One of the features of Yabber that is less visible than others is the lender rate email signature. The signature is an image that may be used in an email signature to return the lowest rate of a specific type. Yabber provides links to the direct image and will also create a HTML link for inclusion in your email signature.

As always, we have to reiterate that culturally we're not a rate-driven company, and we wouldn't expect you to be rate driven either. However, rates are a top priority for your consumers, so it's only appropriate that we give them what well over 90% consider to be the single most important attribute when considering a mortgage. Consumers don't know or care about the 'structure' or maximising borrowing power or any of that fancy work that takes place behind the scenes, so rates draw consumers in for a conversation, and it's the discussion with a client that'll further qualify you as a broker of choice. We often talk about 'rate-chasers', and while they exist, and while a portion of those people should be avoided, they only exist because they haven't showered themselves in your expertise. Remember, we're communicating with customers in a language that they understand... not one that you want them to understand. Bottom line: rates create more conversations and your expertise will deliver a client.

The signature includes various font and formatting options, and each impression and click is tracked to the user level in Yabber and through website statistics.

The feature is quite old so hasn't seen an update in some time, but the 'legacy' version performs as advertised. The system will invariably be updated in the future to include more features.

To be clear, the image will always show the lowest rates associated with the lenders defined for a specific website. The values change dynamically as rate changes take effect.

The Result

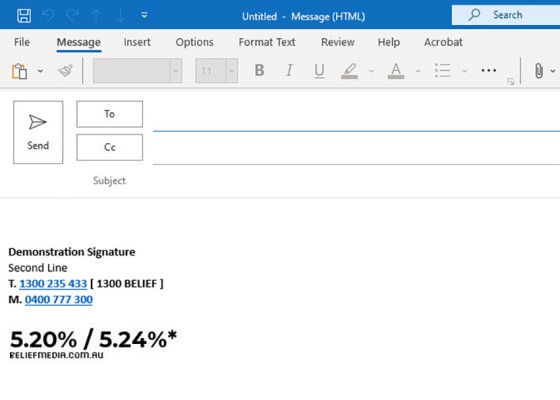

The result of the most commonly used rate signature image is shown below. The image will link to our demonstration rate page which is proven to significantly improve your conversions. The video on this page becomes significant in terms of its messaging given the multiple traffic entry sources.

Your website domain is listed under the rate simply to avoid hotlinking, although we've had a couple of requests to remove it so the next version will support this change (the image shows your lowest rate of type so won't necessarily apply to others).

Another version may be presented by altering an image attribute (introduced shortly), and this change will render a line above the rate. It's expected that you will simply include this line into your standard signature.

The asterisk is used on the comparison rate, so if the signature image is used it is expected that you will also include the required comparison disclaimer.

In both cases above we have centred the image, although it will render to the left by default. An attribute in the image URL will optionally indent the text to be consistent with your signature design.

Signatures in Yabber

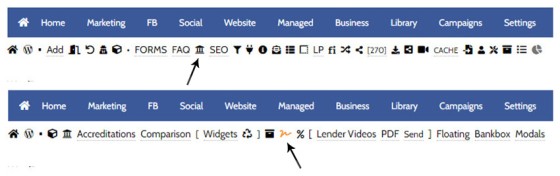

You will locate the Lender Signature panel by following the 'Lender' icon in the Website module. From within the 'Lender Data' module you should select the 'Signature' icon.

Pictured: You will locate the Lender Signature panel by following the 'Lender' icon in the Website module. From within the 'Lender Data' module you should select the 'Signature' icon.

