The DTI is the Debt to Income Ratio and is often used by lenders as one of the many methods of assessing lending risk. In isolation it tends to present a good risk ratio, and it's one of the many calculators that should be regularly used inline to give website funnel participants further insight. The DTI calculator is one of the many Belief calculators and is linked to from the primary Calculator Archive.

Installation of the DTI Calculator is a known website asset so you will occasionally find its use in articles sent to your website via the Article Module.

This FAQ will give the appropriate guidance to include the DTI Calculator on your website with shortcode or with an Elementor widget.

LVR Calculator: The DTI Calculator Elementor Widget is paired with the LVR Calculator Widget. The LVR Calculator is introduced in an article titled "How to Include the LVR Calculator on Your Website With Shortcode or Elementor Widget". We would have broken these calculators into two if it didn't cause compatibility issues with existing websites.

The Result

For our inline example we'll use the shortcode of [bm_dti]. All the calculator attributes may be altered and these are shown towards the end of the FAQ. The result below is the default output.

The green, amber, and red indication towards the top of the calculator will be updated to be a defined attribute. The values were defined at a time when NAB accepted far higher DTI ratios.

An example of a DTI Calculator with a border applied is shown below:

DTI Calculator Border: Shortcode used to return the result above is as follows: [bm_dti max="25000" from="8000" from_debt="1700" border="3px #000000 dashed" background="#F8F8F8"]. Shortcode attributes are introduced shortly.

Usage is simple: use the upper slider for your monthly pre-tax income, and use the lower slider for your monthly debt (of all types). The resulting DTI is shown above the sliders. All attributes shown above may be altered.

DTI Elmendorf Widget

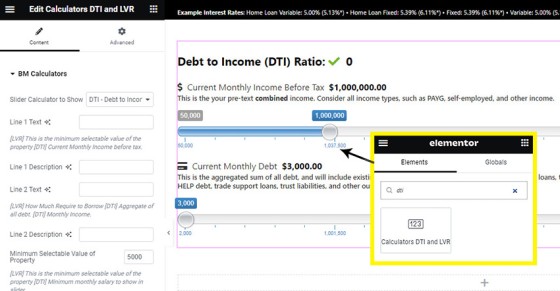

You will locate the DTI Calculator in Elementor by searching for 'DTI'. Drag the DTI block onto your page, define your options, and save.

Pictured: You will locate the DTI Calculator in Elementor by searching for 'DTI'. Drag the DTI block onto your page, define your options, and save.

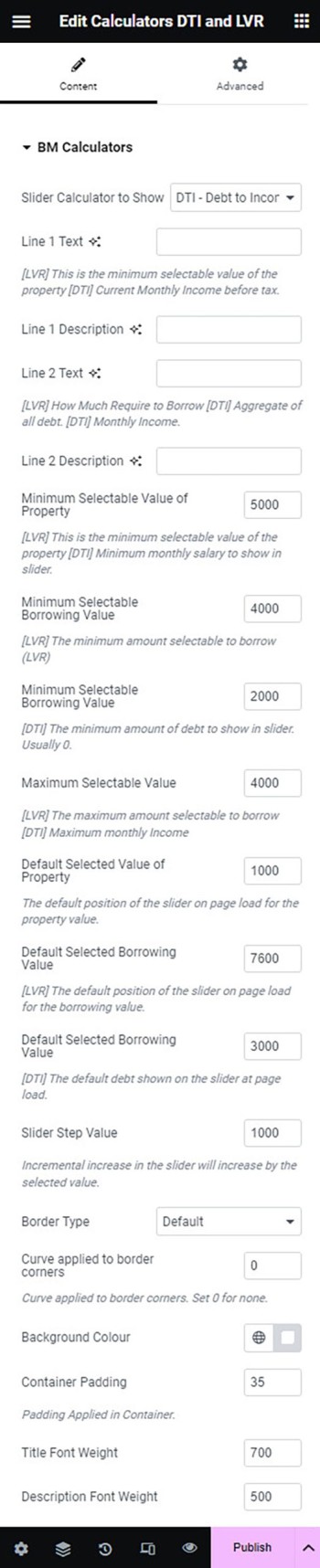

The upper option should be selected to 'DTI Calculator' (the other option is 'LVR Calculator'). The options panel provides the facility to update virtually every calculator attribute. The fields are self explanatory, particularly when compared against the real-time result rendered to your page.

Pictured: The options panel provides the facility to update virtually every calculator attribute. The fields are self explanatory, particularly when compared against the real-time result rendered to your page.

Edit the presentation as required.

Shortcode Attributes

If shortcode is used, most of the calculator attributes may be altered to a return a result identical to that returned via Elementor. Availabla attributes are as follows:

line_1

line_1_description

line_2

line_2_description

background

ffffff (white).min

min_debt

max

step

Border

3px #000000 dashed.border_radius

background

ffffff (white).padding

dti_font_weight

margin

margin applied above and below the container. Defaults to 20(px).●

Shortcode attributes are due to change. Backward comparability will be maintained.

Try and use calculators in post content as often as possible to give the user a dynamic resource for on-page context and to keep them on their current conversion page (we want to control the funnel pathway and leave as little decision-making to the user as possible).

■ ■ ■

Related Calculator FAQs

Your website includes a large number of calculators. These are sourced from either the MFAA or FBAA, or created by us. It is up to you to ensure that any industry calculator is appropriately licenced.

The LVR Calculator (or Loan Value Ration Calculator) is the most basic calculator on your website... and it's also one the most commonly used. The LVR calculator is one of the many Belief calculators and is linked to from the primary Calculator Archive. Installation of the LVR Calculator is a known website asset so… [ Learn More ]

The DTI is the Debt to Income Ratio and is often used by lenders as one of the many methods of assessing lending risk. In isolation it tends to present a good risk ratio, and it's one of the many calculators that should be regularly used inline to give website funnel participants further insight. The… [ Learn More ]

We introduced the Calculator archive in an FAQ titled "How to Add MFAA or FBAA Calculators to Your Website. The page links to all the available calculators on your website. The returned single calculator pages are quite naked in design; they include a title block, calculator, right sidebar menu, and optional lead magnet form.… [ Learn More ]

in a previous FAQ we introduced how to include calculators on a page with Elementor or Shortcode. The problem is that they don't look real good. As part of the linking architecture, the [link] shortcode provides for a fully trackable popup modal, meaning that you can include multiple calculator links on a single page.… [ Learn More ]

The MFAA and FBAA provide a suite of very basic calculators. FBAA generally provide the suite as part of their membership while the MFAA charge a nominal licence fee. These calculators supplement our own various calculators. It it up to you to ensure that you have the appropriate licence to use the tools. This FAQ… [ Learn More ]

The 'ImageCalc' graphing tool was initially designed to easily integrated graphs into automatically generated PDF documents. It has since been used by brokers in their articles because of its ease of use. The most common methods of including the graphs into standard articles is with simple shortcode, while Elementor is the methods generally sued when… [ Learn More ]