No marketing presence is anywhere near complete without a reliable, scalable, and easy-to-use system for scheduling post-settlement communications. Introduced as a module to support settled clients via appropriate communication, our EDGE systems have the secondary and very intentional effect of developing passionate brand advocates and referrers. We've seen the system directly contribute towards billions (with a 'b') in volume in the years that our clients have used it, and because its powered via our Platform we can see in real time the extremely positive effect its having on broker businesses. We have a number of EDGE system that are used depending upon your existing IT infrastructure. This article introduces the EDGE post-settlement module for SalesTrekker.

Our EDGE post-settlement follow-up systems were designed in a generic manner so they could be applied by any broker using any aggregator platform. However, in the light of operational experience - and despite the fact we'll keep the old system running (likely making it available for free to mailing list subscribers) - we'll be building in automated post-settlement communication into any platform that provides an API able to supply sufficient data to action the relevant communication sequences.

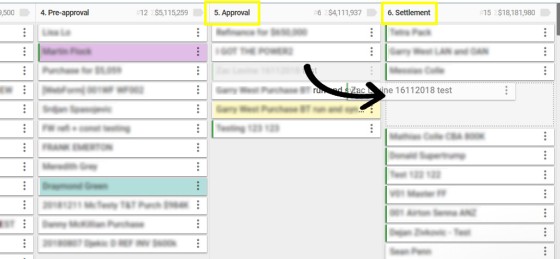

SalesTrekker works by presenting a number of workflows and associated stages relevant to a type of application. Since each application type may be vastly different, and each loan requires a unique workflow to be applied, the stages associated with each workflow are similar but different. Moving a deal from one stage to another triggers certain automated actions from within SalesTrekker - sometimes as simple as an email sent to a client... while at other times more advanced actions are defined. The post-settlement contact with clients of differing types (or different workflows) is also vastly different, and our EDGE integration into SalesTrekker takes advantage of the segregated workflows by automatically creating a post-settlement contact schedule on the basis of moving a deal from one stage to a defined 'Settled' stage within each workflow (each workflow has an associated contact scheduled; for example First Home Buyers will be communicated with in a vastly different manner when compared to investors).

With SalesTrekker's EDGE platform We break the contact schedule into two groups:

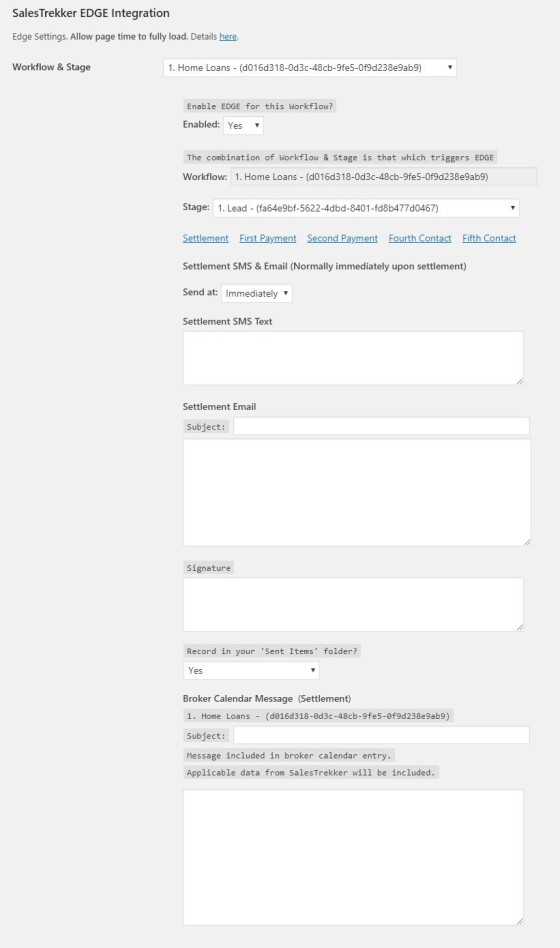

- Primary Contact. Primary contact is the "First 100 days". While we schedule broker reminders into a nominated calendar, we also send the client an SMS and/or email notifying of the pending call.

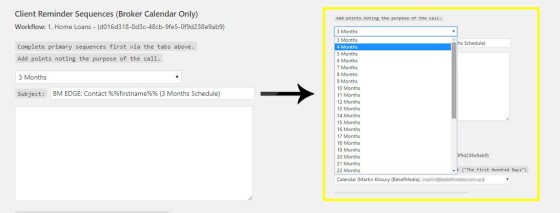

- Secondary Contact. A secondary contact is a scheduled reminder to just the broker's nominated calendar. Any number of contact points may be scheduled in that first three years with custom calendar title and a scripted message (supplemented by automated content we obtain from SalesTrekker).