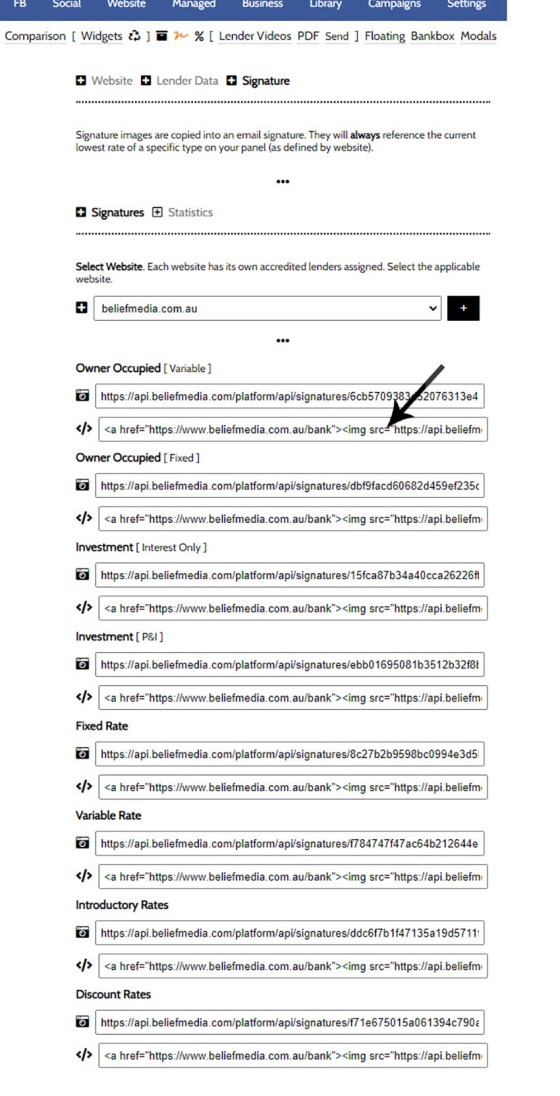

To retrieve the image or HTML code, you should select your website and submit. Details are returned. You may have different sets of lenders assigned to each of your registered websites, so selecting each website will potentially return different results.

Pictured: To retrieve the image or HTML code, you should select your website and submit. Details are returned. You may have different sets of lenders assigned to each of your registered websites, so selecting each website will potentially return different results.

The arrow indicates the HTML code we've used to embed the image above (at the time of writing they're showing a 5.2/5.24 rate associated with a 60% LVR product). Note that multiple rate options apply.

Signature Font and Formatting Options

The Image URL is constructed as follows:

The 1/23/10 component of the string may be altered to style the image in different ways. The 0 value indicates that we do not want the upper introductory text, the 23 is the font ID, and the 10 is the margin applied to the left of the text.

Example font types include the following (in all cases we've replaced '23' with an alternate font ID):

9 - Cambria

17 - Stencil

17 - Typewriter

11 - Gisha

3 - Arial

13 - Impact

8 - Berlin Sans FB

15 - Mistral

The default font is Montserrat Bold (23). Montserrat is the default font we use for a large rate of purposes, so anything with a font ID between 21 and 38 will return various Montserrat variations.

Creating an HTML Signature in Outlook

Creating an HTML signature in Outlook isn't easy, which is why many will simply avoid the feature. We've created an FAQ detailing how to create a dynamic HTML signature in an FAQ titled "How to Create an HTML Signature in Outlook". Inclusion of the image is not as easy as copying text from Microsoft Word as you might have done in the past as we're referncing a dynamic image on each signature load, so we need to ensure we're always referencing an external image source rather than the image binary or local copy.

Pictured: Creating an HTML signature in Outlook isn't easy, which is why many will simply avoid the feature. We've created an FAQ detailing how to create a dynamic HTML signature in an FAQ titled "How to Create an HTML Signature in Outlook". It's not as easy as copying text from Microsoft Word as we're using a dynamic image, so we need to ensure we're always referencing an external image source rather than the image binary. The creation of a HTML signature in Outlook may be required for multiple modules - not just the lender rate image signature.

The signature above is obviously just a demo so doesn't include text required to satisfy compliance obligations. The image also includes a margin of just 2px rather than the default 10px.

The creation of a HTML signature in Outlook may be required for multiple modules - not just the lender rate image signature.

Signature Statistics

We record details of every image impression, meaning that we track the IP address and other information every time your email is viewed. We record this data along with the number of times the image link is clicked. This data is a business imperative if you want to understand how your broader marketing efforts are performing.

Open Pixel: If you're not using the Rate Image, a standard pixel may optionally be used in your signature to assess email interactions in the same way. Even something as simple as a company logo should be tracked for clicks so we're able to improve upon the performance of the signature. A signature is more than just a block of text.

