A lot of advertising we see on Facebook now makes one massive and inexcusable conversion-blocking mistake - the advert links to a conversion-blocking 'quiz' on first contact that requires a user answer a bunch of 'qualifying' questions. In this article we'll describe how you can multiply the effects of your advertising and improve upon your ROI by removing this business-debilitating step entirely.

There's a reason our Facebook clients are now returning monthly volumes well in excess of 400-million on the back of their paid promotion, and much of that has to with the way they 'qualify' (or don't qualify) their clients. In a moment we'll introduce the broker-qualifying Venus Report that is optionally provided to a lead just after the top-of-funnel, and we'll explain why it performs far better than any quiz-style 'funnel-blocking' tool in the market.

We know finance professionals only want ready-to-go leads. It's the single industry we deal with where businesses only expect qualified clients delivered to their pipeline, but it's also the only industry where we'll see massive opportunity and volume discarded because of a seriously flawed qualification system.

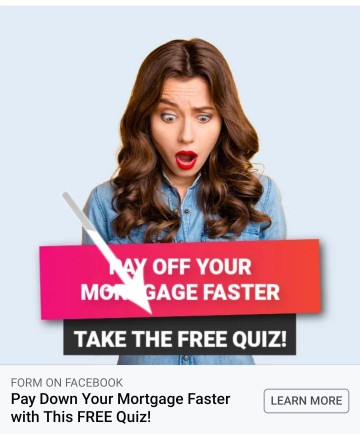

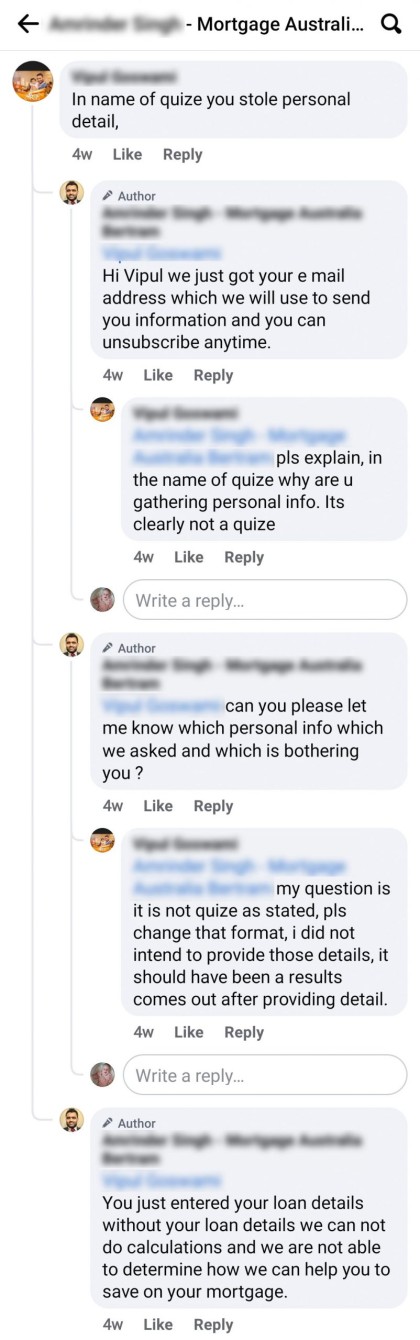

Pictured: The pictured 'quiz', like hundreds of others like it, doesn't actually do anything other than potentially disqualify perfectly suitable candidates. It's not a quiz - it's a disqualification questionnaire.

Not only does a silly quiz disqualify those candidates that are likely most suitable for a loan, it disqualifies those that simply don't want to surrender their details to a dodgy form (usually a non-compliant means of collecting information). The 'quiz' is just plain stupid... at least on first contact.

Pictured: A little off-topic, but don't blatantly lie in your ads. Don't pretend like you're only taking on limited numbers into your diary when you have a professional obligation to help anybody. Don't say that "for this month only we're giving away free home loan health checks" when your service and that of the industry is almost always 'free'. Just don't lie - it's not a good start to your relationship.

We'll address the issue of deceptive adverts another time.

Some serious boneheads will ask a series of questions that are designed to do nothing other than completely disqualify clients, often using an LVR to indiscriminately and inaccurately disqualify real clients (the submission is essentially discarded and doesn't go any further, and the user taking the time to complete a questionnaire won't receive a return phone call; does this support your 'Customer First' claims?). Often used by the lead-generation guys, the funnel road-block actually discriminates against the highest-value clients (we completed this with a high-LVR 'doctor' loan and didn't receive a callback).