For most buyers, there are at least three contact points in the post-settlement period where we advocate the broker responsible for writing a loan has a direct conversations with their client - they are Settlement (obviously), before first payment, and after the second payment (we've provided options for up to 5 primary contact reminders). While we use the client's 'payment' date as a trigger point it's often quite acceptable to drag out contact for those paying fortnightly into a monthly contact sequence. It's at these early scheduled appointments where we'll send an email and text message (both at 10am on the day of contact) and schedule a quick appointment into your calendar. Following a specific patter and purpose during each contact point helps develop that client into a passionate advocate and referrer. In a sense the contact also plays its part in reputation management (the end 'conversion' goal of any post-settled client may be 'just' a testimonial... although the primary objective with any post-settlement client is an referral relationship).

Pictured: Moving the SalesTrekker deal into a defined stage (usually "Settled") will automatically trigger our Platform to send EDGE contact points into your defined calendars. We'll schedule broker reminders, client SMS messages, and client 'reminder' emails. The "First 100" days are usually managed by the broker although there's an option to optionally send the "First 3 Years" of contact points to a calendar owned by administration staff.

Following the primary points of personal contact we schedule any number of contact points (defined by you for each workflow) over a three-year period into a calendar as a means of providing continued customer post-settlement support. These short but necessary appointments are made to ensure our clients don't wander off into the arms of another broker ("clawback insurance"), they keep us top of mind when it comes to providing referrals and product feedback, and they further establish your business as that of choice. As part of our "Magic Lantern" framework for generating client advocates there's absolutely no question the system works.

How The SalesTrekker EDGE Module Works

As the SalesTrekker deal is moved from one workflow to another (the trigger) we'll action a number of steps.

- The "First 100 days". We'll schedule between zero and five broker calendar appointments with your client. We call this the "First 100 days" as it's your opportunity to provide excellent early customer support. Each call is 'scripted' in that it has a particular purpose. Each contact point includes an SMS and email (sent at 10am on the scheduled day) and a phone call from the broker. The reminders are normally sent directly to the broker's calendar. The idea is that we'll illicit a testimonial, feedback, or referral (via our referral form) in that early period.

- The "First 3 years". We'll create any number of contact points in the following 3 years (or 2 years and 9 months if we exclude "The First 100"). Each contact point is curated based on the workflow (or loan type) and includes a calendar title and description (SalesTrekker details are included in each calendar reminder). This reminder is usually sent to the individual responsible for maintaining ongoing customer support (often the broker who wrote the deal).

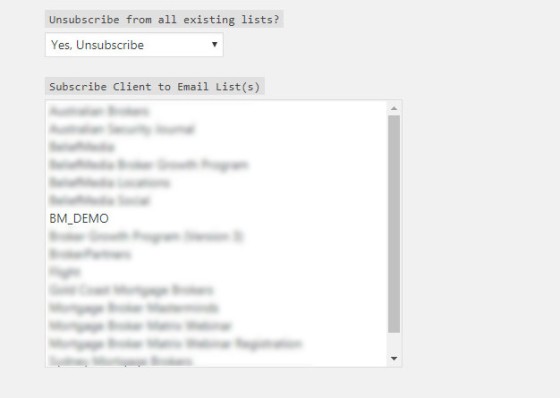

- Email Management. As email segregation is imperative we'll unsubscribe the client from any marketing related or pre-sale email list and subscribe them to a list or lists most appropriate to their loan type. The email campaign continues into one of our other programs - usually Venus or Mercury (two campaign types we use post-settlement).