On clicking on the rate link, the user is first passed through Yabber where information is obtained before returning them to the applicable lender archive on your website. The redirect URL carries the obligatory UTM tracking tags so we're able to further understanding how the signature click continued to perform once the user viewing session was created. In big-picture terms, we can also resolved the email click to a user and support conditional content - an email signature click is a valuable marketing metric that simply cannot be ignored.

Full statistical data is returned indicating how many users clicked on various tracked images in your email signature (remembering, our tools aren't limited to just the Lender Rate Image).

Lender Date Images are obviously a tiny feature of Yabber, but a lot of little things add up to big results.

■ ■ ■

Email Marketing Module FAQs

FAQs related to the Email Marketing module.

In a previous FAQ we look at the various parameters that could be passed in a URL for the purpose of tracking links. While all URL parameters are tracked in some way, those listed are considered primary within the Xena Analytics module in that they are intrinsically linked to the Triggerly module. One of… [ Learn More ]

UTM and Tracking tags are applied in a URL for the purpose of tracking links and campaigns sources. This FAQ will not take a deep dive into what URL tracking parameters are or how they're used. Instead, we'll primarily look at supported Yabber tracking tags (the word 'supported' is somewhat of a misnomer because all… [ Learn More ]

In the Formly FAQ where we detailed how to create a subscription form, we introduced the concept of placeholders, or those pieces of text that are dynamically replaced with another piece of text when an email is sent. This simple feature allows you to use templated designs with dynamic user content. While the amount of… [ Learn More ]

Microsoft Contact Folders aren't as relevant as they once were, and the 'new' (2024) versions of Outlook will categorise contacts with 'Categories' rather than folders, although folders are still made available even if they're not part of the standard Outlook interface. Yabber will still require that a contact folder be applied from time-to-time, although they're… [ Learn More ]

Calendars play an important role on your website and in Yabber. They are used for form-related functions, social media, events, and general scheduling. While Yabber makes an attempt to keep your calendars up-to-date, there will occasionally be a need to create or update a calendar, synchronise a calendar, or delete a calendar. This FAQ describes… [ Learn More ]

In various FAQs we introduce the concept of a 'Dynamic Email Signature', or a signature that references engaging up-to-date information of a specific type. We know that every touchpoint should create engagement of some type, and email is used daily so it stands to reason that we'll use the tool to manufacture various pathways. The… [ Learn More ]

One of the features of Yabber that is less visible than others is the lender rate email signature. The signature is an image that may be used in an email signature to return the lowest rate of a specific type. Yabber provides links to the direct image and will also create a HTML link for… [ Learn More ]

The facility to add an email or any other type of subscriber to a Microsoft Contact folder was introduced in the FAQ on creating a form. The purpose of adding a contact to segregated Microsoft Outlook contact folder is more than just 'providing a backup' as many see it. The lists are used when… [ Learn More ]

When a user unsubscribes from an email marketing campaign, we have the option to redirect them to a single default landing page, or a specific landing page that'll try and resubscribe the user back into the same or another list. We go to great lengths to attract a potential client, so we must provide a… [ Learn More ]

Email filtering is part of the Forms module. When creating a form you are presented with an option to define a large number of "What are you Interested in?" options. These options might include 'First Home Buyer', 'Refinancing', 'Renovating My Home', 'Investment Finance', and so on. A user may select any of these options when… [ Learn More ]

When you are first assigned a Yabber subscription, there are no Mailing Lists or forms created. However, before you create your first list you have the option of creating a large number of default email lists. If we set up Yabber for you, this is our default action. If you set up your own account… [ Learn More ]

Before email and calendar tools may be used, we generally have to define our default email and calendar for various facilities. This action is normally completed by us during the setup, but if you're doing it yourself, or you are required to alter values, this FAQ will guide you through the process. It will only… [ Learn More ]

An Admin Email is an email that is referenced within other areas of Yabber, such as EDGE, Fact Find Reports, Referrals, and Triggers. Instead of creating a single email, we create the email as a template that we may use from multiple locations, meaning that if an update to the message is required, it need… [ Learn More ]

As described in our FAQ detailing the Email Marketing Module, one of the benefits of using the Microsoft 365 integration is complete ownership of all your email with a single source of sending and management. All email sent from Yabber will optionally be added to your MS365 'Sent Items' folder. To include or exclude… [ Learn More ]

Whenever an email is created in Yabber that is associated with general email marketing or automated emails (admin, autoresponders etc.), an email signature is selected from a Library of signatures. This means that when a change to your signature is required, the change will be globally applied whenever that email signature is referenced. In some… [ Learn More ]

Related Lender Data FAQs

Related FAQs and features relating to Lender Data. The Lender features tends to touch most modules, so only primary FAQ modules are shown.

