Ever since Facebook introduced the Messenger platform  back in 2016, developers were all over the bot functionality and Send/Receive API. The Messenger API supported sending and receiving text, interactive rich bubbles containing multiple calls-to-action, and other features out of the gate making those that adopted the technology in that early honeymoon period benefit significantly. This article looks at how we've used Facebook Bots in the marketing space since we introduce them to the Australian finance space back in 2016 (days after the functionality became available), what we've learned from several hundred thousand messages, and what we've determined is an appropriate path moving forward in the face of changes that severely impact the feasibility of bots as a subscription-based "promotional" tool.

back in 2016, developers were all over the bot functionality and Send/Receive API. The Messenger API supported sending and receiving text, interactive rich bubbles containing multiple calls-to-action, and other features out of the gate making those that adopted the technology in that early honeymoon period benefit significantly. This article looks at how we've used Facebook Bots in the marketing space since we introduce them to the Australian finance space back in 2016 (days after the functionality became available), what we've learned from several hundred thousand messages, and what we've determined is an appropriate path moving forward in the face of changes that severely impact the feasibility of bots as a subscription-based "promotional" tool.

What makes our Facebook bots so powerful is that they're tailored specifically to your business via self-hosted tools (with a new self-hosted creation plugin due very shortly). We create an experience that is consistent with other elements of your marketing program and integrate it fully into your marketing and IT infrastructure. We're the only marketing company to do this, and it's why our bots outperform anything else on the market.

The open rates for bots are still quite high - usually between 85 and 95 percent. As our potential market shifts towards new methods of online communication it is only prudent that we include such features into our own communication strategies.

All our bot functionality is provided to clients as part of our one fee (the lowest in the industry) and all bot features come with a conditional lifetime licence (including new 'generic' bot sequence updates). Unlike any "competitors", all our bots are fully integrated into appropriate ancillary systems - such as email lists, our proprietary questionnaire to PDF report (for which we have a specific bot in development), and other CRM systems. It's our high-level integration that takes the bot interaction and places our lead into an appropriate longer-term and more sustainable conversion campaign (this integration is now more important than ever since Facebook has banned the subscription-based promotional aspect of the tool).

The 24+1 Facebook Messenger Rule

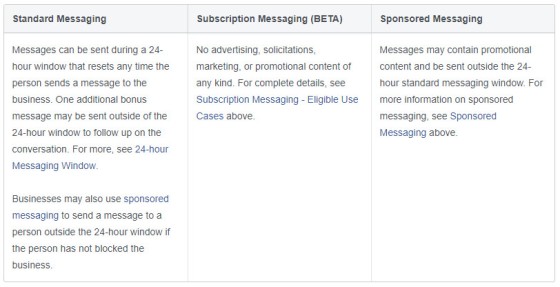

From Facebook, "Businesses and developers using the Send API have up to 24 hours to respond to a message sent by a person in Messenger when using standard messaging. A bot may also send one additional message after the 24-hour time limit has expired. The 24-hour limit is refreshed each time a person responds to a business through one of the eligible actions listed in Messenger Conversation Entry Points. This is commonly referred to as the '24 + 1 policy'." It's this 'unlimited' messaging that takes place in the first 24 hours that permits those early conversations to take place.

Subscription Messaging

Subscription messaging is the type of ongoing messaging that takes place after the the first 24+1. However, with all things Facebook they opened up the Messenger platform without much consideration and turned it into a spam-pit rather quickly. Not unlike their cleansing of the newsfeed by forcing Business Pages to adopt the power of invisibility, Facebook are once again - and very sensibly, I might add - placing restrictions on how Messenger can now be used as a means to contact clients.

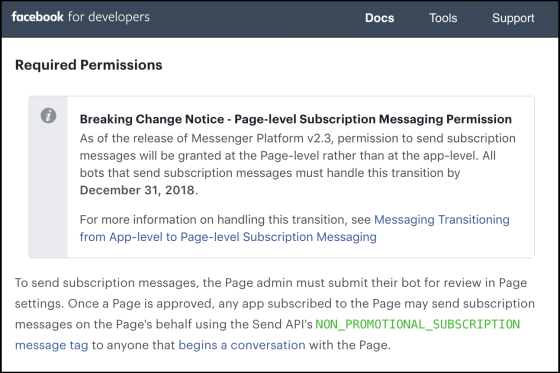

The changes make the barrier to subscription-based messaging that little more challenging because the application for subscription messaging must be made on the Page-application level; that is, you'll have to create an app and submit it to Facebook for manual review. Once a Page is approved, any app subscribed to the Page may send subscription messages on the Page's behalf using the Send API's NON_PROMOTIONAL_SUBSCRIPTION message tag to anyone that begins a conversation with the Page.

