We've got a love-hate relationship with the finance industry; we love the industry but hate how it's represented in the marketing space. Discussed in an upcoming article we'll talk about how marketing representation in the finance space (often those that call themselves "Facebook Marketers") are betraying the trust of their clients by providing a sub-amateurish solution outdated by at least 10 years (likely closer to 20). Their products are fundamentally flawed, they aren't future-proof, and don't integrate nearly enough psychology-based technology to provide sound business (or client) outcomes. What continues to amaze us is that we're still priced lower than almost all of them for a lead generation program that is infinitely more powerful than anything they provide.

Anybody that tries to tell you that introducers and referral partners, or any "old-school" method of marketing – or indeed developing your clients as referrers (your greatest marketing asset) – is a waste of time has never worked in the industry... and they've never seen the predictable 6-figure returns from the relationship that developed from a $30 lunch. We don't endorse referrer relationships immediately (it's usually our industry-leading Facebook advertising, leading Facebook Messenger program, or other methods that are more appropriate in the early stages), but we absolutely do advocate them. In fact, our model for attracting referral partners to your business is unlike anything brokers have ever seen before, and it's currently generating some of the highest volume brokerages in the country.

So, if you've ever read that somebody will generate you "140 leads per month", they're feeding you with a message that isn't entirely relevant. We'll provide you with as many leads as you're prepared to pay for; whether that be 10 or 1000. Good marketing is focused more on Return on Investment (ROI) than any arbitrary number we might throw at you (there's simply a predictable cost assigned to obtaining to obtaining each deal, and you can apply as much advertising that floats your boat in order to return as much business as you're able to support). At the time of writing we're delivering about 15000+ email subscribers to our mortgage clients each month with the highest initial and subsequent conversion in the industry. This figure has more to do with what our brokers can handle rather than what we're capable of providing them. As you'll hear us say over and over, attracting low-cost leads to your business is no longer difficult; providing an experience that converts them into opportunities or opportunities is the new challenge.

It should be noted that the Customer Acquisition Cost (CAC) and Lifetime Value of a Client (CLV, or LTV) is a short-term and longer-term consideration. Those that fail to be persuaded by our early conversion efforts often relegate themselves to a criteria that has an elastic effect on our CAC, but it's the conversion and appropriate post-settlement goodness that contributes to the LTV. However, brokers initially want to see a return on investment now. It's here where the immediate cost of a profitable conversion becomes relevant, and we refer to this as the 'Raw Prospect'. Now, if we were to triple the effectiveness of an existing program (and we do this routinely by way of our "Rescue Package" for those that believe they have a good experience in place), we've essentially cut the cost of a lead acquisition by two-thirds. If you were previously making 100k per year from your current advertising spend you'll immediate have that same budget return $300k. So, it's the cost of a lead that's important... not how many you might return. In reality, tripling an existing program is something we might undertake in the first few days; it's subsequent growth that belittles what has become the industry standard product.

Here's the thing that confuses many that come to us: given that our offline techniques are so overwhelmingly effective, we often (but not always) use Facebook marketing as a means to moderate growth for predictability. It becomes a means of sustaining a predictable and planned measure of quarterly success.

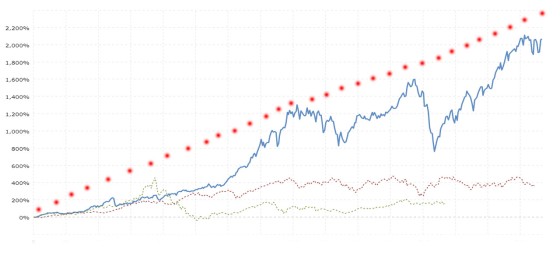

Pictured above, the red line above indicates a growth trajectory based on predetermined KPIs we establish very early on in our program while the blue line indicates organic business driven in part by our offline growth strategies. So, Facebook and other advertising platforms are generally used to build predictable growth geometry by "filling in the gaps". Your marketing budget is used like a tap to ensure it translates to a growth strategy that is supported by internal staffing and other systems. So, even as traditional sources of business might drop off we’re able to compensate with a higher allocation of funds to advertising and other marketing efforts. Growing too fast is just as dangerous as not growing at all; as mentioned earlier, we often see business use no paid Facebook promotions whatsoever after a period of time because their organic growth meets or exceeds their planned KPI objectives.