There are a large number of ways in which to return various heading content blocks on your website, such as headings, titles, statements, blocks - most of which are listed below this FAQ in the related section. However, these assets are usually used in the design of certain pages - most notably landing pages -… [ Learn More ]

You have a best interest duty requirement imposed upon you that essentially mandates you quickly communicate rate data to your clients - first when the board makes a cash rate decision, and then later when changes are made, or when repricing might be appropriate. Yabber provide a basic facility to create an RBA Cash Rate… [ Learn More ]

One of the features of Yabber that is less visible than others is the lender rate email signature. The signature is an image that may be used in an email signature to return the lowest rate of a specific type. Yabber provides links to the direct image and will also create a HTML link for… [ Learn More ]

All rate data returned via Yabber will automatically segregate the requested 'standard' products from those 'conditional' products, such as green finance or leveraged residential lending against a business product. In all cases where we've had feedback from users and the validity of rates was questioned, the product has existed and was entirely valid, but the… [ Learn More ]

In an FAQ titled How to Define and Send Lender-Specific Videos for the Lenders Archive and Product Pages we looked at how to assign videos to the Lender Product Archive and Pages on your website. Familiarity with the former module is required, as this FAQ will simply show you how to link directly… [ Learn More ]

In a previous FAQ we introduced how to define the single video for your website Lender Archive page. However, this is the top-level entry page that effectively acts as a conduit to the Lenders Archive Pages and the thousands of Lender Product Pages. Each of the specific Lender Archive Pages, and all of… [ Learn More ]

The Lender Archive Video is a single video shown on the entry Lender Archive Page. It is important for the purpose of amplifying funnel enthusiasm and introducing your website visitors to the purpose of the vast information archives you make available. The video should always include an appropriate call-to-action, appropriate disclaimers, and other helpful… [ Learn More ]

We've said it over and over again, but we'll say it again regardless. You don't want to be a rate-driven broker, and you don't want to attract rate-focused mortgage customers. However, that doesn't mean that we selectively deliver self-serving information on our website or in the funnel at the expense of the information that well… [ Learn More ]

There are a couple of dozen different ways to show Lender Data on your website, and the floating Lender Panel is just another one of them. The panel is also a feature that you're not likely to use. We'll often say that we have to serve information on our website that the consumer wants and… [ Learn More ]

The Modal Module made available in Yabber is an incredibly powerful feature that provides enormous flexibility in how and when we interrupt the funnel in order to provide appropriate course correction. The system is supplemented by a linking feature that permits you to link directly to any modal manicured within the system. In order to… [ Learn More ]

Lender Modals are popups shown based on the lender pages on your website. Each lender is assigned to a 'Lender Group' with a group consisting of a single lender or multiple lenders, and the defined modal will show when a user visits the specific lender archive product pages on your website. A default lender… [ Learn More ]

The inclusion of transactional account data on your website is important because it's part of a mortgage product that a consumer will interact with every single day. In terms of our compliance obligations, only those transactional accounts that are associated with lender products may be shown, and this effectively includes every transactional account made available… [ Learn More ]

Business Finance is an important part of your business model, and the lending is a gateway loan into typical residential lending. The business finance products made available on your website are sourced from your accredited lenders. This FAQ will details how to include a Business Finance Lender Widget anywhere on your website.

Business Finance Widget… [ Learn More ]

Personal Loans are a getaway into other types of lending, so it's something that your business shouldn't ignore. It's a common type of finance that is widely used, and one that takes very little time to process. Your website includes various pages for personal vehicle, maritime, motorcycle, caravan, aircraft, and other types of specific assets,… [ Learn More ]

Margin lending is a type of loan that allows you to borrow money to invest, by using your existing shares, managed funds and/or cash as security. It is a type of gearing, which is borrowing money to invest.

