There are a couple of dozen different ways to show Lender Data on your website, and the floating Lender Panel is just another one of them. The panel is also a feature that you're not likely to use. We'll often say that we have to serve information on our website that the consumer wants and not just what we want to show them, and this means showing some lender-focused funnel-kindle everywhere. It just works, because it's what consumers are most interested in (the funnel guides their wayward understanding). However, the default framework, and front page in particular, includes more than enough information to ignite the funnel and manufacture those early important pathways, so we don't recommend using the feature we're about to describe.

Why Was it Created?: The Floating Panel was coated because a single client required it. Others have found a user for it on certain pages, such as their Blog Archive page which a common entry point.

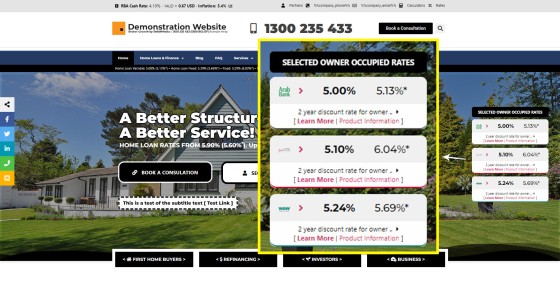

The Floating Panel is a small panel that will float to the right hand side of the page when viewed on a desktop with a certain resolution. The panel includes a defined number of rates for particular product types, links to the applicable product pages, and important 'Learn More' links to pages on your website. Styled to your liking, it'll float in a fixed position as the user scrolls down the page.

Pictured: The panel includes a defined number of rates for particular product types, links to the applicable product pages, and important 'Learn More' links to pages on your website. Styled to your liking, it'll float in position as the user scrolls down the page.

Again, you have Lender Data shown precisely where it should be shown so there's little reason to replicate the same data in a different format.

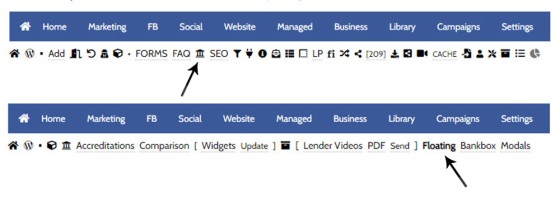

You will locate the Floating Panel options in Yabber by first selecting the Website module. Select the 'Bank' icon, and then select 'Floating' from within the Lender module.

Pictured: You will locate the Floating Panel options in Yabber by first selecting the Website module. Select the 'Bank' icon, and then select 'Floating' from within the Lender module.

The Panel is Conditional

The Panel is conditional in nature in that it will show Owner Occupied data by default, but if the user is resolved to be an Investor, it will show Investor products. The conditional aspect of the panel is minimal but sufficient to ensure that we maintain relevance with the important investor and refinancing groups.