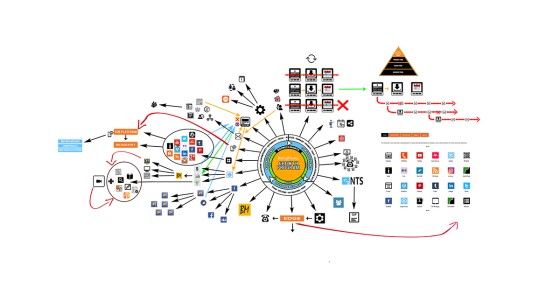

Keep in mind that our program is designed to reduce administration (without outsourcing) by automating various actions (and we're the only marketing company in the finance space to do so since we're only technology driven company in the space). Leads shouldn't be introduced to your business in such a way that it compromises your ability to do business.

Now, this brings us to the perennial question: what is a lead?

What is a Lead?

If you've read some of our material you might find a little repetition in this section.

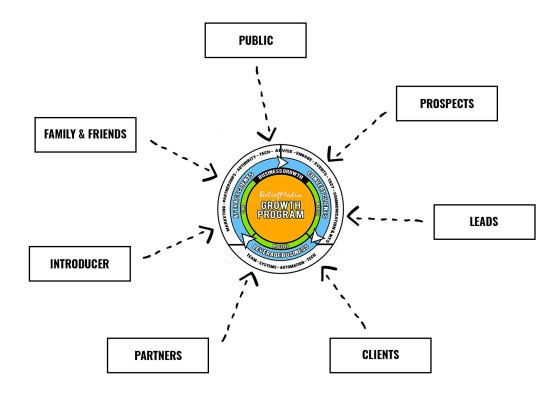

BeliefMedia's Gravity framework is simply the sources of leads and potential traffic to your business. In reality there are numerous paths that a consumer might take to reach you; we've narrowed it down to just the primary groups. Each group of consumers is treated vastly different, and each is managed in different ways. Each source of incoming business has a varying heat index (or cost factor), and each represents a varying degree of 'difficulty' in order to convert. For example, the most challenging group to establish a dialogue is the 'public' in almost all cases. There's (usually) a clear cost associated with their acquisition and there's a challenge in order to convert them into business... and then there's another more difficult challenge to turn them into brand advocates. On the other end of the scale is 'family and friends'. While many are protective of their own family (and often choose to separate church and state) they are usually the easiest to convert and far easier to develop as referrers than any other group.

The Gravity framework is a small part of the Matrix that we use internally to guide our clients through the necessary components of real and sustainable Digital Growth.

We advocate over and over that no source of lead generation should ever be ignored - it's never acceptable to concentrate on "just one thing". Unethical marketers will often tell you what they want you to believe - in this case, it's "just one thing" that you'll need to grow (often Facebook) - in order to assign value to their services... and it's this sales-pitch that has become a hallmarks of many marketing charlatans. It's never "just one thing".

The single biggest difference between prospects and leads is their engagement; leads are characterized by one way communication (usually just a mailing list subscription), while prospects are characterised by two way communication. Different aggregators often have different interpretations of the two terms in their software systems and other communication so when you’re developing your SOPs it’s important to inherit their language to ensure a shared vocabulary.

One step below a lead is a mailing list subscriber. We can measure the temperature of an email lead by way of email analytics, and by means of our custom BeliefMedia Pixel, but if they're an inactive subscriber they should be considered frozen; it's only after they express interest in us that they might edge towards what might be a characteristic of a 'cold lead'. In order to convert this audience and decrease our Custom Acquisition Cost we absolutely must have a high-value email education campaign, and this is where our clients truly excel when compared against the weak solutions available to brokers through other marketing channels (and another area where it helps to have finance experts as your Relationship Managers).

Once an individual makes contact with your business and your process begins, that person will now be an opportunity (meaning that a deal will progress if they meet qualifying criteria). The term 'opportunity' is usually shared by most aggregators and for this reason we advocate only sharing qualified prospects into your aggregator CRM software (our software permits you to optionally add a 'lead' to your CRM as a 'contact' or – only because it was asked for, and not because we think it's appropriate – an opportunity.