If you have anything resembling the nonsense above associated with your top-of-funnel marketing it's time to give us a call - we'll provide some no-obligation guidance.

A Quiz is a Funnel Block

The purpose of a funnel needs to be understood. A funnel of any kind is designed to attract as many consumers into the pipeline as possible: the more interested consumers that pour into the top usually translates to more business that makes its way into your Opportunity-based pipeline. Any page-view, keystroke, information, or layer of abstraction of any kind that interrupts that initial (lead-capture) transaction will seriously impact upon your conversions and subsequent ROI. It's this early transactional nature of the advertising experience that is more akin to a linear 'sales funnel' (as opposed to the 'Marketing Funnel' we'll introduce shortly).

The initial transaction we have off the tail end of paid promotion should normally (but not always) be designed to collect a name and email at the very least. If we fail at this early and initial conversion there's nothing on the other side. Again, it's that second page - God's gift to anybody in the marketing space - that applies what we've coined as an 'Escalation of Commitment" strategy. Once you capture that early attention we're able to do 'something' else with that user.

Once again, have a user enter a funnel experience and then do something with them - it's what a funnel is designed to do.

A Little Off-Topic...

You may want to consider reading our article on conditional redirects to understand how the first funnel transaction can course-correct that early funnel experience based on a first-page interaction, and then understand why the funnel entry-point is absolutely required on virtually every page of your website (every page on your website is a potential organic entry point, therefore every single page on your website is a type of landing page).

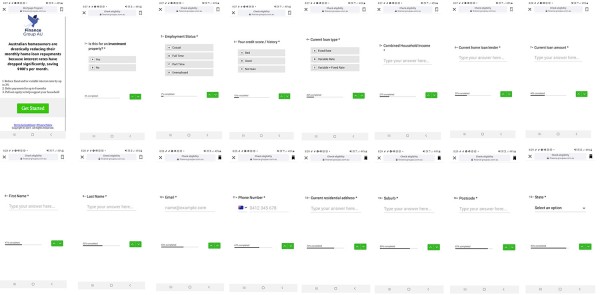

Pictured: The conditional redirects. Save your always-important and vital second page for a measure of qualification if required. Don't block your funnel entry-point with nonsensical BS.

Those 'every-page' forms and landing panels on every page change shape based on assets that a user has already subscribed, or a determined interest type based on browsing behaviour. This methodology will literally explode your conversions. Those knuckleheads that don't integrate your website as part of any paid or organic campaign are downright professionally negligent.

How do we force a conditional redirect to a more suitable, appropriate, and higher-converting 'second page' to take place? We include a subscription form on virtually every page of your website, and that form includes an integrated calendar contact form (if the redirection is applied, the second-page redirection is predicated upon phone and calendar details).

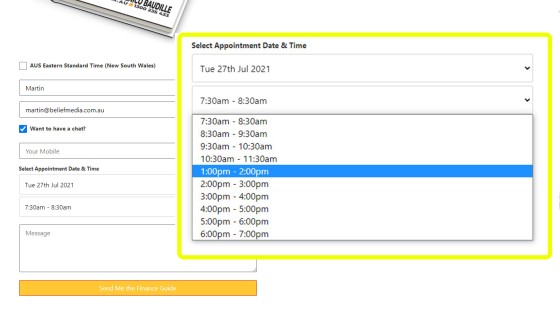

Pictured: The Calendar Booking Form. Discussed in the linked articles detailing calendar usage, a user may optionally select immediate contact or make a firm booking in your calendar. This form should be on every suitable page. Certainly, never ever integrate a third-party system that doesn't surrender details to your website 'intelligence'.

As discussed in an article titled "The One Thing You’re Missing in Your Calendar Booking Forms" we look at the one calendar field that is possibly more important than any other... yet largely ignored by virtually all finance professionals.

You're Going to Disappoint

If your ads start with "Don't Finance the Traditional Way", and then carry on with the 'loyalty tax', you've subscribed to some of the worst advertising made available as generic templates - they're horrendously poor. These laughably poor ads follow on with the typical quiz-style 'qualification' questions'. The problem is clear: this style of ad is deceptive (predatory?), and the so-called 'quiz' will seriously upset your audience. You're asking questions that are entirely irrelevant to top-of-funnel entry (a funnel block), and then you're not even delivering upon your promise.