Subscription messaging will be heavily policed with a policy  stating that only non-promotional material may be sent after the 24+1 timeframe expires.

stating that only non-promotional material may be sent after the 24+1 timeframe expires.

Belief Clients & Brokers

All BeliefMedia brokers will obviously have continued use of the basic usage within that first 24+1 period... although we'll be creating page-level applications and making the submission to Facebook on your behalf if you would like to continue with ongoing subscriptions. If the latter applies the former functionality will also be powered by your own application.

To be eligible for subscription messaging you must satisfy one of the following criteria.

- News: Integrations whose primary purpose is to inform people about recent or important events, or provide information in categories such as sports, finance, business, real estate, weather, traffic, politics, government, non-profit organizations, religion, celebrities, and entertainment.

- Productivity: Integrations whose primary purpose is to enable people to manage their personal productivity with tasks, such as managing calendar events, receiving reminders, and paying bills.

- Personal trackers: Integrations that enable people to receive and monitor information about themselves in categories such as fitness, health, wellness, and finance.

The case that applies to most brokers is news. While you'd struggle to justify your application without a supporting online presence you may nominate cases such as Interest Rate rises as very legitimate "announcements". While the promotional aspect is going the way of the Dodo, the often ignored effect of using Messenger with post settled clients cannot be entirely dismissed. For example, when the dust settles we'll build the notifications into EDGE... justified by the 'Personal Trackers' application where finance is noted as a eligible user case.

Pictured: Facebook's Acceptable Use summary as detailed on their website  .

.

What Bot Changes Means For Your Business

Those that are using bots heavily have already been contacted with most brokers now utilising their own applications (to enjoy continued non-commercial messaging). In reality there's effectively no change except that the type of message will be different; you're no longer permitted to promote your business via an email-style drip-feed campaign through messenger.

In February of this year we migrated the Facebook Bot product directly into our Broker Growth Program. All former bot features will continue to be available and we'll continue to register your own Facebook applications on your behalf.

Free Finance Bot

Want a free Broker bot? Over the years we've built a number of generic broker bots to perform tasks such as calculate borrowing capacity and applicable duty, return a general payment schedule, and so on - typically the same features provided by way of a calculator (our clients will enjoy higher-level AI-based interactions). The good news for those that don't work with us is that the same Messenger bots that have generated nearly a billion in volume will soon be made available at no cost... as long as you're on our mailing list and subscribe to our new Broker Marketing Facebook Group  . They are without question the highest-quality bots in the industry and driven by real-world broker needs.

. They are without question the highest-quality bots in the industry and driven by real-world broker needs.

What We've Learned

As the only finance marketing company to provide our own bots with our own technology we've had the benefit of garnishing statistical feedback on various types of interactions. What we've learned is this: bots are a powerful tool (nowhere near effective as they once were) and always have to integrated with a higher-level campaign. For example, if we determined that a user was a first home buyer from an interaction we'd direct them to an applicable landing page for a download (or make the download directly available), provide them with optional contact methods such as a calendar booking (we integrated with your live calendar the same way we would on a landing page), or we'll ask for their email and send them something while subscribing them to our systems. Bots in isolation are like having half a conversation.

The Messenger Bot is more of a supplementary tool now than a standalone solution and the program of contact - given the shorter time period to make an impression - needs to be cleverly crafted to drive a conversion. In recent weeks we've found pointing people to our Compliance Questionnaire to PDF report has an extremely positive effect.

Conclusion

As we stated earlier, the partial loss of Facebook bot effectiveness places additional pressure on the creation of technology and copy to support individual brokers. There's absolutely no one-size-fits-all approach with bots - they should all be crafted for each individual business taking advantage of their sales positioning, niche, and specialty in order to convert in that early period of communication. Any online marketing experience is designed to qualify the broker - not the client... and bot is often (but not always) an effective means of achieving this for those clients that don't dive into a funnel-based transaction. We're seeing a lot of worst-practice solutions introduced to the industry at the moment - much of it driven by sourcing improper use of third-party technology and the associated "tail wag the dog" methodology.

For those brokers looking for the leading Facebook Marketing Bot service on the market with full integration in your existing systems, and all included in a single package fee, please make contact with us for a discussion.