Compliance We've consulted with ASIC to determine if it's acceptable from a compliance perspective to include details… [ Learn More ]

Despite the ubiquitous industry rhetoric suggesting that sharing rates on your website will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company with other Lender Rate features, your powerful website presence will quickly… [ Learn More ]

Despite the ubiquitous industry rhetoric suggesting that sharing rates on your website will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company with other Lender Rate features, your powerful website presence will quickly… [ Learn More ]

A number of FAQs make reference to 'Lowest Rate Placeholders'. Placeholders are a string of text that is replaced in many blocks of text with the lowest available rate of a specific type from your accredited lenders. The placeholders shown below are in no way definitive - in fact, they're just one style of placeholder,… [ Learn More ]

The Lender Widgets on your website are one of your most powerful website features. Despite the ubiquitous industry rhetoric suggesting that sharing rates will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company… [ Learn More ]

Quite frankly, the Lender Archive Page link shortcode is rather pointless because the standard link shortcode is arguably more effective. The reason it exists is because we have other plans for how the shortcode is to be used. So, if you're linking to a specific lender archive, such as that for the Commonwealth Bank  ,… [ Learn More ]

,… [ Learn More ]

The Lender Widgets on your website are one of your most powerful website features. Despite the ubiquitous industry rhetoric suggesting that sharing rates will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company… [ Learn More ]

The Lender Library is an unusual page. It was once a hidden page on broker websites that was used almost exclusively by brokers. It has since become a standard public page within the website framework. The article in our blog titled "Mortgage Broker Lender Document and Media API, and Lender Documents Elementor Block" should be… [ Learn More ]

In order to represent your panel of lenders on your website, most brokers will use a silly slider of static images, and others will use a single fixed image comprised of multiple images - just a lazy solution. Your website includes a grid of images that links to the application Lender Archive Page that'll… [ Learn More ]

The Featured Product panel is a means to provide an array of information on a single product. The information may be shaped in numerous formats which is guided by the Elementor plugin options. As is expected from any finance professional, the rate data (and other product data) is always maintained to reflect the current rate.… [ Learn More ]

Like it or not (and most brokers don't), rates play a huge part in attracting the early attention of your website visitors. You will attract more traffic and you will attract more clients. What you do next will unlikely be rate focused, but our early efforts should be focused on creating conversations.

Note:

This FAQ provides… [ Learn More ]The Featured Rates Panel is one of nearly 30 tools used to render lender data and comparison information, and it is one of two panels used to return 'Featured' rate data in a manner similar to that which we're about to describe. The 'other' featured rate panel' is somewhat of a legacy Elementor-only feature.… [ Learn More ]

There's a Rate Ribbon on the front page of your website below the centre-fold block that presents the lowest rates of various types. The purpose of the ribbon is to position yourself as a broker, showcase your digital expertise, and create early funnel pathways. Each rate shown in the ribbon links to the relevant

The single line rate bar is shown on the broker website framework by default as part of the header and in the centre of the front page. The purpose is to position yourself as a broker, differentiate yourself from the 'others', showcase lowest available rates from your accredited lenders, and create website pathways. This FAQ… [ Learn More ]

The Published versus Comparison Rate graph was created to support a single FAQ on 'What is a Comparison Rate', but the graph often finds value elsewhere. To include the graph on your page, use the shortcode of [comparison_interest_faq]. The Result:

The graph simply illustrates how the published rate is often vastly different to the… [ Learn More ]

There are times where you will need to return the current cash rate into your website (often in your website footer as a quick reference). The shortcode of [bm_cashrate] will return 4.10% (bolding is ours). Simple. Note that the current cash rate is always shown in the header of your website. This panel links to… [ Learn More ]

All queries to lender data is measured against your accredited lenders. Once our accredited lenders are defined in Yabber, all queries from each of your specific websites will only return data from those lenders as defined in Yabber. Lenders are added to the system regularly and data is generally updated daily. Access the Lender Data… [ Learn More ]