Consider the following very typical exchange.

Pictured: We tested a 'variation' of the advert attached to the comment thread with a discretionary budget for a participating Platinum broker and our advert and funnel converted 12X more clients (we obviously made the advert compliant). This sloppy and deceptive copy is not a reflection on the broker - it's likely they were relying on a best-practice experience.

As the consumer correctly stated, the 'quiz' should have provided details immediately (around 3-minutes of coding, by the way). To call this style of questioning a 'quiz' is deceptive and somewhat predatory.

We've taken 42 screenshots of consumers complaining in exactly the same way.

It is likely the market will start to move away from this ridiculous model (the pretenders always change their tact after we write about something).

The Venus Report - a 'Quiz on Steroids'

It should be understood first and foremost that we've not entirely quiz-averse (although our quiz is unlike the typical nonsense peddled to the industry). We use what we call a 'Venus Report' to ask typical qualification questions to a client but it provides a genuine service to the client (and not presented as any kind of qualifying tool) - a PDF report is generated and sent to a client based on the questions they answered. It's likely that our report is the only such tool actually made available to the industry.

We find clients willingly engage with the Venus questions because they're aware of the fact it provides them with real information - not the other way around. Of course, the manner in which they engage with each question will help shape their website journey, course-correct their marketing funnel, and provide a more personalised customer experience. The report demonstrates your expertise and authoritativeness as it's provided as a genuine service.

When do we show the Venus report? The short answer: when it's appropriate (never, or at least almost never, on funnel entry). When you have collected and individuals' name and email we employ the Conditional Redirect, so on the basis of their interaction we send the funnel participant to a suitable and more appropriate second page based on their first-page interaction. So, if a user makes a booking with us we can immediately send them to the second page - one of the most important pages you will ever serve - with the optional Venus report. If a user doesn't make a booking (remembering our integrated Outlook calendars are hidden behind a checkbox) we might send them to a page designed for a measured and appropriate escalation (often with the calendar form open).

The Venus Report is presented with the promise that a PDF report immediately sent to them. On the basis of various trigger questions, such as LVR and credit history, the report is tailored to that client specifically (in fact, it's branded with their name). Bottom line: Venus is a client tool - not a broker tool. The fact the broker might use the information to assess the 'suitability' of an individual is secondary to the primary service the tool is meant to provide.

The purpose of a marketing funnel, or even a basic advertising experience, is to qualify you as a broker - it is not designed to qualify the client.

So, we do use what many would call a 'quiz'... but it's a quiz on steroids and one that'll explode the effectiveness of your funnel - it's designed to make your business stand out from your competition which is the purpose of a marketing funnel. At the time of writing we're looking at including various product options that are suited to the respondent based on their responses (we're cautious about compliance and other issues here so it'll go before serious review before it is released into the market).

We Tested Our Own Quiz Questions

We've been doing this since 1997 so we thought our evolved methodology and proprietary technology returned more business... but were we missing something? We tested the quiz-style questions and our settled returns reduced by over 600%. The reason is clear: standard consumer psychology is predicated on the principles of 'know, like, and trust' - with our own Magic Lantern model squeezing 'Expertise' and 'Authoritativeness' into the mix. Asking for a salary, purchase price, or credit history before you've established any of the Lantern attributes means far more users will simply bounce... and higher-value clients are more likely to bounce than others.

The conclusion from our experiment (over $100,000 in advertising spend across five of our clients over eight weeks - so 'bigger' spenders) was conclusive: our method and funnel ideology returned far more business, and converted up to 600% more business. The quiz-style method we've just described in fairly typical of the technical and marketing-illiterate actors in the space that base promoted returns on the principle that even bad marketing returns business.

It is important to understand that our Venus Report (the equivalent to a 'quiz') surrenders large amounts of information to a our website, meaning we can shape that user's journey based on the information they've shared by way of completing the report. If your marketing representation has led you astray by reselling you a highly inappropriate High Level subscription, or they've sent your paid traffic to Lead Pages or Click Funnels, they've objectively failed you.

You should never ever send traffic to a third-party website when you have the capacity to serve that information within your own domain... and this especially applies to important resources such as Landing Pages and Calendar Forms (copying third-party code into a page is just as bad).

It's What Lead Generation Company's Will Use to Qualify

I'm not a fan of the pay-per-lead model at all. In all those cases we've evaluated the advertising was non-compliant and added no value whatsoever to the business paying for the traffic. Why pay somebody else to generate your leads when it's so ridiculously affordable and effortless to generate them yourself?

