In a slightly more practical sense, if you presented 25:options to a person five times over, the chances of any two people selecting the same sequence is around 0.0000001024%, or around one in 9,765,625. Reduce the number of options to just 3 and the odds are around 0.004%, or one in 243.

The digital relevance?

Generally speaking, in order to for us to guide a funnel user into a preordained pathway, it would appear that 'less is more'... or is it?

Knowing the stats are stacked against us, how is it that we can pass a user through a digital funnel with seven interactions (giving the funnel participant the illusion that they have choice at each touchpoint), and then successfully craft out an *identical* pathway 29% of the time (so, nearly a third of people make exactly the same decision seven times over), with 68% following predicted patterns through the first three interactions (and this is despite the number of available options averaging 12 at each turn).

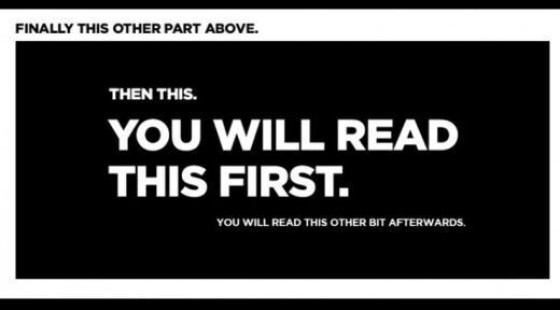

This is the basis of Choice Architecture, or the psycho-babbly-arty science of giving a user the illusion of choice while we guide them *exactly* where we want them to go. The underlying methods just described forms the basis of our progressive disclosure and conditional framework. The point? A digital framework that coverts isn't an accident.

It's always nice watching funnel participants exercising the digital version of free will.