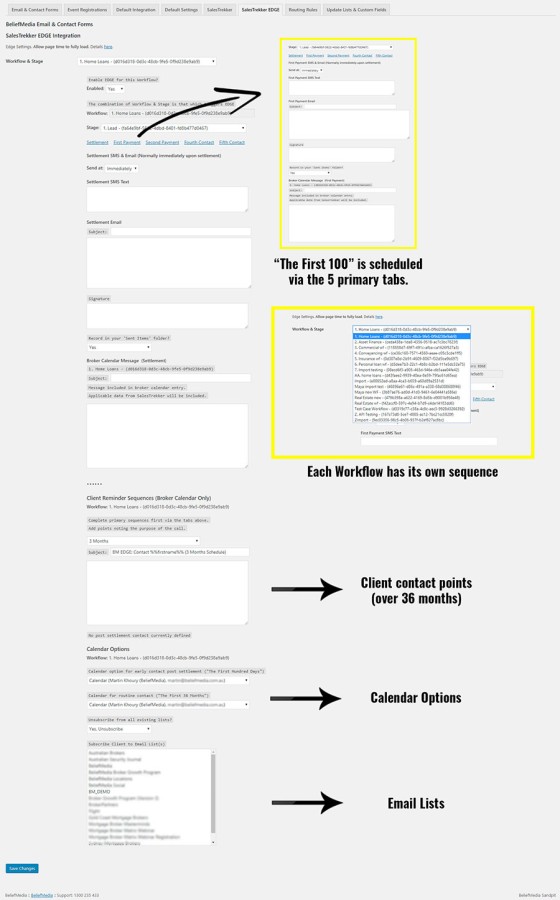

The following is a screenshot of the SalesTrekker EDGE entry page.

Since the image is quite small we'll reproduce each segment in isolation to further details its purpose.

The first five contact points ("The First 100") are sequences in the early post-settlement period. This is normally conducted to coincide with early payments so our discussion points are more appropriate. However, we've found that some brokers prefer to make their early contact on a monthly basis despite fortnightly payments. There are five primary contacts for each sequence... so if you have multiple sequences (as we do in the SalesTrekker developer sandpit) it can take about 5 seconds to load the page (load time is often aggravated by way of requests to the Microsoft API and our Email Marketing API).

For each sequence type there's a mandatory option for a title and description that will be included with the broker's calendar entry. It's a good idea to have this entry consistent throughout your company based on company-specific best practice. We'll usually include a few 'mandatory' talking points.

The "First 100 Days" is almost always managed by the broker that facilitated the loan. This personal touch is a necessary pillar of our Magic Lantern methods. The calendar entry for ongoing contact may optionally be sent to administration staff. While each conversation will be guided by very specific talking points (noted in each calendar entry), one significant purpose of regular contact is to maintain your business as top-of-mind. Other conversion or moderation opportunities might be introduced at various points.

Mailing List Management

When a client settles a loan we don't want them to receive any emails associated with any early marketing campaign. So, as the loan settles we'll optionally (but highly recommended) unsubscribe the user from any list that they might be subscribed to before subscribing them back onto purpose lists designed to develop, educate, and inform.

Considerations

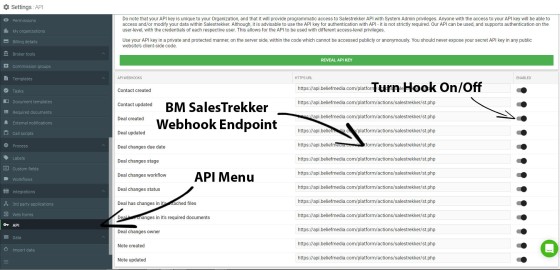

Our SalesTrekker EDGE module works on the basis of data submitted to our Platform via ST's webhooks API. To enable functionality you'll simply need to have ST enabled in your website plugin (via the Integrations menu) and then point your SalesTrekker webhooks to our Platform (pictured below). While we rely on only the dealChangesWorkflow webhook we recommend all webhooks be pointed to our system to take advantage of our full suite of ST system features.

When you successfully enable your SalesTrekker features from within our plugin we'll update our own system. We silently discard any data submitted to our API that is malformed or doesn't authenticate against our system... so if you change your API via SalesTrekker you'll have to update your plugin as well to enjoy continued use.

Not Using SalesTrekker?

We've decided that EDGE must be automated in every respect in order to provide the features we consider necessary so we'll now make attempts to build an automated solution using your own aggregator CRM. It's expected that we'll simply provide our former EDGE module as a free service to brokers while clients will receive a high-level integrated service.

EDGE is included with a conditional lifetime licence as what we consider an 'Essential Service'.

Conclusion

Your funnel does not terminate when a client is settled into a product. The nature of your relationship up until this point is somewhat adversarial, and the post-settlement period is an opportunity to further develop that real referrer-based relationship.

Many talk about 'automation' but very few actually understand what it means... and even fewer provide the features and service we consider absolutely necessary. EDGE is just one small part of a bigger proprietary system designed to support brokers. If you're interested in learning more or having a chat with Australia's leading finance marketing experts please call us on 1300 235 433.