Creating a Floating Profile

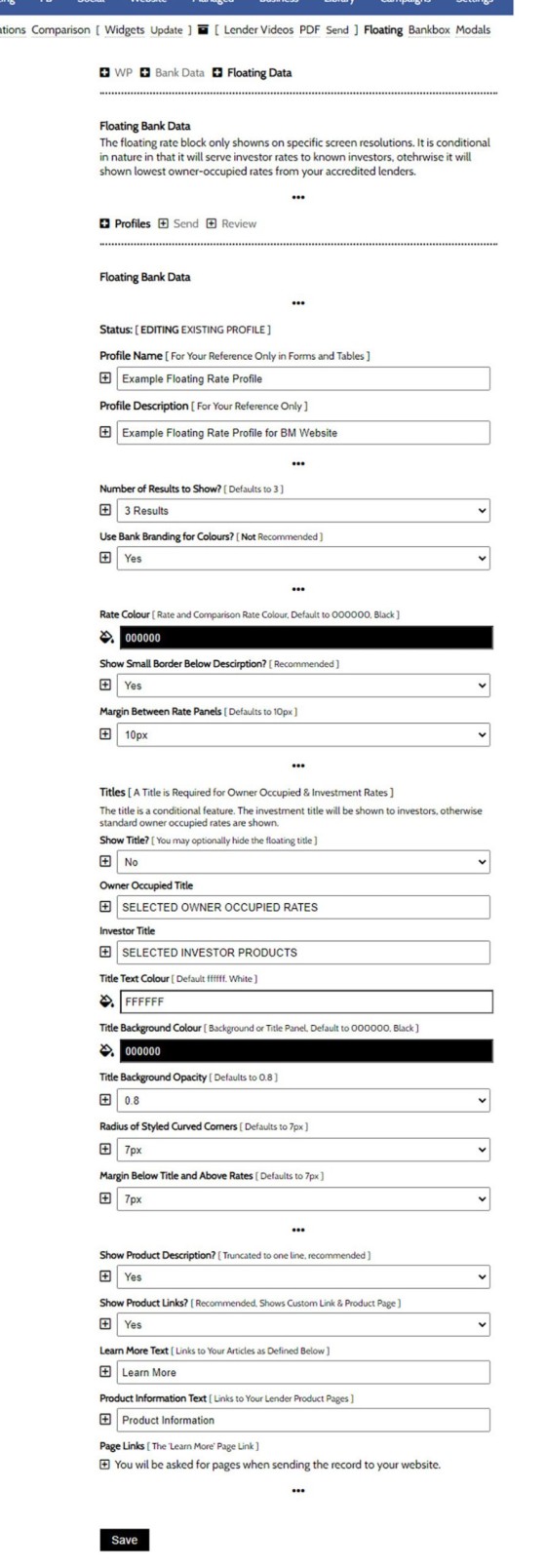

A profile is the array of attributes that define the style and presentation of the panel on your website. If the floating panel is used, a single profile is usually created for any single website. The profile is created via the 'Profiles' panel.

Pictured: A profile is the array of attributes that define the style and presentation of the panel on your website. If the floating panel is used, a single profile is usually created for any single website. The profile is created via the 'Profiles' panel.

The values themselves are reasonably self-explanatory when referenced against the image above. The two most important options - the link to the Investment and Owner Occupied pages on your website - are defined when you send your profile to your website. The method of sending these important page links at the same time we send a website update is because the same profile may be applied to any of your registered websites.

Once you have created your preferred profile, click 'Save'. You can always come back to edit your profile so don't worry about perfection just yet.

Sending the Floating Lender Panel to a Website

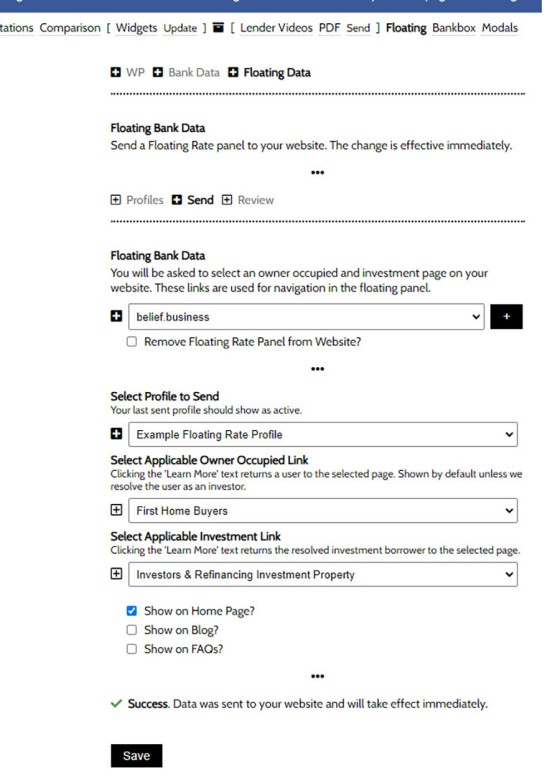

Sending the floating panel attributes to your website is completed via the 'Send' panel - it's here where we'll select our 'Learn More' owner-occupied and investment links. So, select your website, profile, links, and 'Send'. Note that we may also define what pages the Panel will show. When saved, changes are made on your website immediately.

Pictured: Sending the floating panel attributes to your website is completed via the 'Send' panel - it's here where we'll select our 'Learn More' owner-occupied and investment links. So, select your website, profile, 'Learn More' links, and 'Send'. Changes are made on your website immediately.

To disable an active Floating Panel, select the checkbox that says "Remove Floating Panel from Website" when sending your update.

Updates to your website are made immediately. It probably doesn't need to be stated yet again, but all up-to-date data is sourced from your accredited lenders, and the data is archived on your website for up to 48 hours.

The result is as pictured earlier.

