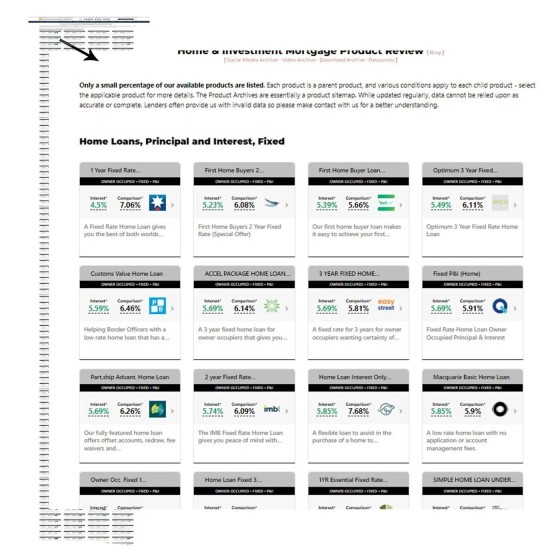

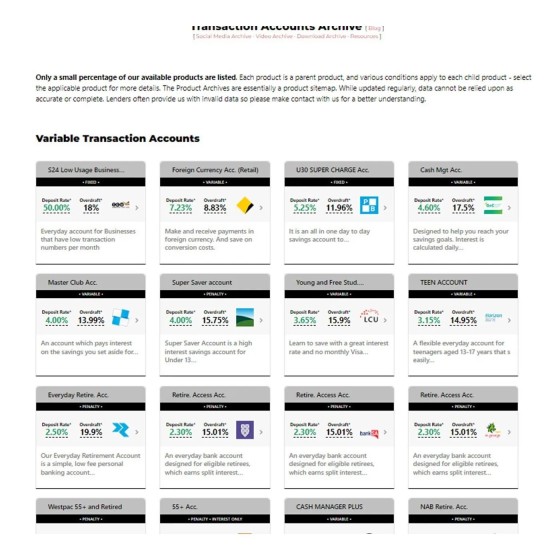

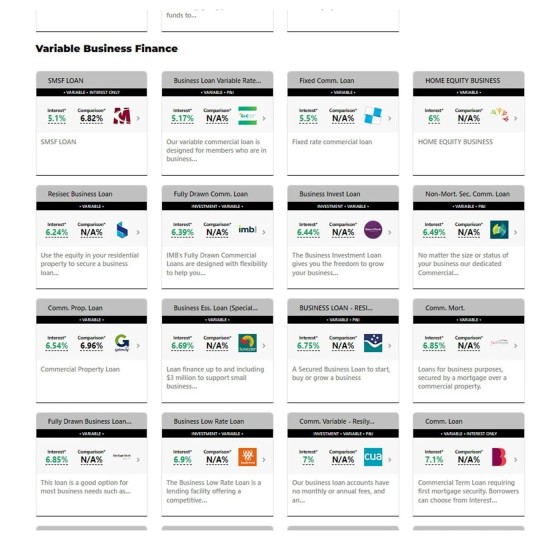

The pages show each product type (SMSF, Hone Loans, Business, Personal etc.) on their own page, listed by repayment type. Ordered by rate, we (generally) show only 'parent' product types for each lender with the panel linking to a full product page that shows conditions, rates, and so on.

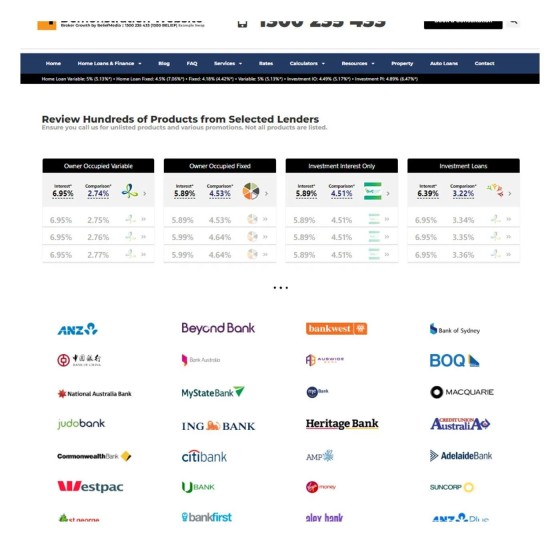

This was the final lender feature before we push the (optional) comparison engine to all clients.

A few brokers have mentioned that 'they prefer to have a real discussion' with clients, suggesting in part that rate/product data didn't play a significant role in creating conversations. We can categorically state that the data has a *massive* impact on page views and conversions (once you get somebody on your website)... and the data simply does what it is meant to do - qualify *you* as a broker. Before you've had a chance to demonstrate your expertise and authoritativeness in the real world, your digital assets are an incredibly persuasive tool, but they won't perform as intended until you freely give away what borrowers are interested in seeing. It doesn't matter whether you think borrowers are interested in rates (they are) - we use them as a tool to get to that first conversation... and It's then up to you to advise them on the other stuff.

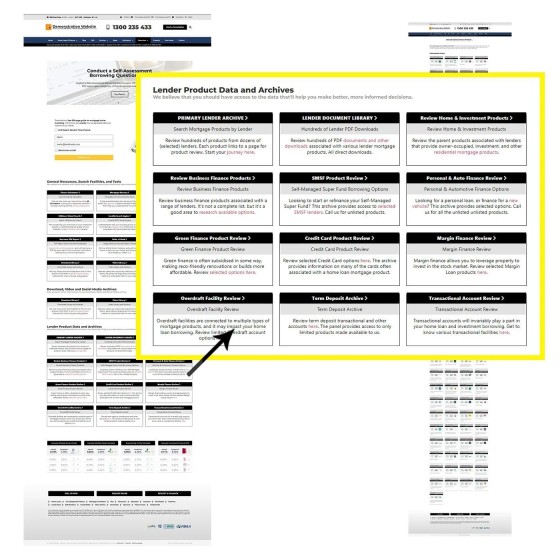

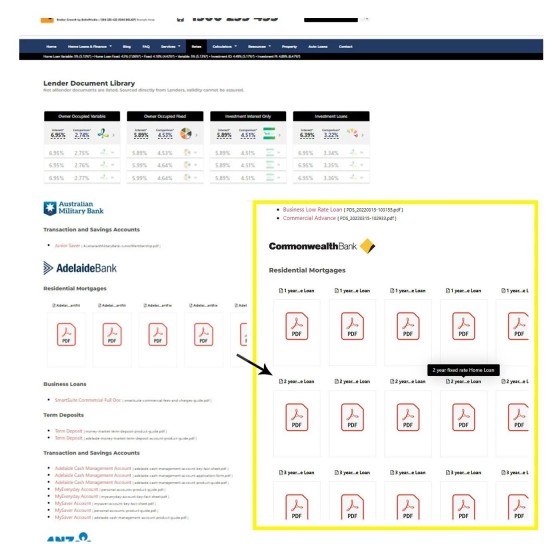

We've updated the 'Resources' page with appropriate BMbox-style links.

We're posting around a dozen features this week, with a seriously significant update to the landing page module