The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, also known as the Banking Royal Commission and the Hayne Royal Commission, was established on the 14th December 2017 to investigate and report on misconduct in the banking, superannuation, and financial services industry. The commission uncovered its fair share of banking malfeasance and corporate greed, but it seemed to be mortgage brokers that attracted a great deal of unjustified and disproportional attention.

The Royal Commission conducted seven rounds of public hearings over 68 days, called more than 130 witnesses and reviewed over 10,000 public submissions. Commissioner Hayne submitted a final report to the Governor-General on the 1st February 2019 with 76 separate recommendations. The final report and the government's response to the report were made public on 4 February 2019.

In the aftermath of the Royal Commission the Government has begun to individually assess Hayne's 76 recommendations, and at the time of writing a large number of recommendations have made their way into law, the Government very reasonably backpedaled  on (flawed) Responsible Lending laws, many recommendations are still under review, and others recommendations were completely abandoned. Certainly, from a brokers perspective, the Best Interest Duty (BID) tends to dominate aggregator-level compliance discussions despite the fact the burden represents only a slither of the broader obligations that actually apply. The BID, however, is one of the more visible consumer-facing components of the recommendations that can quite easily lead a non-compliant or unprepared broker into a world of costly liability or litigation.

on (flawed) Responsible Lending laws, many recommendations are still under review, and others recommendations were completely abandoned. Certainly, from a brokers perspective, the Best Interest Duty (BID) tends to dominate aggregator-level compliance discussions despite the fact the burden represents only a slither of the broader obligations that actually apply. The BID, however, is one of the more visible consumer-facing components of the recommendations that can quite easily lead a non-compliant or unprepared broker into a world of costly liability or litigation.

When introducing revised 'Responsible Lending' practices, Treasurer Josh Frydenberg suggested that the current practice of 'lender beware' be replaced with a 'borrower responsibility' principle... although brokers know all too well that they now represent the defenseless punching bag that'll inherit all blame should the borrower or lender ever screw the pooch... so what Frydenberg meant to say was 'blame the broker'. In turning brokers into human condoms the banks wear for protection while they screw their customers, the fuzzy, costly, and and utterly subjective best interest duty becomes something of costly and time-consuming arse-covering industry nightmare. That said, brokers should take advantage of legislated BID requirements in order to add further value to their business, and they should utilise all available technology to mitigate the additional time necessary to satisfy the requirements (and we have a ton of compliance modules in development that'll change the way you do business).

As a marketing company we're bound by the same compliance requirements as any mortgage broker business, and we take this responsibility very seriously. If we screw up, so do you. That said, we've never inherited a product from an inferior program that comes close to actually satisfying even the most basic compliance requirements (not just those imposed by BID)... and it's totally unacceptable. Certainly, and as discussed in a recent podcast, virtually every 'Pay Per Lead' service on the market, and almost all of those 'Facebook Programs' on the market, violates numerous important compliance requirements. A marketing company should never introduce non-compliance into a business operation, yet we see it every day. In an effort to ensure the marketing industry conducts itself in a manner that is consistent with applicable legal obligations, and to put an end to the industry malfeasance, back in 2016 Belief established the first version of the Finance Marketing Guidelines that we make available to anybody that works in the industry, and it was updated last year to reflect the overarching mandates of BID. Additionally, we provide a statement of compliance to all our clients.

A full and complete archive of the Royal Commission data was initially created as an internal reference. However, the archive includes a massive trove of tremendous information, including compliance documents, franchise manuals, and aggregator operating manuals, and it soon became clear that the information was something that should be archived for eternity as a usable resource for our clients.

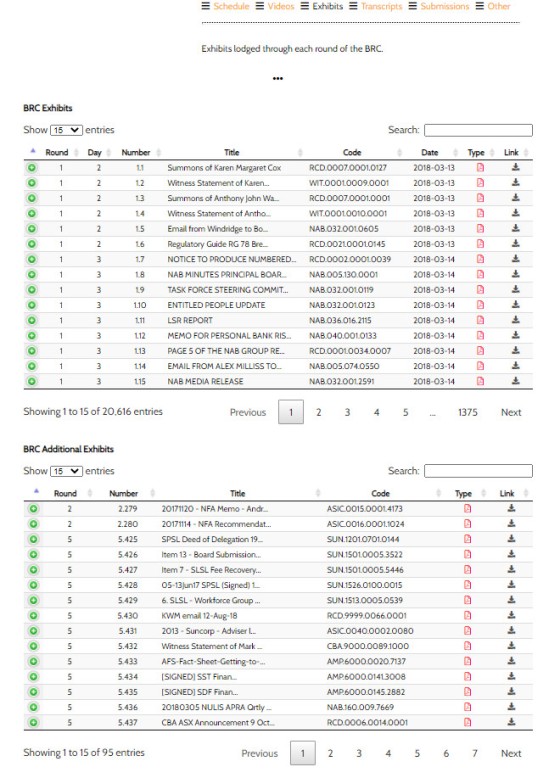

Pictured: The Banking Royal Commission data is made up of a number of panels: Schedule (Primary data, reports, and round information), Videos (all BRC hearings, with each video soon to be indexed), Exhibits (the thousands of exhibits made available during each hearing, representing an amazing resource for brokers), Transcripts (transcripts of each heading), and Submissions (all submissions made for all rounds). The thousands of PDF documents were indexed by keyword and topic.