So, in summary, as an industry we should stop categorising online leads as true leads unless they've committed by way of a phone appointment or calendar booking. There is a name for a passive online lead – a mailing list subscriber. It will take time, effort, and other resources via our Symphony email framework to develop that subscriber into a valid lead (or even an 'active' subscriber).

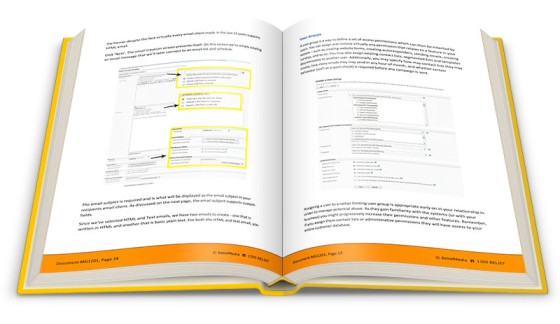

Pictured: We provide our clients with a 120-page book on taking advantage of the full suite of advanced features made available via the self-hosted email platform (are your emails still carrying MailChimp branding? - this is a big no-no in the finance space). A short 2-page 'quick start' section is provided in order to send your first basic email. Ongoing education and resource material is provided in order to ensure you continue to build compelling email campaigns that provide the education your leads email subscribers are looking for.

Note that your email list does have clear and indispensable value and will return predictable volumes. A certain number of email subscribers almost always translates to a predictable number of people that elevate themselves to the prospect level. However, it's a value that only be drained from the funnel if the email program is structured efficiently (and it rarely is).

Qualification of Leads

I'm pretty sure qualification is a marketing term used by the snake-oil salespeople trying to sell you their "system". The term "qualification" is extremely subjective and open to wayward interpretations that makes it easier to sell a flawed product. The truth is, the job of a marketer is not to qualify a candidate for you... but rather qualify you in the minds of your potential client. You're an educator first and foremost; there's always something you can do for a client if they don't meet the required criteria of all lenders or the arbitrary criteria you've set yourself (and we go into this in our program). Bottom line: those that you help on the fringe - whether you write them a loan or not - are likely your greatest brand advocates.

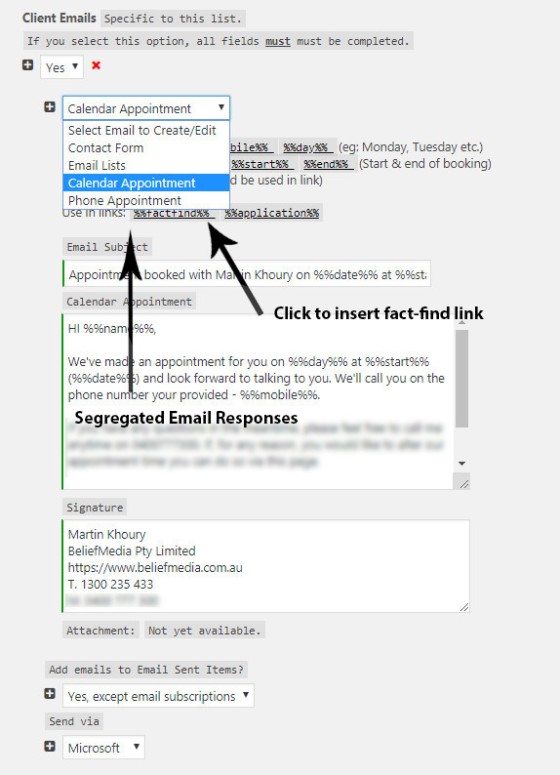

Some brokers will redirect to a form asking for personal borrowing details after a subscription or booking (this is what most incorrectly call "qualification"... and some will recklessly ask the questions on a booking page before a user has committed in some respect). The unnecessary so-called qualification step is one we mitigate by providing a link via the initial email to either a fact-finding questionnaire, more comprehensive compliance-based questions, or even an online application (all hosted on your website, of course. A form should never be hosted anywhere other than under your own secure and branded domain name). Keep in mind that our initial email is different for different audiences; your lead will either be a subscriber, make a booking, or provide a phone number for a callback - we absolutely cannot treat all subscribers or inquires in the same way. For the First Contact email we have an option to include various placeholders into our email via the click of a link that places the relevant links into our email body. Then, after a user chooses to completes the optional compliance-based questions (usually an enhanced fact-find) we'll qualify you further by sending them a PDF report based on their responses to our questions.