Reviewing and Editing Profiles

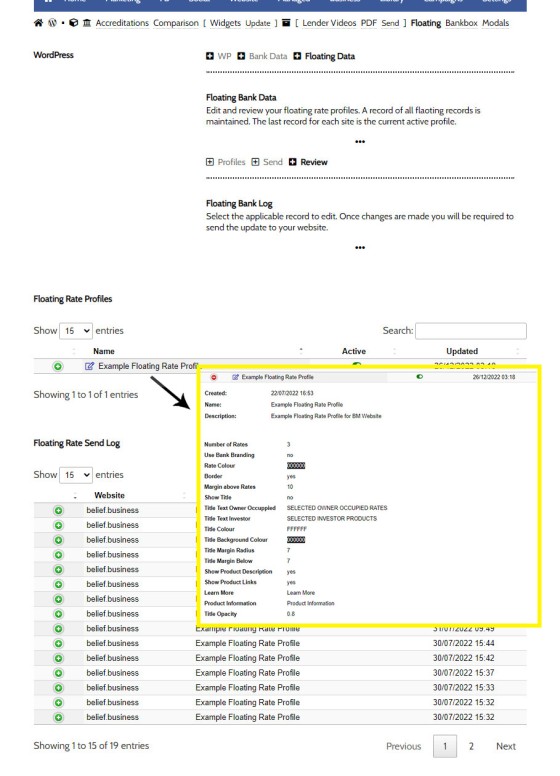

Review and edit profiles via the 'Review' panel. To edit, select the 'Edit' icon. To review an existing profile, select the green icon and the resulting accordion will return associated data.

Pictured: Review and edit profiles via the 'Review' panel. To edit, select the 'Edit' icon. To review an existing profile, select the green icon and the resulting accordion will return associated data.

As many profiles may be created as required, but only one profile will be applied to any single website.

■ ■ ■

Related Lender Data FAQs

Related FAQs and features relating to Lender Data. The Lender features tends to touch most modules, so only primary FAQ modules are shown.

There are a large number of ways in which to return various heading content blocks on your website, such as headings, titles, statements, blocks - most of which are listed below this FAQ in the related section. However, these assets are usually used in the design of certain pages - most notably landing pages -… [ Learn More ]

You have a best interest duty requirement imposed upon you that essentially mandates you quickly communicate rate data to your clients - first when the board makes a cash rate decision, and then later when changes are made, or when repricing might be appropriate. Yabber provide a basic facility to create an RBA Cash Rate… [ Learn More ]

One of the features of Yabber that is less visible than others is the lender rate email signature. The signature is an image that may be used in an email signature to return the lowest rate of a specific type. Yabber provides links to the direct image and will also create a HTML link for… [ Learn More ]

All rate data returned via Yabber will automatically segregate the requested 'standard' products from those 'conditional' products, such as green finance or leveraged residential lending against a business product. In all cases where we've had feedback from users and the validity of rates was questioned, the product has existed and was entirely valid, but the… [ Learn More ]

In an FAQ titled How to Define and Send Lender-Specific Videos for the Lenders Archive and Product Pages we looked at how to assign videos to the Lender Product Archive and Pages on your website. Familiarity with the former module is required, as this FAQ will simply show you how to link directly… [ Learn More ]

In a previous FAQ we introduced how to define the single video for your website Lender Archive page. However, this is the top-level entry page that effectively acts as a conduit to the Lenders Archive Pages and the thousands of Lender Product Pages. Each of the specific Lender Archive Pages, and all of… [ Learn More ]

The Lender Archive Video is a single video shown on the entry Lender Archive Page. It is important for the purpose of amplifying funnel enthusiasm and introducing your website visitors to the purpose of the vast information archives you make available. The video should always include an appropriate call-to-action, appropriate disclaimers, and other helpful… [ Learn More ]

We've said it over and over again, but we'll say it again regardless. You don't want to be a rate-driven broker, and you don't want to attract rate-focused mortgage customers. However, that doesn't mean that we selectively deliver self-serving information on our website or in the funnel at the expense of the information that well… [ Learn More ]

There are a couple of dozen different ways to show Lender Data on your website, and the floating Lender Panel is just another one of them. The panel is also a feature that you're not likely to use. We'll often say that we have to serve information on our website that the consumer wants and… [ Learn More ]

The Modal Module made available in Yabber is an incredibly powerful feature that provides enormous flexibility in how and when we interrupt the funnel in order to provide appropriate course correction. The system is supplemented by a linking feature that permits you to link directly to any modal manicured within the system. In order to… [ Learn More ]

Lender Modals are popups shown based on the lender pages on your website. Each lender is assigned to a 'Lender Group' with a group consisting of a single lender or multiple lenders, and the defined modal will show when a user visits the specific lender archive product pages on your website. A default lender… [ Learn More ]

The inclusion of transactional account data on your website is important because it's part of a mortgage product that a consumer will interact with every single day. In terms of our compliance obligations, only those transactional accounts that are associated with lender products may be shown, and this effectively includes every transactional account made available… [ Learn More ]

Business Finance is an important part of your business model, and the lending is a gateway loan into typical residential lending. The business finance products made available on your website are sourced from your accredited lenders. This FAQ will details how to include a Business Finance Lender Widget anywhere on your website.