In most cases in the marketplace the pay-per-lead model added no value to your website, the interaction didn't utilise a marketing funnel in any respect (it was usually a sales funnel with a follow-up email campaign), and in all cases we've evaluated the advertising was non-compliant. A marketing agency of any type - include a lead generation company - should never ever introduce non-compliance of any kind into a business.

We responded to a number of ads to see what would follow. In all cases we included details that were on the 'fringe' of most borrowing requirements. Since nobody asks for occupation we often answered with 100% LVR style of answers, and we'd often miss a '0' on our income, or incorrectly state the borrowing requirements (in a few cases we entered details for entry-level solicitors or doctors). In virtually all cases no contact was made, and in all cases we submitted real-world details that would absolutely qualify for a loan outside what many would consider the 'typical' qualification criteria. I was completely ignored in virtually all cases. Even if my fringe answers were unacceptable by certain standards, what about Guarantor Loans? what about FHB grants? what about tiered lenders? what about the bank of mum and dad? what about rentvesting? what about a lower purchase price? There's a lot of 'what if's'. In all cases, what about the professional customer first obligation that all brokers subscribe? What about the Customer First mantra that is supposed to underpin the manner in which we conduct our business? What about our vocational commitment to actually helping people?

Ignoring by qualification is practice that needs to end. Now.

Apart from the fact that pay-per-lead companies shouldn't exist, their qualification questions (or are they disqualification questions) are a totally unnecessary and business-destroying tactic used to bypass any human interaction. Most lead generation companies are just garbage, and any finance business should be ashamed to be associated with these people. Their business model relies on your business not having the capacity to deliver leads yourself, so they'll often feed you with advice that limits your capacity to grow. It's just disguising.

How Do You Qualify?

In an article titled "The One Thing You're Missing in Your Calendar Booking Forms" we introduce something that is often overlooked, and it's costing you business: if you're not first, your last. You don't need a client to book in an appointment, you just need to know that they want you to contact them, and a calendar form should perform this very basic function. A calendar appointment doesn't have to be scheduled in the future (and shouldn't be, necessarily, as they'll simply talk to another broker before then). The way you generally qualify is simple: talk to the lead.

You can always find a few minutes to talk to somebody... even if that time is used for a basic qualifying understanding of their borrowing position. A qualification call takes 3-minutes at times, and can always lead to something else. If somebody doesn't qualify for something now, and there's no other way in which to help them now, they'll always mature into something later... and you want them to be your client. If you have a personal assistant that isn't offshore, have them make the initial inquiry on your behalf - at least get the process started.

It has to be stressed once again that the Venus Report isn't designed to qualify the client - it's designed to qualify you, but that doesn't mean it won't provide you with a detailed understanding of the client. We don't encourage Venus as a qualification tool in any respect because there's always borrowing pathways that might be explored if a lead doesn't fit into that narrow category that simply 'qualifies' based on popular criteria. If (and it's a big 'if') you're going to introduce a real means of qualification once a user is participating in your marketing funnel, it may (and it's a big 'may') be suitable to provide a qualification step at that point. Bottom line: don't let technology qualify your leads when the technology is not designed, nor suited, to the task.

Bottom line: there are plenty of ways in which to qualify a client, but the top-of-funnel quiz isn't one of them. Period.

Conclusion

We can't help feel partially responsible for the shift to quiz-style questions. Since we introduced Venus and some of our other techniques in a public way we've had others try to play a futile game of catch-up. In doing so, they've misunderstood our methodology or they're simply trying to compete with a similar but far inferior product. Either way, they've got it seriously wrong.

Remember, the funnel is a catch-all. Never place a layer of complexity between your consumer-facing marketing asset and your pipeline. If a lead doesn't convert on that first landing page or other asset you should apply escalation on the second page... and if the lead vacates your experience without any contact intent, let your funnel play the part it is designed to play.

Remember, your marketing funnel is an immersive, enjoyable, and educational journey - do not sell. If you demonstrate the Lantern attributes your expertise and authoritativeness will sell itself (and please don't be misled into thinking a marketing funnel is an email campaign - an often misunderstood and business-limiting understanding).

The effectiveness of your campaigns, your website, or any of your marketing assets, is predicated upon more than just an ad, quiz, and email campaign. If you would like to know why our Facebook and other programs are the most effective in the industry, please give us a call.