The Banking Royal Commission website  is due to be decommissioned by the end of January 2022. Once the primary website is retired a permanent archive will be made available on the NLA

is due to be decommissioned by the end of January 2022. Once the primary website is retired a permanent archive will be made available on the NLA  website. The problem with both BRC versions is that the documents and other Commission assets are returned in a very generic and non-searchable format. It was important for us to turn the dataset into something the industry can actually use, so we've tabled all media into a relational database, indexed every PDF document (when we were able to extract text), and we've created a means to track engagement and downloads. We've essentially created the usable resource that the Government should have made available in the first instance.

website. The problem with both BRC versions is that the documents and other Commission assets are returned in a very generic and non-searchable format. It was important for us to turn the dataset into something the industry can actually use, so we've tabled all media into a relational database, indexed every PDF document (when we were able to extract text), and we've created a means to track engagement and downloads. We've essentially created the usable resource that the Government should have made available in the first instance.

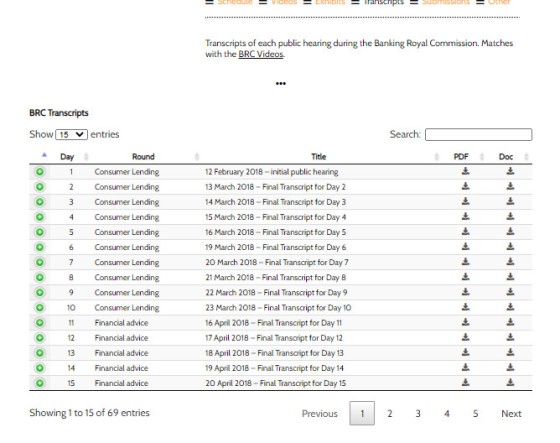

Pictured: Banking Royal Commission are available from their own panel. All PDF documents were indexed by keyword and topic into a searchable index.

If you're a Yabber  user you can navigate your way to the Banking Royal Commission data via the Tools -> Resource menu. All videos are available from within Yabber or on YouTube

user you can navigate your way to the Banking Royal Commission data via the Tools -> Resource menu. All videos are available from within Yabber or on YouTube  .

.

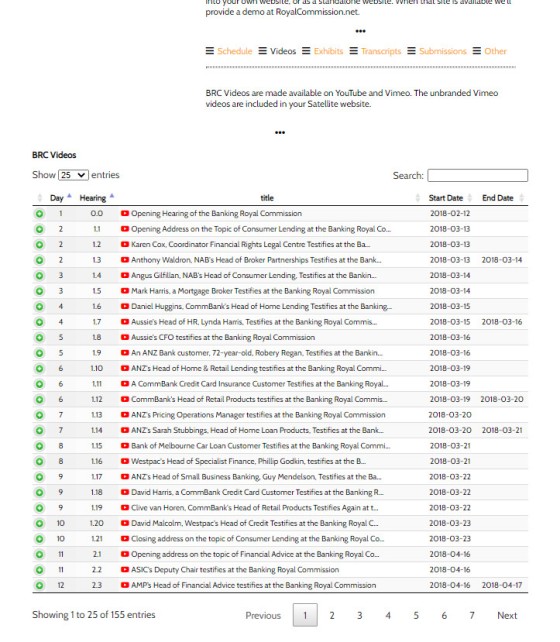

Pictured: All Banking Royal Commission videos are available to be viewed in Yabber but they're also available on YouTube and Vimeo. It's expected we'll make the Vimeo versions available in your Satellite website (should you choose to use it). Clicking on any video icon launches that video in a popup modal. The green icon returns a panel with video information.

We've since build a WordPress plugin and standalone website that'll both find their way into our Satellite module over the next few months, and we've created a public demonstration website at RoyalCommission.net that'll be made available sometime soon (it's the exact website we make available as a free Satellite download). We've built a robust API that returns RESTful data in a manner that you may integrate into your own application.

If any client would like a copy of all the BRC assets you should simply send us a USB drive with a self-addressed envelope and we'll send you a copy of all data (sadly, the size simply prohibits a reliable online transfer unless you're using Microsoft OneDrive, in which case we simply share the collection with you directly). Aggregators may request their own full and complete dashboard-style Satellite website for their own internal intranet.

The Banking Royal Commission archive is representative of the significant way in which we support brokers outside of the typical 'lead generation' functions (which we perform better  than any competing service).

than any competing service).