Business Finance Widget… [ Learn More ]

Personal Loans are a getaway into other types of lending, so it's something that your business shouldn't ignore. It's a common type of finance that is widely used, and one that takes very little time to process. Your website includes various pages for personal vehicle, maritime, motorcycle, caravan, aircraft, and other types of specific assets,… [ Learn More ]

Margin lending is a type of loan that allows you to borrow money to invest, by using your existing shares, managed funds and/or cash as security. It is a type of gearing, which is borrowing money to invest.

Compliance We've consulted with ASIC to determine if it's acceptable from a compliance perspective to include details… [ Learn More ]

Despite the ubiquitous industry rhetoric suggesting that sharing rates on your website will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company with other Lender Rate features, your powerful website presence will quickly… [ Learn More ]

Despite the ubiquitous industry rhetoric suggesting that sharing rates on your website will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company with other Lender Rate features, your powerful website presence will quickly… [ Learn More ]

A number of FAQs make reference to 'Lowest Rate Placeholders'. Placeholders are a string of text that is replaced in many blocks of text with the lowest available rate of a specific type from your accredited lenders. The placeholders shown below are in no way definitive - in fact, they're just one style of placeholder,… [ Learn More ]

The Lender Widgets on your website are one of your most powerful website features. Despite the ubiquitous industry rhetoric suggesting that sharing rates will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company… [ Learn More ]

Quite frankly, the Lender Archive Page link shortcode is rather pointless because the standard link shortcode is arguably more effective. The reason it exists is because we have other plans for how the shortcode is to be used. So, if you're linking to a specific lender archive, such as that for the Commonwealth Bank  ,… [ Learn More ]

,… [ Learn More ]

The Lender Widgets on your website are one of your most powerful website features. Despite the ubiquitous industry rhetoric suggesting that sharing rates will only attract 'rate chasers' (partially true, but outside the scope of this FAQ), the rate information shared on your website will objectively attract and convert more mortgage clients. Used in company… [ Learn More ]

The Lender Library is an unusual page. It was once a hidden page on broker websites that was used almost exclusively by brokers. It has since become a standard public page within the website framework. The article in our blog titled "Mortgage Broker Lender Document and Media API, and Lender Documents Elementor Block" should be… [ Learn More ]

In order to represent your panel of lenders on your website, most brokers will use a silly slider of static images, and others will use a single fixed image comprised of multiple images - just a lazy solution. Your website includes a grid of images that links to the application Lender Archive Page that'll… [ Learn More ]

The Featured Product panel is a means to provide an array of information on a single product. The information may be shaped in numerous formats which is guided by the Elementor plugin options. As is expected from any finance professional, the rate data (and other product data) is always maintained to reflect the current rate.… [ Learn More ]

Like it or not (and most brokers don't), rates play a huge part in attracting the early attention of your website visitors. You will attract more traffic and you will attract more clients. What you do next will unlikely be rate focused, but our early efforts should be focused on creating conversations.

Note:

This FAQ provides… [ Learn More ]The Featured Rates Panel is one of nearly 30 tools used to render lender data and comparison information, and it is one of two panels used to return 'Featured' rate data in a manner similar to that which we're about to describe. The 'other' featured rate panel' is somewhat of a legacy Elementor-only feature.… [ Learn More ]

There's a Rate Ribbon on the front page of your website below the centre-fold block that presents the lowest rates of various types. The purpose of the ribbon is to position yourself as a broker, showcase your digital expertise, and create early funnel pathways. Each rate shown in the ribbon links to the relevant

The single line rate bar is shown on the broker website framework by default as part of the header and in the centre of the front page. The purpose is to position yourself as a broker, differentiate yourself from the 'others', showcase lowest available rates from your accredited lenders, and create website pathways. This FAQ… [ Learn More ]

The Published versus Comparison Rate graph was created to support a single FAQ on 'What is a Comparison Rate', but the graph often finds value elsewhere. To include the graph on your page, use the shortcode of [comparison_interest_faq]. The Result:

The graph simply illustrates how the published rate is often vastly different to the… [ Learn More ]

There are times where you will need to return the current cash rate into your website (often in your website footer as a quick reference). The shortcode of [bm_cashrate] will return 4.10% (bolding is ours). Simple. Note that the current cash rate is always shown in the header of your website. This panel links to… [ Learn More ]

All queries to lender data is measured against your accredited lenders. Once our accredited lenders are defined in Yabber, all queries from each of your specific websites will only return data from those lenders as defined in Yabber. Lenders are added to the system regularly and data is generally updated daily. Access the Lender Data… [ Learn More ]