The Bank of New South Wales (now Westpac) held a press conference in 1964 to announce it would purchase its first-ever computer to undertake processing of cheque clearing and ledger postings in Sydney. The investment would cost them around 1 million, or around $26 million at today's value. The bank's manager, R. J Abercrombie, at the time said the computer would help the bank contain costs and relieve workers of arbitrary tasks and refocus on assisting customers.

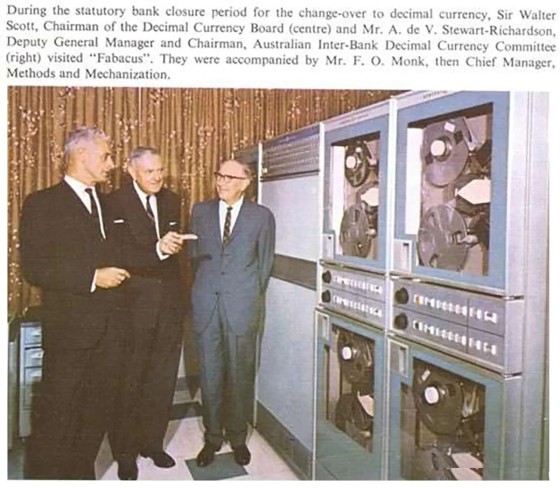

The GE225 - or the FABACUS (First Australian Bank's Accounting Computer Used in Sydney), as it came to be known - was the size of three wardrobes and had 20 kilobytes of core memory. It was installed on Level 9 of "The Wales House" building, which is now the Radisson Hotel. It was essentially a punch card operation - the programs were stored on punch cards that were fed into the computer from a reader. Data was captured by cheque readers connected to the computer which scanned the MICR (Magnetic Ink Character Recognition) encoding on the bottom of cheques, and stored the data on inch reel tapes. The cheque readers also performed the function of sorting cheques in order for them to be returned to their relevant branch.

Cheques and deposits from nearby branches were brought via exchange cars to the GE225 for processing, and the processed records were returned to each branch the same way every day. For the majority of branches, cheques were delivered and returned by mail.

Additional bank systems - such as staff records and unit trust - were converted to become computerised soon after, and the workload for the GE225 quickly grew. The bank required more computer equipment to accommodate its growth, and the original computer expanded to three GE200 series machines and related equipment.

Thesuccess of the system in Sydney saw the bank expand its operations to all interstate branches, and it later built additional computer centres in Melbourne, Brisbane and Perth.