Pictured above is the means upon which to provide a questionnaire link into the 'First Email' sent to those that make a calendar bookings. Clicking a simple descriptor inserts a link to the online questions that return a PDF report to both you and your client (sent through your Office365/Exchange email). It's completely optional for the client (and rather unnecessary for the broker, really) but it once again establishes you as the broker among brokers. The email campaign is then sent off to the email marketing platform for additional followup. The industry's highest-performing email subscription experience is detailed (in brief) here.

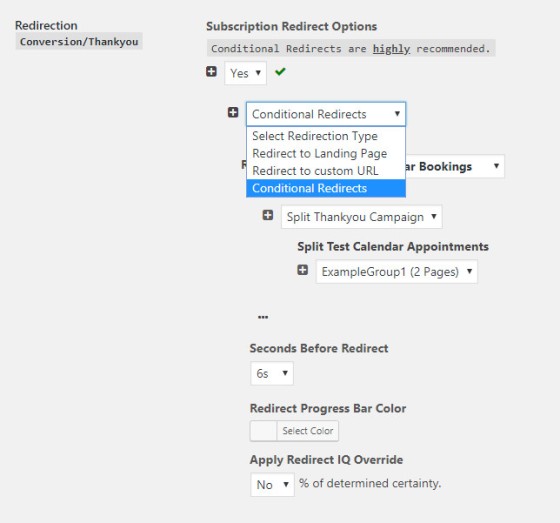

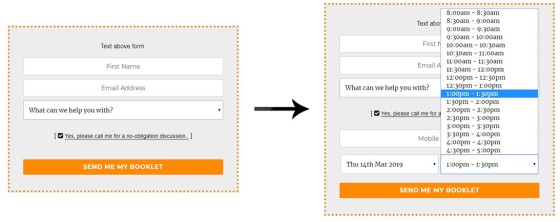

While we're not talking about landing page optimisation in this article, it's worth mentioning once again that we're the only company in the finance space to conditionally redirect a user to the most appropriate second (thankyou/conversion) page based on first page interactions. In fact, we're the only company (once again) that offers a true two-page conversion (any keystroke or additional page-load beyond the forced second page severely diminishes conversions).

Pictured: The entry page calendar booking option (sent directly to Outlook, of course). Because others that share our space are limited in their technology, they'll wait until a third page before showing a slow-loading third-party calendar... requiring the user to enter basic details again. We present this as a passive (hidden) option on the first entry page. Given that 75-80% of all of those will either make a booking or provide a phone number on the first page when that option is available (despite the fact it's initially hidden), we're able to redirect to a far more appropriate page based on their interactions (we call this an 'escalation of commitment'). If a generic page is all you're showing on the second page (something we might show for basic subscribers) you're objectively throwing money away on your marketing spend. Our industry leading email subscription experience is discussed here. Of course, the subscription is just one part of a journey, but it is an entry point roadblock, and your initial landing experience is a conduit that has to be optimised for conversions. What we've shown above is just one reason why our programs are so effective.

So, what is qualification? Again, the definition in our opinion is utterly objective. In our experience our online methods are the only means of "qualifying" a client that makes sense (remembering that we're qualifying you - not them). We've spent more money on advertising than any other company in our space and we absolutely know what works. At the time of writing our systems are processing 15000+ monthly email subscribers (aka "leads") with a low acquisition cost, and it's a clear indication that what we're doing absolutely works. Another means of qualification in the finance field is an online application (again, always an optional link) but this is beyond the scope of this introduction.

Conclusion

Until we're able to definitively what a lead, prospect, or opportunity actually means, we're not able to apply the highest means of converting that particular group. Our definitions and methods of converting various market segments are those that have developed from years of having worked in the finance field, and over twenty years curating the industry's highest-yield digital campaigns. Additional articles relating to email campaigns  and the marketing funnel

and the marketing funnel  journey are used to illustrate our expertise in the field, and why competing products are generic, low-performing examples of worst-practice.

journey are used to illustrate our expertise in the field, and why competing products are generic, low-performing examples of worst-practice.