source: Reporting Standard ARS 223.0 , APRA).

As you know, various banks apply their own risk-based DTI criteria. For example, Commbank may flag applications with a DTI higher than 4.5, and they'll usually manually scrutinise applications higher than 7. NAB cap their DTI at 8 (which is quite high), Westpac will refer your application to credit assessors if the DTI is higher than 7, and ANZ generally won't accept applications with a DTI higher than 7.5. It's an important figure... so we need to provide a means for consumers to assess and understand these numbers.

We have an existing form-based LVR calculator, but the new dynamic slider-based version is a more user-friendly option.

All our calculators work on a dedicated page, or inline in content (negating the need for a user to visit another page). Both forms can be styled in every respect; colours, text, initial values, ranges, and so on, can all be defined in shortcode or Elementor.