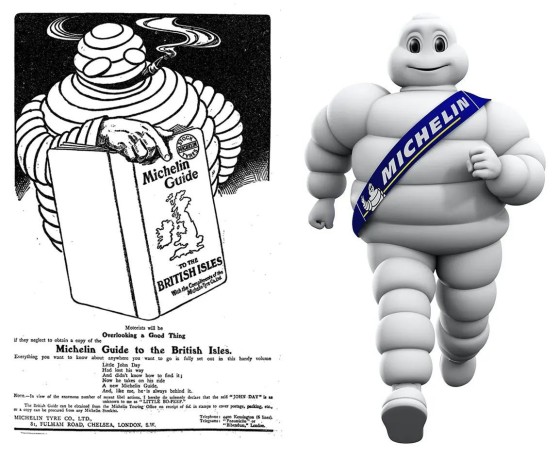

In 1900, there were fewer than 3,000 cars on the roads of France. To increase the demand for cars and, accordingly, car tyres, car tyre manufacturers and brothers Edouard and Andre Michelin published a guide for French motorists in 1900, the Michelin Guide.

The Michelin Guide was a lead magnet. It was initially created for two reasons:

1. Solve a problem for the small number of cars on the road in France.

2. Create demand for the product indirectly by encouraging drivers to wear out their tires visiting restaurants.

Relevance: create a compelling unique value proposition. Don't focus on what everybody else does " focus on what sets you apart ("Sales Positioning").

Again, the guide was created by a tyre company!

Approach diversification in two (primary) ways:

* Diversifying business interests and structure.

* Diversifying online business methodology.

For the mortgage industry, business diversification might mean introducing insurance or partnered financial advice on one end, and creating a "Michelin Guide" on the other end of the spectrum. As an industry with a total reliance on stringent legislation and compliance that dictates the terms of your survival, it makes sense to diversify simply for the purpose of business risk management.

In terms of digital, this story supports our (fairly obvious) claim that your website and digital assets should be richly diversified and compelling to attract and convert new business. Your lead magnets should be amazing and your funnel experience should be educational and engaging. Your website should be the 'Finance Michelin Guide' of the industry, packed with tools, resources, education, and sticky content.

Digital can be completely transformative! Stop paying for leads - attract better quality customers for a few cents on the dollar.